Front-Running the ECB

Less than one week after the ECB signalled it would start purchasing investment-grade corporate bonds, bond issues are already going through the roof, as everyone is trying to front-run the ECB. From risk-free loans (through open market operations) to corporate loans (through investment-grade bond purchases), the ECB has come a long way in expanding its participation in the European economy. Already yielding just below 1pc, investment-grade bond yields will hit the ground in just a few months, as more and more top issuers join the party where lenders pay borrowers for the privilege of lending money. The rush into highly rated bonds has already started and will eventually spread to lower rated bonds and contribute to decrease yields across the bond spectrum. But the question remains: Will corporate investment re-emerge or will companies use the proceeds to repurchase outstanding shares?

Unlike what happened during the December meeting, this time the ECB delivered what investors were looking for: an expansion of the current asset purchase programme. On Thursday, Mario Draghi announced an expansion of monthly purchases from €60 billion to €80 billion, while also cutting the three ECB key rates, in particular, further decreasing its deposit rate, now standing at -0.40%. But if those measures kept investors entertained, the announcement of corporate bond purchases certainly amused them. The ECB will start purchasing European investment-grade bonds issued by non-bank corporations, as part of its asset purchase programme with the aim of “further strengthening the pass-through of the Eurosystem’s asset purchases to the financing conditions of the real economy”. In simpler words, the ECB believes that cutting rates to banks and purchasing sovereign debt has not done enough for the real economy, such that it is now trying to help companies directly, and expecting them to invest the money. Such a move was a big positive surprise for investors, who see an opportunity to make a profit by front-running the ECB.

The pass-through always fails because the engine is broken. Banks get loans for free from the ECB but are severely limited by Basel III rules regarding their lending activities. Banks often just can’t lend; when they can, they are unable to find solvent lenders; and when they find those solvent lenders, they’re unable to seduce them to borrow anything. Regarding sovereign debt, we all know how limited governments are in terms of spending by EU rules. They had certainly enjoyed the lower interest costs that came with central bank sovereign purchases, but that has not translated into any more spending. In fact, there is no pass-through between banks, governments and the real economy. In recognition of this fact, the ECB is aiming to more directly target corporate spending. Through lending to corporates directly, the central bank could eventually improve the so-called pass-through.

It could… but it won’t! Money can either be spent on new investment projects or serve to repurchase shares. With the biggest European companies sitting on cash piles, I believe they will opt for the second option. That’s bad news for the ECB and good news for equity investors.

The lower rated companies (and in particular those not even rated as they just don’t issue bonds) constitute the most important part of the European economy. That is where the pass-through to the real economy really lies. Without ensuring that money flows to these companies and families, the ECB is doomed to fail once again.

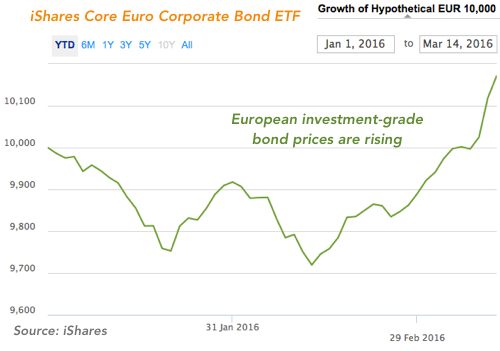

So, let’s go back to the tweaked ECB programme. The new bazooka is already triggering a frantic demand for corporate bonds. After all, with sovereigns now mostly under water, investors need to move on to where they can keep their returns afloat. The battlefield is now the corporate bond market. This market was severely hit after 2009. Bond issues halved and have since been recovering slowly. The start of this year was really bad as bond issues were rare. But as soon as the ECB announced its corporate bond purchase the market was boosted as never before. Year-to-date (less than three months into the year), corporate bond issues have already hit half of last year’s levels. Bond ETF inflows accelerated to levels never seen before. Last week €857 million flowed into Eurozone corporate bond ETFs, a record weekly inflow. But as investors rush into the market, that record will enjoy a very short life and be replaced by a new one this week. March has seen €1.7 billion of ETF inflows. With assets under management of around €6.3 billion, the iShares Core Euro Corporate Bond ETF is the largest in the category. The fund saw its price jump 1.4% on Friday, its largest ever single-day rise.

With details regarding the corporate bond purchases still to be disclosed by the ECB in a few weeks time, investors will continue to heavily demand corporate bond assets either through primary issues, secondary purchases or, indirectly, through ETFs. Some of the buyers are just speculators purchasing corporate bonds at inflated prices – not because the issues are worth it, but just because the buyers believe a greater price-insensitive fool will later purchase from them at an even higher price. That fool is of course the ECB, which will start purchasing these bonds only towards the end of the second quarter. But there are some other players in this market, in particular those investors that have spent the last year desperately searching for a safe place to put their money and get some yield. These were battered by the ECB when the central bank started purchasing sovereigns and are now trying to get what they can from the top of the corporate bond market while the positive yield lasts.

The rush into bonds is very well depicted by a few examples:

– Valeo, the French auto supplier, just issued a €600 million 10-year bond for which the company received orders totalling €7 billion;

– Maersk, the Danish conglomerate, issued €700 million in bonds and received offers totalling €4.75 billion;

– Bellin Hyp, a German bank (not even targeted under the corporate bond purchase programme as it is a financial corporation), has just sold €500m and has been paid for doing so, as the yield was set at -0.16%.

– Siemens, Air Liquide, Deutsche Bahn, all have some bonds outstanding at negative yields.

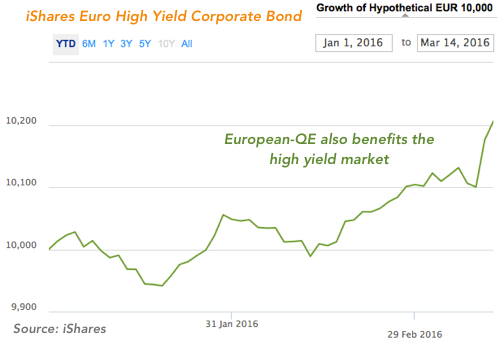

The positive yield in high grade corporate bonds is decreasing fast. But it is not alone. While the ECB won’t purchase bank debt (as it is already financing them anyway) nor high yield issues, the effect is propagating across the bond spectrum. The high yield market is also regaining life as yields are getting depressed in the top ranks of the bond market.

While many are just looking at the bonds currently targeted by the ECB, I believe some good opportunities may arise in other parts of the market. The positive effects deriving from the ECB programme will ripple across the spectrum; and in the near future, when the ECB finds its programme falls short of inflation expectations, other options will be put on the table. In a matter of months everyone will be discussing the next asset class to be targeted by the ECB. It will certainly be something riskier than high-grade corporate bonds.

Comments (0)