Lifetime ISA (LISA) – What’s Not to Like?

While the central bank is hurting savers in a bid to turn them into heavy spenders, the government is attempting to do the opposite by creating new savings products to seduce youngsters into saving at an earlier age. Announced in the Budget by George Osborne, the LISA is the most recent addition to the savings world – one that offers substantially more flexibility than existing products.

When announcing the new budget, George Osborne claimed this budget is “for the next generation” as it aims to cut government spending and create a surplus by 2019-20 in order to lessen the burden on future generations. At the same time, concerned with the lack of an incentive to save due to low interest rates, he announced a new Lifetime Individual Savings Account, or simply, LISA. The new package to be launched in April 2017 will allow individuals to save for both a first-time house purchase and for retirement, thus combining two different life goals into a single product.

The LISA will be open for individuals aged between 18 and 40, allowing them to start saving at the earlier ages and incentivising them to keep saving until the age of 60, through investment benefits and/or withdrawal penalties. As a hybrid product, LISA allows money to be taken out at two different moments in life without incurring penalties or even taxes. The first is when the saver wants to purchase his or her first house; the second is when the saver hits the age of 60. Unlike other products, LISA allows savers to take the accumulated savings as a single lump-sum without incurring any taxes, at both the aforementioned moments, which makes it attractive relative to other products that force much more contention. Currently, pensions only allow for lump-sum withdrawals of up to 25% or force a conversion of the full amount into an annuity, which may be very unfavourable when interest rates are at ultra-low levels.

While the government will be providing more detail over time, LISA works in a very simple way. The saver puts money aside every month and the government tops up that money with a 25% bonus, up to £1,000 per year until the age of 50. Someone saving £4,000 per year will get the maximum benefit, by accumulating £32,000 in bonuses. At a time when interest rates are so low that pension funds struggle to achieve their return targets, this kind of bonus is precious and makes all the difference, in particular as compounding evolves over time, boosting the rate of return on an individual’s own money. Assuming a rate of return of 6%, an individual saving for the full benefit of £32,000 between 18 and 50, would have £454,449 on his fiftieth birthday. If saving occurred without the bonus, the amount accumulated would be £363,559.

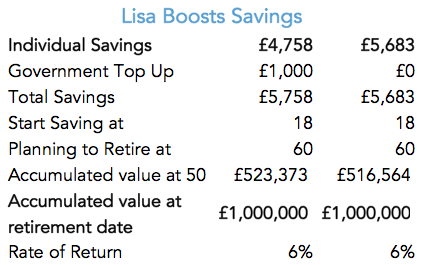

Considering the above rate of return, an individual wishing to hit £1 million in savings at the age of 65 would need to save £5,683 per year (£474 per month), if starting at the age of 18. But because the LISA includes an accumulated government benefit of £32,000, the same individual would now need to set aside just £4,758 each year (£397 per month).

For those wishing to save to buy their first home, LISA is an excellent option. The average age of first-time buyers is 31. An individual saving £4,000 per year from 18 to 31 to buy a house would accumulate £94,411 under the LISA scheme but just £75,529 without the benefits. When compared with the help-to-buy ISA, the LISA provides a greater benefit. While both match an individual contribution with a 25% bonus, the first puts a cap on the bonus at an overall £3,000 while the second simply limits government contributions at £1,000 per year. In the aforementioned scenario, the second option provides £13,000 in government contributions.

LISA provides flexibility and is particularly well suited for all those working on their own without access to a corporate pension package. It may also be of use for higher earners, as a second lifetime savings scheme. Additionally, it may be a vehicle for wealthier parents to help their children while enjoying some tax advantages of doing so. But, for those enrolled in a corporate pension scheme, this may not be an alternative package, as companies also match employees’ contributions.

In cutting interest rates and purchasing financial assets, central banks have been creating several difficulties for pension funds and savers in general. Faced with such low rates of return, individuals don’t have an incentive to save. If, on the one hand, that may be expected to lead to higher present consumption, on the other hand, it may also lead to lower future consumption, as individuals are not saving enough to maintain living standards across time. The BoE has already destroyed the defined benefit pension scheme and is contributing to a progressive reduction in companies’ share of pension schemes. The government needs to counter this effect through the creation of savings incentives.

While LISA has a few shortcomings, it signals that government is concerned with the progressive lack of savings. Traditional pension schemes are lagging behind real needs, and people should realise they need to supplement their current contributions. New incentives must be given to push them into saving enough to maintain their lifestyles after retirement, and LISA may be just the first push towards recognising the issue. The next would be to recognise that the current pseudo-Keynesian view about savings hurting the economy is just plain wrong, and is in fact planting the seeds for future disaster.

Comments (0)