Zak’s Daily Round-Up: DLG, PRU, S32, IMTK and IOF

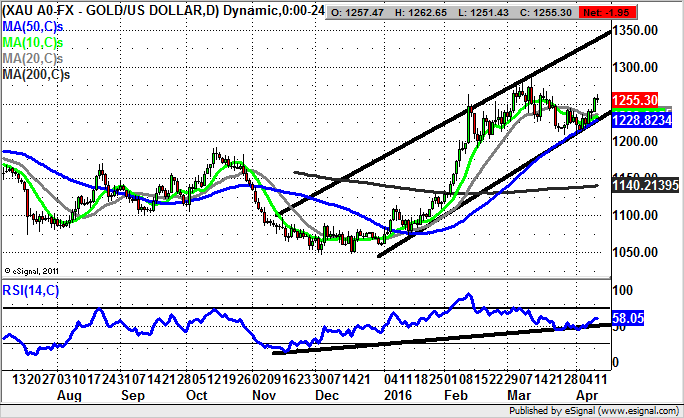

Market Direction: Gold above 50 Day Line Targets towards $1,340

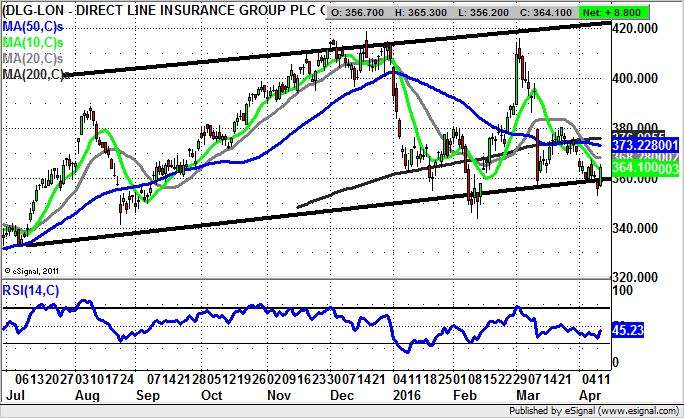

Direct Line Insurance (DLG): Gap Floor Trigger for 415p

I still find it amazing that RBS’s (RBS) jewel in the crown, Direct Line Insurance, was floated off at around one third of the present £5bn market capitalisation. While it may be said that keeping Direct Line would have been a drop in the ocean in terms of propping up the bust state owned bank, someone did not exactly come up with a great strategy – even though it has to be admitted floating off the insurer has been a good way of the market realising the value of the company. As far as the charting perspective on the daily chart time frame it can be seen how there has been extended consolidation in the 340p–360p zone over the post July period. The hope overall is that there will now not be any sustained move back below the 340p level, with the idea now being as little as an end of day close back above the floor of the March gap at 380p could cause the price action to head back higher in quite an aggressive way. Indeed, one would expect a retest of post December resistance at 415p within 4-6 weeks of any prompt 380p clearance.

Prudential (PRU): Above 50 Day Line Targets 1,450p

What is interesting about the present daily chart configuration of Prudential is the way that we have been treated to so many gaps over the near term, both to the downside – which one would have expected given the early 2016 decline for the market as a whole – and the upside. The position now is that the stock is trading in the wake of a March island top, a bear trap rebound from below the 50 day moving average at 1,277p, and a bounce off the floor of a rising trend channel from late January. The expectation now is that we shall see an end of day close back above the top of the March gap to the downside at 1,333p. This should then be the momentum trigger to serve up a move to the top of the 2016 price channel as high as 1,450p over the next month. At this stage only a move back below the 50 day line would really knock the idea of a further intermediate recovery for Prudential shares off the agenda.

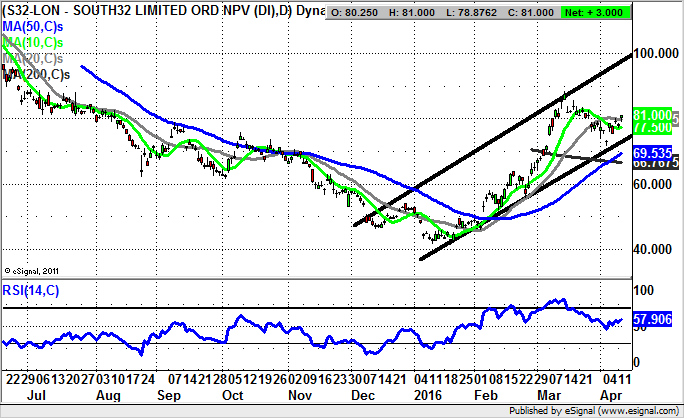

South32 (S32): 100p December Price Channel Target

This is the first time I have charted S32, with the message at the moment being that the occasion is timely in favour of the bulls. The reason for this suggestion is the way we are looking at the shares having gapped up through the 50 day moving average at the beginning of February – after an island bottom for January. Then for March we were treated to a gap through the 200 day moving average, now at 66.76p. All of this would allow us to conclude that this is a stock in solid price action mode, with the March/April price pattern likely to be a right hand shoulder of an extended basing pattern in place since as long ago as August last year. All of this allows us to conclude that provided there is no end of day close back below the 50 day line, now at 69.51p, we can justifiably anticipate a decent rally. The favoured destination at this point is regarded as being towards the top of a rising trend channel, which has been in place since as long ago as the beginning of December. The five month price channel has its resistance line projection heading as high as 100p, with the conclusion to draw being that this could be hit as soon as the next 1-2 months – while the 50 day line continues to support the price action.

Small Caps Focus

Imaginatik (IMTK): Broadening Triangle Target at 8.5p

We have some interesting to very interesting plays as far as today’s small caps are concerned, with few coming in more so than Imaginatik. This is said in the wake of the clearance last week of the former March 3p intraday peak, and the latest break above the 200 day moving average at 4.93p. All of this goes to suggest that while above the 200 day line one would be looking to a journey towards the top of a broadening triangle at 8.5p, which has been in place for as long ago as July. This 4-6 weeks timeframe destination would retest the former 2015 resistance zone, with the only near-term negative being the way that the RSI at 80 is extremely overbought. However, the expectation is that provided there is no break back below the former February resistance at 3.64p we are on track for a robust breakout at Imaginatik.

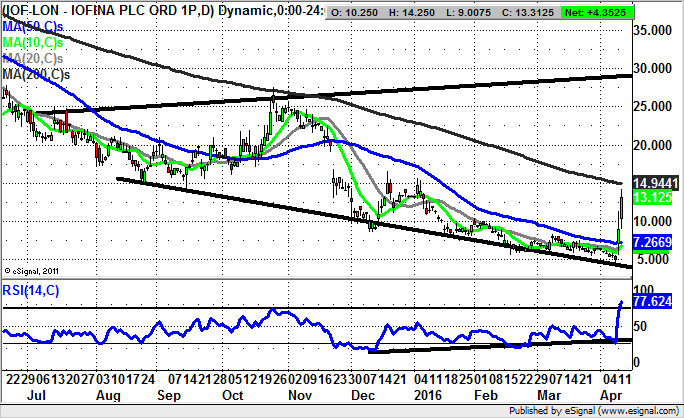

Iofina (IOF): Triangle Target as High as 30p

There is perhaps only one real issue with the present setup at Iofina, which appears to be very encouraging as far as the potential upside is concerned. This issue is that the shares served up an equally robust looking rebound in the autumn, before falling to the new lows seen below 5p just last week. However, the good news is that this latest probe looks to have been something of a selling climax and we can expect to see at least a rebound back to test the 200 day moving average now at 14.94p – much as in the way we saw a test of this feature briefly in October. The likelihood is that a weekly close above the 200 day line later this week would set up the prospect of a top of July triangle at 30p over the following 1-2 months.

Comments (0)