Fundamentals Favour the Yen

We live in such great times! A few decades ago we were fighting hard to increase competition among private companies. The EU, for example, was built on free market principles. Today, the task has been so flawlessly accomplished that the same principles have been transposed to the central banking business. Who could ever have imagined that while Apple, Samsung and Microsoft compete against each other to get a share of the mobile phone market, the BoJ, the ECB and the FED would also compete to get a share of the inflation market! Competition between companies brings prices down; competition between central banks brings interest rates down. The former expect their sales to increase; the latter expect their currencies rates to depreciate. But, when competition is really fierce, prices come down without any assurance regarding sales. In central banking, that means cutting rates and sometimes observing exchange rates going higher. The BoJ is a living example of how badly this business can go…

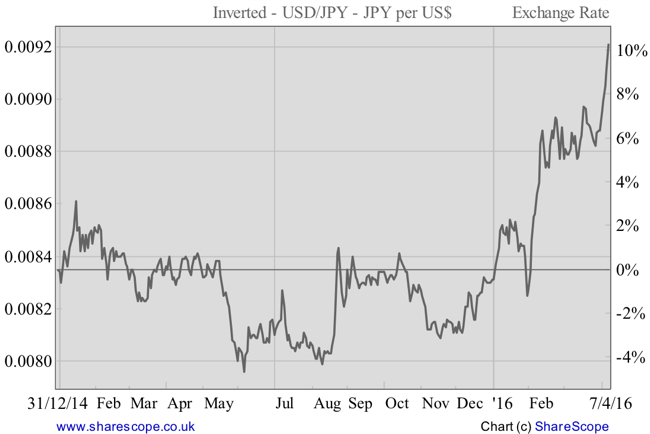

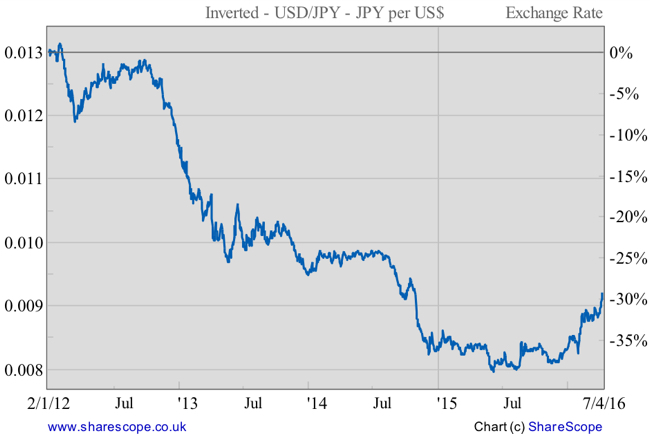

If there is a central bank specialising in competitive devaluations, that must be the BoJ, as it has been attempting to invert the upward trend of the yen for many years now. From time to time, the BoJ had some success. From a level of 75 against the dollar in November 2011, it was able to push the yen to 125 in June last year. But since that date the BoJ has experienced limited success in preventing the yen from rising. From a level of 125 against the dollar, the yen moved upwards to now trade at 108.7. That makes for a decline in the dollar of 13% (which translates into an increase in the yen of 15%).

Year-to-date, the yen is up 10.7% against the dollar and seems to be in a strong uptrend.

In a market with a single company, it would be relatively easy to estimate what would happen to sales if prices decrease, as there would be no other company competing for the resources. The picture would change drastically if that same company faced a lot of competition. This reasoning can be transposed to central banking. While no one admits it, we are currently in a currency war. With quantitative easing losing momentum in the US around 2012-2013 and Shinzo Abe promising bold monetary action, everyone was selling the yen, expecting it to lose ground against the dollar. But the downside (to the yen) seems much more limited today.

In terms of policy action – a.k.a. currency wars – the BoJ now faces fierce competition from the ECB and the FED. In an unprecedented move, the BoJ cut its deposit rate to -0.10%, in January. That move was even accompanied by comments from the central bank’s governor giving clues it could cut rates even further, if necessary to boost inflation. The move quickly turned speculators into net sellers of the yen. With the BoJ purchasing yen 80 trillion in assets per year, the negative rates were the only bit missing. Were it not for the fact that the BoJ acts in a competitive market, everything could have gone well. But less than two months later, the ECB increased the pace of asset purchases through its quantitative easing programme from €60 billion to €80 billion per month, extended its purchases to include corporate debt, and cut its deposit rate to -0.40%. At the same time, the FED has been largely downplaying any prospects for further rate hikes and, at some point in time, the scenario of negative rates was even mooted by officials. What seemed like an inversion in easing in December has turned into another deep dive. All these events act against the BoJ’s intentions, pressing the yen higher.

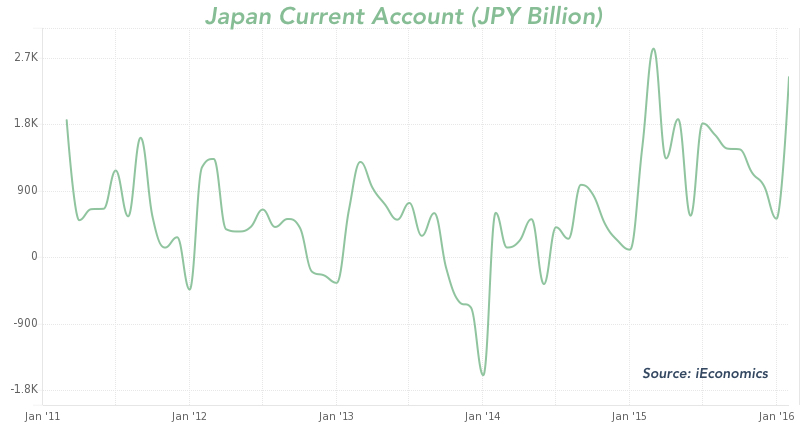

But, a higher yen is not just the result of central bank competition. It is also the result of the country’s external position. Data on the Japanese current account has just been released showing a surplus of yen 2.434 trillion ($15.9 billion) – an 11-month high. This surplus is the 20th consecutive positive balance observed in the Japanese current account. The lower yen of the past has been driving positive results. On one hand, the country is exporting more, but on the other hand its primary income net inflows have increased drastically due to the higher returns obtained by residents overseas. These returns, even if the same in dollars, are higher in yen terms. Additionally, lower oil prices also helped the current account.

An improving trading account with a surplus now near 3% of the country’s GDP, pushes the currency higher.

The Japanese Finance Minister Tard Aso commented to the press that the government may do something to prevent the yen from rising if needed, but he didn’t seem to be in a hurry. In fact, the reason to push the yen lower is to boost exports and help reflate the country, which now seems a less urgent problem to solve. The Japanese economy doesn’t lead the deflation queue anymore. While prices are not increasing near 2%, they at least are not decreasing anymore. At the same time, with the current account showing such a healthy balance, I don’t see any reason for the Japanese government or central bank to spend their faltering ammunition at this point. They should rather wait and see.

With the current account showing record positive balances, the FED delaying interest rate hikes, the ECB increasing the pace of its asset purchases and the BoJ eventually regretting the deposit rate cut of the recent past, I believe it likely that the yen will continue its uptrend. There are still many positions open against the yen, which were set in the hope that negative rates would ignite a depreciation. But, with such hopes now fading, most of these positions will be closed, further helping the yen. That’s not to say that I believe the BoJ wouldn’t do something to prevent a major uptrend in the yen; I just believe that isn’t going to happen right now. The yen could easily reach the 100 level against the dollar before something happens.

In a country where 54% of households’ assets are held in demand deposits, any decrease in interest rates is deflationary, as it steals income from savers. Maybe the BoJ is now learning that. They certainly wouldn’t dare hike rates right now, but they don’t have an incentive to cut them either.

Comments (0)