Declines In Chinese Stocks Are Just the Beginning

Eugene Fama has spent his life collecting evidence and theorising markets’ rationality. He believes that even if there are some naive investors in the market, who just trade for the sake of it, there is at least one group of informed investors that will drive prices to fundamental values and eliminate any price distortions. Under such setting, the norm is rationality, to which markets almost always converge… Almost, that is, because there are frictions that can sometimes prevent prices from fully converging to their fundamentals.

Perhaps Fama would change his opinion if he were starting his academic tenure today. For markets to be rational and for prices to converge to fundamental value as a result, one would need a free market. But as far as I know, there’s no such thing as a free market. It doesn’t matter which market you are thinking about. Take China, France, or the US, for example. None of them is a free market, as the central bank manages financial market risk and prices. When asked about the need to deflate bubbles when the market is rising, the central bank will tell you they believe rational and free markets do their job. But then when markets decline, they start buying assets. It seems rationality is not bidirectional for them, and thus they believe they need to intervene as soon as markets start declining. Under such a framework, where a central bank sets interest rates, spends trillion of dollars purchasing assets, bails out failed banks, and is willing to do whatever it takes to save markets from any speculative attacks, it would be a mere coincidence that equity prices, at any given time, would be equal to their fundamental values. Therefore, it doesn’t matter how rational/irrational investors are. What matters the most is how deep the central bank is willing to go and by how much prices are to be distorted in the end. Investors know prices are detached from their intrinsic values but keep buying assets. That happens not because they’re irrational but just because they believe in the saying, “don’t fight the FED”. In the end, rationality seems to be compatible with price distortions. It’s just a matter of following the trend even if you believe markets should go in a different direction.

The recent turmoil experienced in the Chinese markets and the subsequent interventions from the PBoC and the regulator are a great example of how intervention can be so extreme to the point it creates bubble after bubble, never allowing a market to reflect fundamentals. Unlike the economy, which is growing at its slowest pace in 25 years, the Chinese financial markets have been rising at a stunning pace. The reason for this lies more in the adopted policies and conditions that favour the bullish trend and less in the expected future cash flows for companies. The government is actively promoting stocks, convincing those who always stayed away from the stock market that investing is good for them. People are buying ever more stocks and margin lending has been growing in an uncontrolled fashion as a result. Unofficial, shadow lending, which uses derivatives to achieve a similar result, seems to be also completely uncontrolled. Newspapers help the government propaganda about the stock market, amplifying the benefits of investing and softening the risks that derive from it. All this, without the accompanying improvement in economic prospects, can only have one outcome. Despite all the efforts to keep markets on a steeply rising trajectory, they have been exposed to some volatility recently that saw the SSE composite record some huge single-day declines.

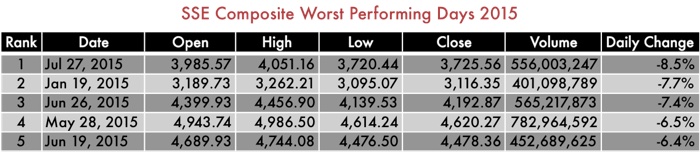

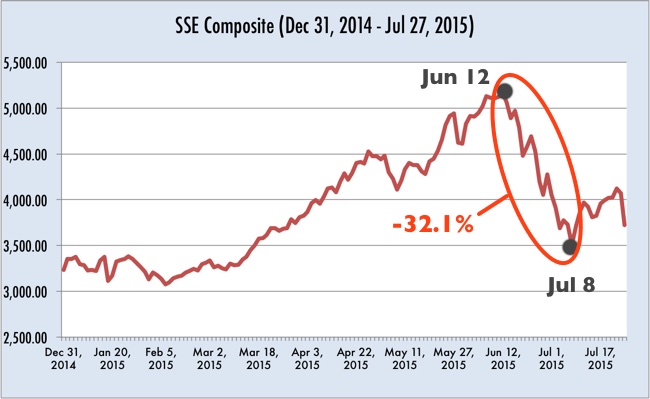

Despite suffering a few shocks, the index had done very well until 12th June, when it hit a year high of 5,166.35. By then the index was up nearly 60% for the year. But then suddenly the market started declining and recorded a few sell-offs. On 19th June it declined 6.4%. Then, on 26th June, another 7.4% loss. During the period between 12th June and 8th July, the SSE index plummeted 32.1%. Volatility has been rising fast and even though there were some days during which the market was able to reverse prior losses, the market has been more or less in freefall during the period between 12th June and 8th July.

But, as I mentioned above, monetary authorities and regulators usually like to believe (or pretend) that rather than a return to fundamentals, a market decline is a bout of irrationality that should be averted through policy intervention. Desperate times need and justify desperate measures, they believe (or argue). The PBoC had to cut rates and to loosen reserve requirements while it tried to directly influence the market through equity purchases of state-owned stocks, a quantitative easing with Chinese characteristics. With such measures in place, the market registered a three-day gain of 13.2%. But then on 27th July the market moved to record the biggest single-day loss of the year, declining 8.5%, at a time many thought the worst was over.

Today, the market opened by extending the loss by another 4%. But the quantitative easing with Chinese characteristics, targeting the shares of state-owned banks, helped lift the market and relieve part of the pain. Instead of dealing with the inconvenient truth that markets cannot rise forever, the regulators prefer to pretend that Monday’s 8.5% decline was led by what they called “malicious” stock sales by large shareholders. Malicious and inconvenient seem like interchangeable terms here.

Beijing has been administering painkillers to dispel the big headaches investors have. The regulators banned short selling, IPOs and sales by major shareholders, and opened direct credit lines from the central bank to margin financing companies. Such measures may give some temporary relief but will just contribute to enhance an unsustainable problem that will culminate in a massive market crash. The rise in margin lending is concerning. Authorities have been implementing measures to crack down on margin lending but at the first sign of smoke they completely reversed them and are now actively promoting even more margin lending in a desperate attempt to reverse market losses. But with margin lending almost quadrupling from Rmb 700 billion in October to Rmb 2.7 trillion in June, the Chinese stock market is heading towards disaster.

Despite the sell-offs, the SSE composite is still up 15% YTD and is almost 80% higher than one year ago, while the economy is rising at the slowest pace in a quarter of a century. But, as the PBoC and the government will continue to support the financial markets, the current bubble will just worsen. Episodes of increased volatility are expected in the near future.

Regarding margin lending, past history can teach us a lesson. The increase of this type of credit has almost always led to market crashes. In the Chinese case, where margin lending quadrupled in months and shadow lending is completely uncontrolled, the risks of a banking collapse are high, if markets decline. Rather than a buying opportunity, the recent declines serve as a warning sign that an epic bubble is underway. Current prices reflect intervention, not fundamentals. But to keep the status quo, the Chinese government will need increasing doses of intervention and will have to impose several restrictions that will make it difficult to buy and sell shares. In the meantime, the government is fuelling speculation, contributing to moral hazard behaviour, increasing systematic risk and losing credibility.

Comments (0)