Volex year-end statement generates positive reception

The price of shares in AIM-listed power products manufacturer Volex (LON:VLX) climbed 12.74% to 140.92p (as of 15:00 BST) after the firm reported that results for the year ended 5th April would be in line with expectations. Full-year sales were up by 5.3% and the firm’s cash position was significantly stronger at year end than it was at the time of the interim results. The company intends to recommend a final dividend of 2p.

Chairman Nat Rothschild commented: “The worldwide COVID-19 pandemic is forcing governments to implement extreme, restrictive measures in an attempt to curb the spread of the virus. Our priorities are first and foremost: to safeguard the health and safety of our employees and our local communities; where possible to support government actions to slow the spread of COVID-19; and to assess and mitigate the risks to our business continuity.

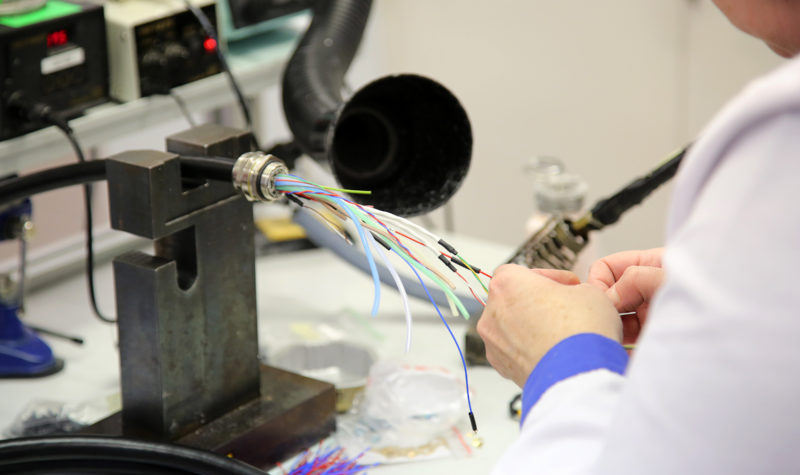

“However, despite this ‘perfect storm’, Volex’s business has proved remarkably resilient, continuing to produce a solid performance in both sales and operating margins. Our strategy to diversify our products, customers and geographic footprint, together with our exposure to medical devices (and high-speed data centre products, which are in even greater demand as much of the world’s population works from home), has resulted in continued growth and strong cash generation, despite significant headwinds.

“In order to mitigate any unforeseen financial impact should the macroeconomic outlook deteriorate further, the group is taking steps to optimise cash flow. However, we have today announced a recommended final dividend of 2 pence per share, which reflects our robust financial position.

“We are closely monitoring all available forms of relief from governments on direct and indirect taxes, social charges, and employee relief funds, and assessing their relevance to Volex. Current headroom under our existing facility, combined with our cash balances, provides the group with circa $60 million of liquidity and, in line with our strategy, our team continues to actively look for new opportunities to grow our business and technical capabilities.

“Operationally, there remain substantial identifiable opportunities for both divisions to improve sales and margin performance through disciplined execution of our strategy, in both the short and longer term. While the duration and impact of the COVID-19 virus remains uncertain, we remain confident that Volex will continue to progress in the year ahead“.

Comments (0)