Just don’t call it taper

Here we are, finally, at a time when both the ECB and the FED are required to take important policy steps and are expected to diverge the most in years.

After much volatility in 2016 because of Brexit, Italy, and Trump, investors are now concentrating their attention on central banks and their magic crafts. Dodging structural issues and journalists’ questions, Draghi has already moved forward.

We can summarise the ECB decision as an extension of a trimmed version of the current asset purchase programme. There’s a shorter name for it, but I want to avoid the word “tapering” as much as possible, because Draghi is clearly not comfortable with it. Next week it will be Yellen’s turn.

The ECB kept its three key rates unchanged (repo, deposit and lending rate) while extending its asset purchase programme from March 2017 to December 2017 but trimming the amount of purchases from a monthly pace of €80 billion to €60 billion.

Investors were widely expecting some kind of extension to the current programme, possibly by six months. The actual policy response imparted mix feelings. On the one hand, it extended the programme by nine months instead of just six; but on the other hand, it cut monthly purchases by €20 billion.

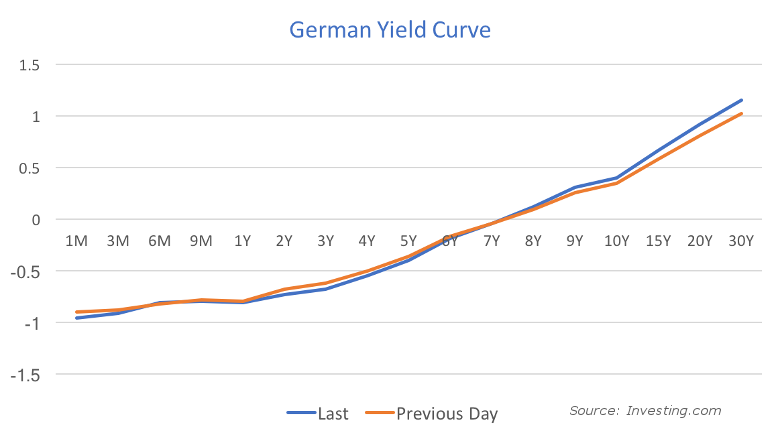

The initial market reaction was to push the EUR/USD higher to 1.0870, but then it started declining precipitously, losing near 300 pips, as Draghi explained the ECB move in detail. The yields on European government bonds finished lower for shorter maturities.

Like it or not (sorry Signor Draghi!), the ECB is tapering its bond purchases.

Although Draghi dismissed questions that contained the word “tapering” with a short and crude “there is no question about tapering; tapering has not been discussed today”, there’s no doubt the ECB has just diminished the thickness of its programme, which, according to the Oxford English Dictionary, can properly be referred to as tapering.

…there’s no doubt the ECB has just diminished the thickness of its programme, which, according to the Oxford English Dictionary, can properly be referred to as tapering.

Semantics aside, the ECB will continue buying bonds until December next year. Many say that this option puts an additional €540 billion in bonds in the hands of the ECB (9×60), as opposed to the €480 billion expected from a six-month extension (6×80). But the implications of the two options are different.

No one was expecting the ECB to completely close its bond-buying programme in March, so some kind of extension to the closing date was expected. If the ECB opted for the six-month deal and maintained the pace of purchases, the market would just wait for another similar extension to occur in October 2017.

The option taken by the ECB is similar in the sense that it is an extension. But, through trimming purchases, the ECB is permanently reducing the pace of its asset purchases. That means the option taken by the ECB is less accommodative than the option expected by the market. While the euro is currently declining fast, I believe there will be an inversion in the trend to reflect these implications.

In addition to the extension of the asset purchase programme, the ECB announced a few important tweaks to the programme. The central bank will no longer impose a floor on the yields at which it can purchase bonds.

Until today, the ECB has never purchased bonds yielding less than the central bank deposit rate (currently held at -0.40%), but that is going to change in the near future. Draghi claims that “QE purchases below deposit rate is not a necessity”, but it still broadens the range of eligible assets.

The measure was complemented with the reduction of the minimum remaining maturity requirement from 2 years to 1 year. These measures help extend the range of eligible assets, at a time when the central bank is running out of bonds to purchase.

Draghi may have a “very, very broad consensus” at the policy committee, but never the unanimity needed for bolder policy action.

While the tweaks are significant, they’re unlikely to lead to substantive changes in policy, because there are other self-imposed limitations that are much more restrictive. The central bank cannot purchase more than one third of a country’s government debt and should purchase bonds from member countries in proportion to country weights.

At a time when Germany runs a budget surplus and is expected to issue much less debt than in prior years, the ECB may find itself constrained because it is unable to purchase German debt to fulfil country quotas. The asymmetry of the European crisis and the ensuing recovery would require an asymmetric policy response that could surpass the proportionality restriction.

But that, I guess, will never happen. Draghi may have a “very, very broad consensus” at the policy committee, but never the unanimity needed for bolder policy action.

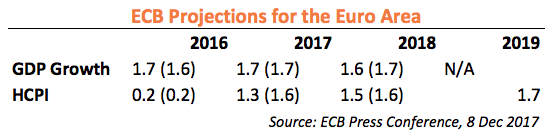

Regarding the risks to inflation stemming from economic developments, the ECB expects the Euro Area economy to grow at an annual pace of 1.7% this year and the next and at 1.6% in 2018. Draghi commented that the recent developments in the real economy have been good but that “risks to Euro Area growth remain tilted to the downside”. Inflation is expected to grow very gradually and to reach 1.7% by 2019.

These figures ensure that the ECB will retain an important role in the European economy for a prolonged period of time, as prices are expected to remain below policy target for many years and growth is only mild.

But, while issuing these projections, Draghi also said that “the risk of deflation has largely disappeared” and noted that the base effects in energy prices will push up broad inflation measures at the start of the next year.

Putting all the pieces together, I believe the ECB lacks the broad consensus needed to deal with the current sluggish economic conditions. Instead of imposing suboptimal conditions on its actions, the central bank should broaden the spectrum of assets it purchases and favour bonds from countries with higher yields.

While the measure would act as a relief bailout with likely moral hazard consequences, it at least would avoid distorting yields any further, with German short-term debt now offering a massive negative return of -1%. It would also be much better to finance growth in a more direct way rather than just contribute towards the general increase in asset prices, which in the end may or may not translate into real growth. (So far, it has not.)

Now, reverting to a more investment-oriented view, it doesn’t seem to me that the end of the euro is near and I expect the currency to recover at least a little, as the market will discount the current policy as being less accommodative than first thought.

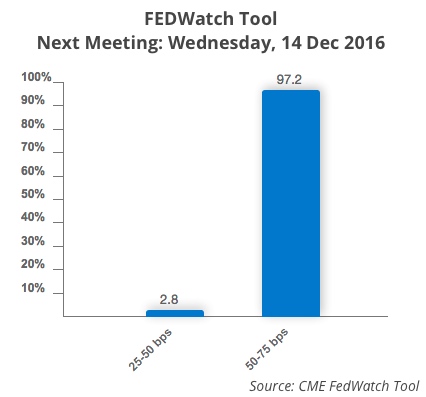

Next week will be Yellen’s turn. Given that an interest rate hike is now a 97.2% probability in the U.S., if there’s margin for anything, it would be for a dovish surprise, which would push the euro higher. In any case the dollar has been running too far, too fast and investors may just sell on the news next week.

While I’m a short-term bull on the euro, I’m also keeping a bullish view on European banks for now – not because these banks are in great shape, but because they had previously been severely battered and are still adjusting.

Comments (0)