Fishing for yield in the FTSE

It may be unloved, but the FTSE offers one of the best income opportunities out there right now, writes Filipe R. Costa.

Investors in the US don’t have cause to complain about 2020, particularly those who love tech stocks. The broad market rose 16% while the tech index Nasdaq 100 soared 48%. Not bad for a pandemic year! Unfortunately, British investors have a lot more cause to complain, as most stock indices closed the year under water – including the FTSE 100, which declined 14%. The good news is that the market is undervalued when compared with other developed markets and offers a reasonable dividend yield.

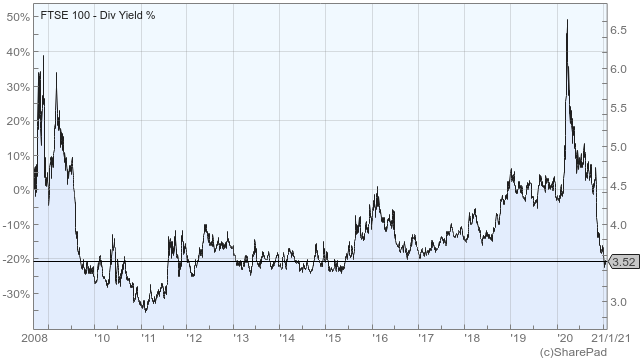

The UK has been an unloved market for many years and was punished quite severely last year. There are some reasons that may help to explain it, but I still believe the current 3.52% yield is too good to ignore for an index composed of such strong companies as the FTSE 100. At a time when investors can’t even get 1.5% out of investment grade corporate bonds, the yield offered by the FTSE looks very attractive. The risk is higher, but the FTSE 100 is composed of stable blue-chip stocks which, when held together, reduce the risk significantly, in particular for someone looking for a medium-term investment.

The first reason why I believe that investing in the FTSE 100 is a good opportunity is that the expected dividend payments represent a good income when viewed against current prices. The second reason is because some FTSE 100 components cut their dividends last year due to the pandemic and may just restore them in 2021 and beyond. This is in particular the case with banks. If everything goes well and we can ramp up the vaccination programme in 2021, most companies will turn around, with some restoring their dividend payments and others increasing them. This scenario will improve income and capital gains.

A quick inspection of the FTSE 100 shows that the dividend cut off for the highest paying decile is 6.3%. For the second decile, the cut off is 4.6%. Inside these groups are two very strong stocks that usually do well even if we enter a recession. They are Imperial Brands and British American Tobacco, which boast dividend yields of 8.5% and 8.3% respectively. But there are many other strong companies, such as BP, Royal Dutch, Vodafone, GlaxoSmithKline, BAE Systems and a couple of banks.

In order to explore the juicy dividend yield and modest valuation of the FTSE 100, you have a few different options. The easiest option is to buy a FTSE 100 ETF. There are many ETFs for this particular selection. I propose two, which are more or less equal. You can buy the iShares Core FTSE 100 UCITS ETF (LON:ISF) or the Vanguard FTSE 100 UCITS ETF (LON:VUKE). Both ETFs give you exposure to all stocks that compose the FTSE 100 index, as they attempt to replicate the performance of the index. Both are very cheap, as the ongoing charges are 0.07% for the iShares ETF and 0.09% for the Vanguard ETF. These ETFs have two versions: distribution and accumulation. If you want to receive dividend payments from time to time you may opt for the distribution version. Otherwise, if you want your dividends reinvested, the best option is the accumulation version.

A different, more targeted option to explore the high dividend yield of the FTSE is to invest in the iShares UK Dividend UCITS ETF (LON:IUKD). This ETF targets the 50 UK companies with the highest dividend yields. In this case the stock universe is the FTSE 350 because the FTSE 100 is too small to select a subset of 50 companies paying high dividends. This fund was more severely punished with the pandemic, ultimately due to dividend cuts and the prospects of future cuts. However, if we return to normality, this fund should also recover faster.

A third option for investors is to go through the FTSE 100 index list and rank it on the dividend yield from highest to lowest to then select a portfolio of stocks. This option is more expensive and may lead to an unbalanced portfolio though.

No matter which way you choose to get exposure to UK stocks, they seem cheap and offer good income at a time when it is ever more difficult to find a juicy yield.

If you’d written this in November 2020, you’d be a genius.