A New Foundation for American Greatness?

The budget document is unrealistic…

Investors have been anxiously waiting for Trump’s budget proposals, to see if the fiscal shock they have been waiting for has any chance of materialising into a real deal. A big step came on Tuesday, when the government presented its budget for the 2018-2027 period. But, as with everything else in Trump’s presidency, the document seems highly controversial, as the economic assumptions on which it is grounded have been pointed out by many as being highly unrealistic.

According to the budget projections, the U.S. economy is expected to operate with real growth hovering 3% and the unemployment rate below 5%. Those figures contrast with predictions made by every other institution, including the FED. But, even if such healthy growth were possible, the government failed to convincingly explain how such growth is going to be achieved and maintained for so long. Trump and Mulvaney (Office of Management and Budget Director) will find it very hard to convince Congress about the budget assumptions and even harder to overcome the apparent incongruence of recording an improvement in the budget due to the feedback effects expected by a tax cut, without recording any decrease in tax receipts due to the same cut.

Apart from the unrealistic view on GDP and spending effects, the key principles behind the budget seem to point in the right direction, as the country needs to revamp its tax code, deal with exponentially increasing social security spending, discard unnecessary regulation where possible, create conditions for higher growth, and, most importantly, find a way to break even in the future.

But, addressing all the problems at the same time is likely impossible, and either Trump cuts taxes and increases spending, allowing for a few more years of unbalanced budgets than predicted in the document, or he opts for fiscal tightness, in which case the margin for tax cuts is limited. Apart from what was pointed out above, it seems that all sectors will experience tighter spending, with the exception of defence, which will get an extra $639 billion until 2028, “so that [our] military remains the world’s preeminent fighting force”, the president says in the introductory note to the budget presentation.

…But the intentions are good

If there’s something one cannot deny about Trump, it is his efforts to change the country and “make America great again”. Over the last few years (at least since the beginning of the century), the world has been plagued with low growth, lack of investment, aging populations, low productivity, sluggish innovation, and an ever-growing government that is becoming fatter in most of the developed world. As rightfully pointed out in the budget document,

“The new Administration inherited an economic situation in which the United States is $20 trillion in debt and yet at the same time dramatically underserving the needs of its citizens due to a broken, stagnant economy.”

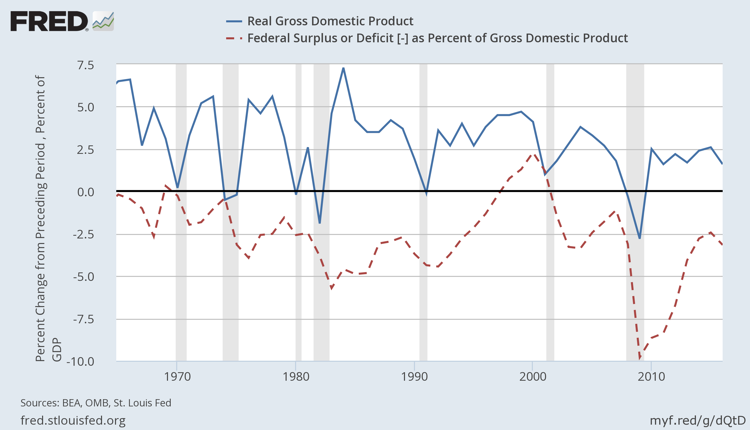

The current trajectory of U.S. politics is not leading the country towards economic prosperity, as is well reflected in the sluggish growth rates on record and the rising public debt.

To address the situation and replace the “current economic stagnation with faster economic growth”, the budget document underpins eight pillars of reform:

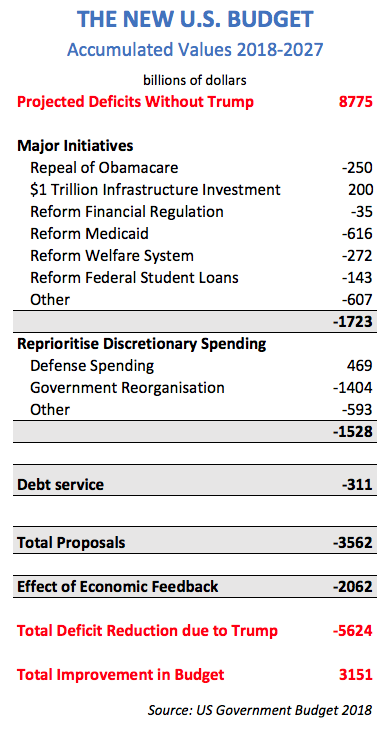

- Health reform – With the aim of repealing Obamacare and reducing Medicaid costs. The budget predicts a decline in spending of 250 billion USD with Obamacare and 616 billion USD with the Medicaid until 2027.

- Tax reform and simplification – There is ample recognition that the U.S. is not competitive in tax terms. The current federal tax rate is one of the highest in the developed world, standing at 35%. To this rate, the State adds 3.9% for a final rate of 38.9%. Corporate taxes average 22.5% worldwide and 24.7% in the OECD. This high rate is making the IRS lose revenues, as many U.S. companies opt to relocate to Europe and other countries. A cut in taxes may well result in increased economic activity overtime.

- Immigration reform – Trump has spent much of his time arguing against immigration, arguing with the support of some studies that claim the U.S. bears heavy costs from such immigration. One of his key pillars of intervention is to reduce immigration to a minimum, in particular with regard to low-skilled immigration, which is expected to translate into a decrease in budget spending.

- Reductions in federal spending – Increasing efficiency and keeping finances tight will lead to savings.

- Regulatory rollback – This is another key point, in particular because deregulation increases flexibility in the economy, and may help drive investment higher, unemployment down, and keep growth higher for longer periods. Trump wants to eliminate outdated and unnecessary regulations.

- American energy development – Trump plans to increase the development of energy resources to decrease production costs and energy prices.

- Welfare reform – Unemployment benefits and other government transfers that may prevent individuals that are able to work from working will be reformed.

- Education reform – There is a plan to return decisions to the State level in order to reduce Federal expenses.

The key values in this budget are: deregulation, reduced government intervention, fiscal balance, economic nationalism, and military strength. In fact, one key note to be made is the fact that almost all sectors will experience cuts, with the exception of defence, which will have an extra $639 billion available to spend until 2028. The following table summarises the new budget:

Trump will deliver an improvement of 3.2 trillion USD in the budget and manage to balance it by 2028. By then, debt-to-GDP would stand below 60%.

And the winner is…

The budget highlights some important concepts that seem to have been forgotten by some politicians, particularly the notion that sometimes it is worth cutting taxes for the economy to grow to then collect more taxes in the future. But, the predicted positive feedback effect in Trump’s budget doesn’t have any counterbalance, while being based on too-good-to-be-true assumptions. Mulvaney stated that tax cuts are budget neutral but they really aren’t. Over the shorter-term, they will have a substantial negative impact in receipts to the extent that Republicans will likely not approve the budget.

A simple sensitivity analysis on the reported figures – one similar to the stress tests conducted by banks – would result in a much inferior improvement in the budget, a still unbalanced budget by 2028, a debt-to-GDP ratio far greater than 60% and the need for further cuts in spending or no tax cuts at all. For those trading the markets higher on the reflation trade, it’s time to revaluate it.

Can Trump deliver 3% growth over the next 10 years? Will his 1 trillion USD infrastructure spending and tax reforms lead to a substantial improvement in growth potential, and more importantly, will the bull market last for so long? In my opinion, there is a little too much optimism right now, at a time when we have a very unrealistic budget in front of us, one that we don’t even know stands any chance of going through.

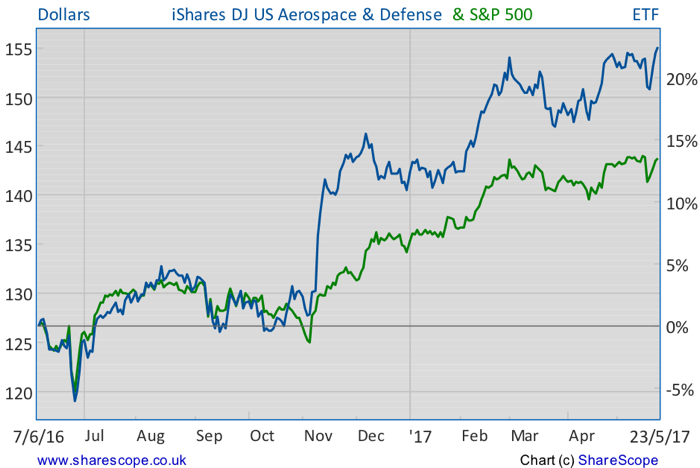

If there’s a positive out of all this, it must be for the defence sector, which is clearly the winner from the budget. The iShares DJ US Aerospace & Defence ETF continues to look very attractive, and looks poised to outperform the overall market.

Comments (0)