India’s DIY recession

During the painful periods of hyperinflation in the last century, there were a few episodes when governments decided to demonetise the economy and to reintroduce money in new forms in an attempt to contain the rampant price increases.

But these moves pale in comparison to India’s bid to absorb 87% of its circulating physical currency and turn it into deposited money, in one of the greatest demonetisations in history. Such an experiment comes disguised as a weapon in the fight against illicit activities, tax fraud, and even terrorism. But, ultimately, it will most likely prove ineffective in delivering on these goals, and even risks sinking the economy and possibly even generating deflation.

Modi unleashes chaos

At a time when global growth is weak, the Indian PM Narendra Modi has just taken a step to auto-inflict pain in one of the world’s last bastions of growth. The precise effects on the money supply and the real economy remain to be evaluated with precision, but so far everything seems to be heading towards failure, recession, and chaos.

In a televised event on 8 November, Modi addressed the nation to declare a new war on “fake money and terrorism [which] are ruining the nation’s fabric”, and announced the abolition of the INR 500 (GBP 5.8) and INR 1000 (GBP 11.7) note denominations. Overnight, those denominations would no longer be accepted as legal tender. Banks were closed to the public for one day to organise themselves. At the same time, it was announced that other denominations would later be introduced, limits on deposit and withdrawals would be imposed and a few other measures would also act to make it difficult for the current stock of illegal cash to enter the system untaxed.

The measures were expected to force the physical currency to enter the banking system and thus force more digital transactions through debit and credit cards and wire transfers. Some of the illegal money would never come back into circulation and the government could use the difference between money printed and money collected to boost the economy and/or improve its finances. At first sight, this seems like a win-win situation.

Dozens of people are reported to have died.

The problem is that three weeks after the measure was announced, the country is still in a chaotic situation. Dozens of people are reported to have died, either because they were standing for hours in queues outside banks to exchange their money, or because they were unable to pay for health care (directly or indirectly), or even because they committed suicide after having saved money for life and now being unable to use it. The amounts accepted for each person at banks are currently too low for a society that relies heavily on cash transactions. Some are splitting their cash and hiring “mules” to exchange it. The process has been nothing less than chaotic and economists agree that it will have a negative impact on GDP.

Not even Rogoff would agree with this mess

One of the most vocal proponents of a cashless society is that of Kenneth Rogoff, who recently wrote the book The Curse of Cash, which argues for the replacement of the traditional physical forms of money with digital money. But, while Rogoff believes in the benefits of such a big step, he also acknowledges the pain that may come with the conversion. He foresees the change as a gradual evolution, to avoid economic and social disruption, which is at odds with the Indian PM’s decision to remove the legal tender status of all INR 500 and INR 1000 note denominations overnight.

People should be allowed to exchange their money over a long period, and steps to remove money from circulation should only be taken gradually in order for the conversion to be smooth and non-disruptive. The main goal is to replace one form of money (physical) with another form of money (digital) without altering the money supply. Such a change requires that digital currency can be widely used, which is doubtful in a country where there are instances where 90% of the population is without a bank account.

Recent data show that only 32% of India’s population has access to financial institutions, the distribution of banks is highly concentrated around large cities, and 60% of workers earn their wages in cash. Under these circumstances, physical money cannot be replaced by digital money and any attempt in doing so will end up reducing the real money supply, seen as the real amount of money that is effectively used for transactions (no matter what M1, M2, M3 or M4 may be). When that happens, it may be the case that the velocity of money increases but this would never be enough to counter the effect on the money supply, which means that nominal GDP will shrink, either in the form of a decline in growth, deflation, or (most likely) both.

Echoes of the Great Depression

One of the biggest puzzles regarding the money supply and money in general is how to correctly measure it. It’s tough to know with precision what exactly is used as money in transactions and that is the main reason economists often attribute an important role to the velocity of money in the process. In the case of India, where 80% of transactions are in cash, circulating cash is 14% of GDP, and financial inclusion is very low, there’s no doubt that any attempt to convert a cash-based society into a cashless one overnight will result in a massive reduction in the money supply, which acts like a massively contractionary monetary policy.

Milton Friedman drew attention to the Great Depression in the U.S. as a period of contraction in the money supply. With the U.S. currently planning to hike interest rates, the effect on the Indian economy will be amplified. With money becoming scarce relative to everything else, its value should increase, which means this measure will likely have deflationary effects. (One parallel is the deflation experienced by European nations when they attempted to readopt the gold standard after World War I at the same pre-War exchange rate.) This should eventually lead to delayed consumption and investment decisions, which will have lasting effects on GDP over the next few periods.

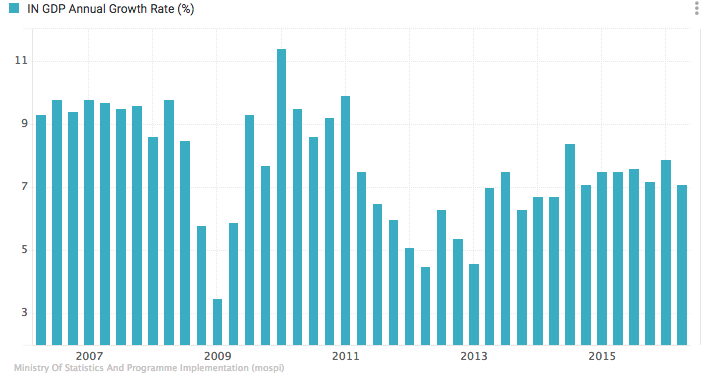

From a growth rate of 7.1% in the last quarter (in annual terms), let’s see where India is heading. In my view the new measures will lead to delayed and lost consumption and investment decisions over a prolonged period of time. There is also a risk of recession and deflation because history shows us that bold contractions of the money supply usually have very harsh consequences for GDP and prices.

As for fighting crime and illegal activities, I am doubtful of the real benefits in this regard. The rupee will be replaced by gold, other currencies and many hard assets. There’s no reason for illegal activities to end. We should also not forget that money is not what the government determines it to be, but what is generally accepted as a medium of exchange. Some small towns in India have already returned to a barter economy. Others may adopt another currency. We just don’t know how pernicious Modi’s decision will prove to be.

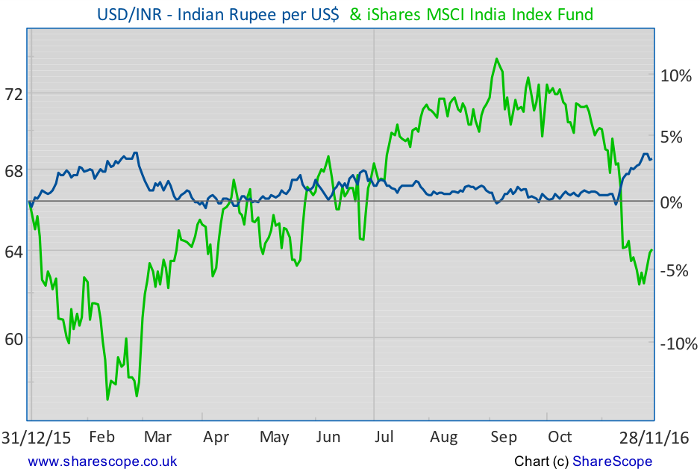

In the meantime, the Indian rupee will likely be pressed higher due to its lack of availability and the equities market will suffer some increased volatility, particularly in sectors more closely related to agriculture, real estate, consumer durables, non-durables and traditional retail.

This is a very good and excellent Research. The Pm has put indians at a Risk and it will effect the growth of india 100 ℅..it was pure political move to make history in at the cost of indians hard earned money. Thank You for a very honest Review in Time .