Mellon on the Markets: “the best single trade I can think of”

Inside the mind of the Master Investor: Influential British investor Jim Mellon reveals his latest thoughts on the markets.

It’s been another pretty good week for equity markets, with some stocks, notably Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX), going to new highs. It’s pretty obvious why this is, but I can’t help feeling a niggle that when this is over – and it soon will be – governments will be ferocious in coming after the FANG-type companies. Not that they caused the crisis, but they are holders of large amounts of cash, and in the case of Amazon have benefited unduly from the collapse of high/main streets everywhere.

So, as with the banks post-2009, the fines, extra taxes and regulations mount up, and these companies will be on their way to being more like the regulated utilities that their financial counterparts have become.

That brings us to the banks. I am a big fan of Lloyds (LON:LLOY) in the UK as an investment, as it is almost entirely UK based, and the biggest by far in retail banking. Shareholders of Lloyds have been (unfairly in my opinion) told to expect no dividend this year. This isn’t because the company can’t afford the dividend – it’s due to “solidarity” directives from the regulator. The same applies to the other big banks, and the larger insurers.

These foregone dividends don’t just go away; they add to the financial companies’ capital buffers, and these firms are very likely to be paying a regular dividend next year, so prospective yields are very attractive. There is very little chance that Lloyds will go bust, and my own view is that NPLs (non-performing loans) will be relatively modest.

Although UK house prices (important to mortgages, which are a big component of Lloyds’ loan book) are likely to fall, what most people don’t appreciate is that this will be a temporary fall.

In my last flash note, I suggested that post the deflationary shock that is evident from COVID-19 (lower oil prices, collapsing retail sales, plummeting manufacturing), we would emerge with boom-like conditions.

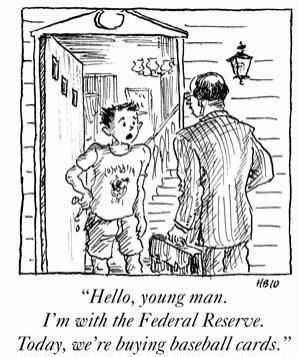

This bonanza will be in part generated by two things: one, the support given to workers in the UK and Europe to allow rapid redeployment of the workforce once this thing is over (and I expect in maybe three weeks’ time that will be the case); and, most importantly, the enormous amount of monetary stimulus that has been injected into major world economies (see image below).

This provides the tinder for very high inflation in the coming years, and boy, is it going to come. That’s why gold went to a seven-year high this week, and I will bet that silver will shortly follow. My goal remains gold at $2,000 an ounce this calendar year, and silver at $25 an ounce. This is the best single trade I can think of, except for shorting bonds.

In the meantime, pundits (and you know who you are!) who forecasted a steep decline for a retest of lows in the markets in the last ten days or so have been proved wrong. Big Wall Street houses are now forecasting sunny uplands, having been pessimistic just three weeks ago at/or close to the bottom. So, a bit of defensiveness is warranted, in my opinion. Earnings are going to be generally bad.

Investors can keep buying the defensive dividend yielders however, as long as they tuck them away and ignore the noise. Similarly – and a bit but only a bit of this has happened – fundamentally good companies in stricken industries – e.g. airlines, hotels, and hospitality – are to be bought, but only the strongest of these. Delta (NYSE:DAL) and IAG (LON:IAG) in airlines; Intercontinental (LON:IHG), Marriot (NASDAQ:MAR) and Whitbread (LON:WTB) in hotels, for example.

There might be another wave of infections, but as I have said in the last two notes, the COVID-19 boat has sailed, there will be a vaccine or cure, and the world will move on.

However, my friends and I are looking ahead, and specifically at the issue of how to prevent a future meltdown owing to some similar or, possibly worse, pandemic. Changing food supplies, having vaccine programmes properly funded, modelling responses much more accurately and, above all, learning from this calamity, are all pretty good ways to start. More on this anon.

Meanwhile, I’d keep going with the precious metals, and very selective buying of shares. Spring is here (in the Isle of Man it feels more like summer), and this particular Season in the Sun (apology to Terry Jacks) doesn’t feel like the terminus of good times.

Happy Hunting!

Jim Mellon

I am realising I am clueless, so I am preparing for the worst and best. Though last year my big winners were gold and silver and the Nasdaq 100, the rest a sea of red. Fortunately I have 80% in cash. Things globally are not adding up in my view, so I remain cautious. I love gold but it seems so expensive I only buy it in 20 pound bits LOL.

Silver is a different matter, it is laughably cheap, I have stocked up my kitchen with Georgean solid silver ware for less than spot price. What’s more it is so beautiful to use.