There is too much optimism in oil markets

While acknowledging the ‘Trump pump’ to the oil industry, I have always been sceptical about the long-term prospects for the industry because I believe prices are capped at a much lower level than they were ten years ago. Any excessive enthusiasm is doomed to revert to an even more extreme pessimism in ever shorter periods, as the OPEC cartel’s past excesses have led to the rise of a whole new hydraulic fracking industry that is always waiting in the sidelines for opportunities to pump oil into the market.

Not sharing my lack of enthusiasm, hedge funds and the “smart money” in general have poured incredible sums of money into oil lately, so high is their optimism. Currently, the ratio of long to short bets on oil is at a record 9 to 1, which is an indicator of how sentiment is tilted towards the bullish side. But for those who follow the precepts of value investing, this scenario alone is enough to make the alarm bells ring; when there is excess optimism, future returns tend to be poor. Compounding the behavioural argument is a fundamental reasoning showing the oil market may be softer than it seems.

The latest data on oil inventories, released last week, showed that inventories rose a near record 13.8 million barrels, pushing inventories close to an 80-year high at 508 million barrels. Despite the agreement reached at the end of November by OPEC members (and later also followed by non-members), oil is still stockpiling, as demand is weaker than expected and oversupply has led to the accumulation of inventories. Despite the data being bearish for oil prices, investors are ignoring the information and keeping oil prices above $50 and way above the prices recorded in February 2016 (below $30).

According to a Bloomberg report “Wall Street is throwing the most money at U.S. energy companies since at least 2000 amid growing confidence that the industry is emerging from the worst downturn in a generation”. This optimism has been so great that “energy firms raised $6.64 billion in 13 equity offerings in January, drawn in by a rich combination of oil prices consistently above $50 a barrel and a rush to drill that’s doubled the rigs in use in the U.S. and Canada since May”.

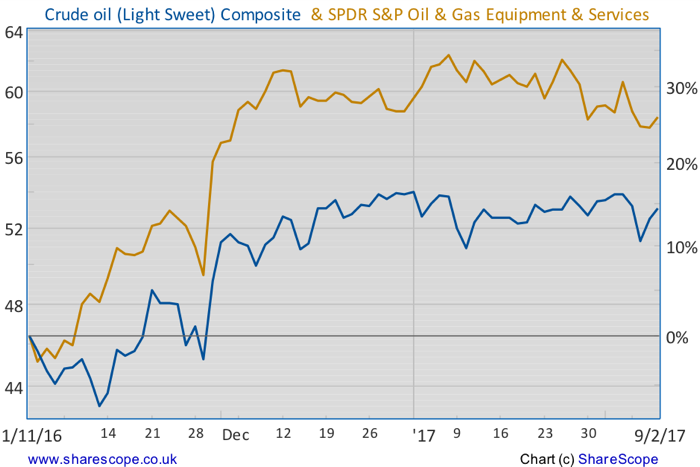

The optimism that rose with rising oil prices helped boost the prices of stocks operating in the oil services sub-sector – those companies providing all kinds of essential services to the fracking explorers. Keane Group Inc (NYSE:FRAC) is a good example of the momentum that is building in the industry, making its stock market debut on January 20 to raise $508.4 million in its IPO.

…when oil prices reach the $50 level, the U.S. fracking industry starts pumping oil into the market, completely subverting OPEC’s plans to keep prices high.

After years without reaching a significant agreement, OPEC was finally able to find a serious commitment towards reducing oil output at the end of November. With other non-OPEC members like Russia also committing themselves to the global output reduction and with Donald Trump winning the U.S. election, the oil industry could only be revitalised. Investors expect OPEC’s commitment to remain and for Trump to unfold a series of measures aimed at giving the U.S. oil independence and at helping boost the fracking industry, which would further help the bullish case for oil.

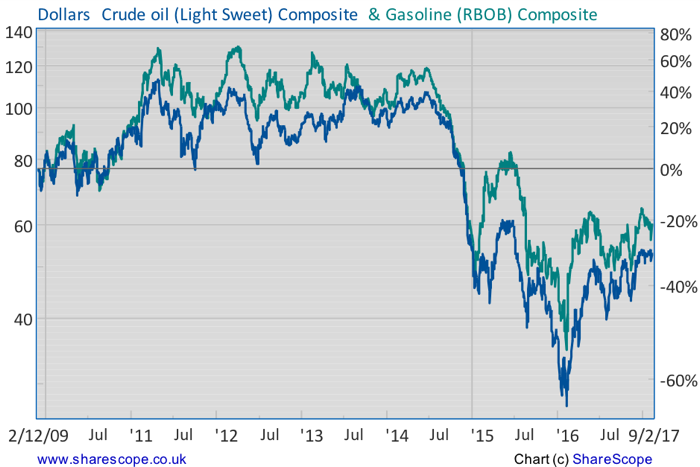

The financial crisis of 2008-09 led to a crash in oil prices from as much as $145 in 2008 to just $35 in 2009. But the market recovered and oil prices returned to three digits, recording $115 in 2011. For most of the time between 2011 and 2014, prices traded sideways, only to fall rapidly to reach $27 in February 2016. At such a low price, the shale industry couldn’t survive and many fracking explorers had to shut down operations. While Saudi Arabia was laughing, the Russian rouble also collapsed and Venezuela was sent into chaotic economic conditions, such is its dependence on oil exports.

Eventually, even Saudi Arabia felt the pinch of low oil prices, which helped the case for OPEC to reach an agreement regarding output cuts. So far, the agreement has been playing very well. OPEC countries have agreed on an average production of 32.5 mb/day for the period January-June 2017 and output was recorded at 32.89 mb/day in January. But no matter how closely OPEC members follow the agreement, the truth is that oil prices haven’t risen since the first few days after the agreement was reached at the end of November.

As I put it in a piece published in this blog at the beginning of October, “oil prices are no longer the result of OPEC’s actions but rather a complex determination that is partially floored by OPEC’s desires but, at the same time, capped by an entire army of shale oil companies anxiously waiting for their opportunity to shine”. The ability of OPEC to control prices is much more limited than it was 10 or 20 years ago because its policy to keep prices high led to a nascent industry that has been making significant gains in terms of efficiency and thus in exploring for oil at ever lower prices.

What that means is that when oil prices reach the $50 level, the U.S. fracking industry starts pumping oil into the market, completely subverting OPEC’s plans to keep prices high. In my understanding, oil prices are nearing a top, which shouldn’t be much higher than the $50s or maybe $60 at most. The fracking industry will ensure prices don’t rise above that level and the extreme optimism among on oil exploration and services companies may prove excessive. The whole industry has recovered and will probably continue to improve, but prospects for growth based on higher price expectations seem limited.

A recent report from Moody’s investors service still predicts a rise in M&A activity in the oil industry in 2017, as the oil industry continues to recover from the 2014 downturn. But with oil explorers being a leveraged bet on oil, stock prices of oil-related companies rising fast, and oil prices remaining mostly unchanged, a bubble may be already forming. If oil prices don’t rise, we will experience a reversion in sentiment and oil stocks will suffer corrections. A candidate for a sell is the SPDR S&P Oil & Gas Equipment & Services ETF (NYSEARCA:XES), which has been rising fast on the expectation of further oil price increases.

Another point to take into consideration is OPEC’s commitment towards output cuts. Until now the commitment has been great, but I wonder how it would play in the near future if oil prices were to continue unchanged at the current levels. The likelihood of breaches increases with stagnant oil prices, as does the likelihood for non-OPEC countries like Russia to get out of any deal. For now, I’m stepping away from oil, oil equipment & services stocks and the Russian rouble.

What about smaller exploration companies that are in the business of discovering new sources of supply?