Should you give in to Bitcoin fever?

I just came accross an article on CNBC about a trader from Saxo Bank who predicts that Bitcoin will be worth $100,000 in 10 years time, as cryptocurrencies gain market share in the highly liquid foreign exchange market. While 10 years is still a long time to wait for such a bold prediction to materialise, investors at least have the comfort of the digital Bitcoin already being worth more than one ounce of gold.

But, while predictions may or may not come good for several reasons, the questions arising on the sustainability of the recent panic buying of crypocurrencies are many. Will some cryptocurrencies really replace physical money? And if that happens, will the government allow monetary policy to be taken out of the hands of the central bank? What is the intrinsic value of a digital asset that was created out of thin air? Is Bitcoin really like gold – or even better? Are cryptocurrencies good hedges against market crashes like the dollar is?

While there are many other questions and issues of interest, these are some of the key questions a serious investor should ask before embarking on the shortcut to riches that cryptiocurrencies seem to offer. What goes up must go down, in particular when there’s no intrinsic value. Remember the lessons taught by legendary value investors like Benjamin Graham (MI April 2016) and John Templeton (MI July 2016) about buying shares at very low prices. These investors were enthusiastic about buying only when prices were very low relative to book value. They were always looking for companies that could be sold for something if dismantled and sold piecemeal. But, is that the case with Bitcoin?

When you buy a house or gold, you have a physical asset to sell; when you buy a few shares in a company, you effectively are the owner of a mix of assets. Demand for the underlying assets may change over time, leading to price changes, but the assets will always be demanded as they have some use value. Certainly, a house will always be a good place to live and gold, as a rare metal, will always be somewhat precious.

A digital piece of blockchain has no intrinsic value at all. It can be replicated and multiplied as needed, if wished.

In turn, a digital piece of blockchain has no intrinsic value at all. It can be replicated and multiplied as needed, if wished. No one would pay for the thin air a blockchain occupies. Thus, the value of a Bitcoin must be derived from its use as a means of payment, and that’s all. But, with volatility being so high in this market, the Bitcoin can hardly be thought of as money. History has shown us what happens when money is volatile. People just look for alternatives. At the same time, Bitcoin isn’t generally accepted as money, which means its value as such is limited. Alternatively, as an asset, the Bitcoin has no intrinsic value at all. It is worth less than the paper it isn’t printed on.

A real money alternative?

Back in 2011, when Bitcoin was ‘born’, the world of digital currencies was pretty much non-existent. Satoshi Nakamoto, an unknown programmer (or group of programmers), created a new cryptocurrency that could replace central bank money over time and be generally accepted as a means of payment.

Unlike central bank money, the new Bitcoin was conceived as a decentralised, peer-to-peer money, which doesn’t need any intermediares to record transactions nor a central bank to issue it. Its availability was designed to grow at an ever-decreasing pace to reach an absolute limit of 21 million units by 2140. Such a creation resembles the old gold-backed monetary systems, which didn’t allow central banks to expand their money supply at will. Any attempt at that would lead to a quick conversion of money into gold, which would lead the money supply to shrink again.

The Bitcoin was conceived to have a limited supply like gold, with the main difference lying in the fact that its supply is limited by a computer algorithm as opposed to the real scarcity of gold. Currently there are 830 alternative crypto currencies and more may be created and used as means of payment. If people lose confidence in one of them, any holdings would amount to nothing when converted into dollars, euros, pounds, or any physical asset. Unlike a physical asset, a cryptocurrency carries no intrinsic value. On that front, it is even worse than central bank money, as the latter is at least backed by the good faith of a government.

The adoption of digital currencies is not new. We already use them. Instead of paying with physical cash, we make 80% to 90% of our purchases with a debit card, which represents a movement in a digital bank account. From the perspective of a central bank and the effectiveness of its monetary policy, this is desirable, because it increases the central bank’s control over the money supply. But the adoption of Bitcoin and other cryptocurrencies would lead to a substantial loss of control.

Governments and central banks will never allow something like Bitcoin to be widely used as money, as it would lead to deflation.

Additionally, Bitcoin is conceived in a way that does not corroborate mainstream economic theory. The reason for the FED, the BoE, and other central banks to cut interest rates and purchase assets on a large scale is because they believe that low inflation levels (or deflation), leads to a reduction in investment and consumption and then to reduced economic activity and output. In short, they believe deflation leads to low growth.

If consumers adopt Bitcoin with its limited supply, one couldn’t avoid deflation and its effects under a growth scenario. Unless mainstream theory is replaced by some alternative thinking, governments and central banks will never allow something like Bitcoin to be widely used as money, as it would lead to deflation. That’s the main reason why Milton Friedman always opposed the use of gold as money.

Or just a speculative bubble?

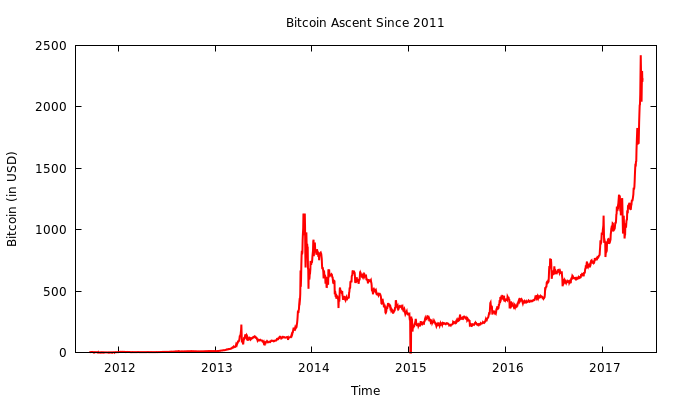

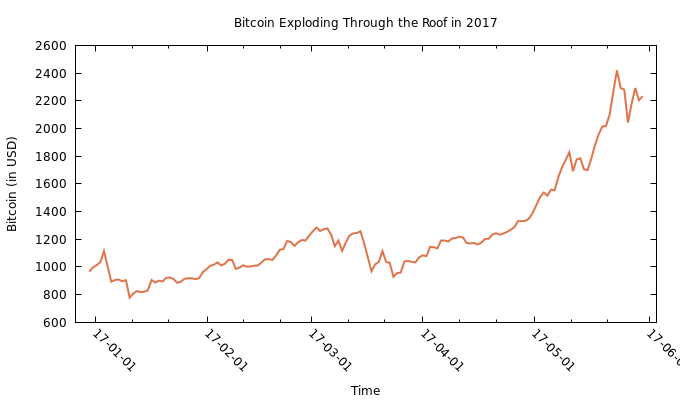

When created, Bitcoin quickly saw its price rise from $0.30 to $32 in 2011. But it returned to $2 in just a couple of months. In 2013, with the Cypriot financial crisis, the value of Bitcoin as an alternative currency rose again and its price was pushed to $266. But those who bought it back then would soon see it crash to $50. Then it peaked once again, that time at $1,200, just to drop 50% to $600 in 2014. Since 2015, it has seen an explosion in price, now trading near record highs at $2,200, which is roughly the price of an ounce of gold.

The price record for Bitcoin since its inception is filled with huge volatility, many times larger than the S&P 500 and the gold market, as this market is highly exposed to sentiment. Unlike the dollar, the yen, and the Swiss franc, if there is a huge crash in the broad market, there is no hope for Bitcoin. Bitcoin would drop even more, as many people would attempt to get rid of it and exchange it for the widely-accepted dollar.

But, even if you believe Kay Van-Peterson’s bold predictions, in what would amount to a spectacular 46.5% compound annual growth rate, be careful. In ten years-time there’s a high likelihood that you would be digitally rich but physically poorer. Exchanging Bitcoins for dollars isn’t easy due to money laundering concerns. It may be made illegal at any time, if governments wish.

Unlike consumers, investors are often attracted by higher prices, in particular at times when sentiment is improving and yields are depressed. Over the last two years, the safety of bonds hasn’t delivered much to investors (pension funds very well know this reality), and even traditionally high risk assets are delivering lower yields than usual. With the Bitcoin being able to double its value in less than a month, many are those who want a share of the action. That’s fine, if you’re a gambler. But if you’re looking for an investment, look elsewhere.

An article about “The Bitcoin?” No one in this space talks about it like this. It’s just Bitcoin or BTC. Please don’t write about BTC or cryptocurrencies as if you’re not an expert on things you clearly know very little about. It comes off as condescending and ill advised to those of us who’ve worked with, mined, and spent cryptocoins for years.

You sound like an old man yelling: “get off my lawn!” at all the millenials getting rich on their BTC, ETH, XRP, etc., etc.. We’re talking Web 2.0 & all the concomitant riches that will be created along with it.

For the love of Bob, we know this stuff is risky and volatile as all get all. But when it drops, we don’t panic, we just buy more to take advantage of dollar cost averaging. Taking a 10K foot view though, the charts for all the major cryptocoins all point in the right direction: Up. You can’t say the same about any other industry at the moment.

If readers listened to people like you they would’ve also NOT bought AAPL, GOOG, and AMZN, in the early days of the dot com era. Besides, when you get right down to it, ALL investing is a gamble of some sort.

So should YOU buy? Just buy 1 or half a Bitcoin and sit on it like you would your silver and gold. The downside is you could lose it all. The upside is phenomenal potential growth. I can almost 100% guarantee that if you *don’t* pull the trigger, you will add to one of the many stories of regret for those that could’ve bought early (but didn’t), or bought early and (and sold out before these huge recent gains).

Do you really want to be that person that tells their future kids or grandkids that they could’ve bought BTC when it was “only” $2600?