How to make sense of bond madness

After some initial enthusiasm, investors are now having second thoughts about the reflation trade and once again pouring more money into bonds, as inflation is expected to remain low for longer than first appeared. But, when yields on a 70-year sovereign are at 1.65%, something must be seriously wrong and it can all only end in tears.

Financial markets move like a rollercoaster, heading up and down in prolonged and erratic movements that become self-fulfilling at certain points. Investors tend to follow the main trend, quickly following the herd, no matter how foolish that may seem. Adding to the mix, we have central banks that have been helping on the volatility side and turning the market ever less informative. How can we make sense out of it all? Read on…

Trump’s victory changed everything

A few months ago, pre-Trump victory, everyone was acting as if central banks could never again lead inflation to coil around their 2% targets. More than 70% of the sovereign bond spectrum was by then under water in Europe, with investors happy to pay for the privilege of lending money to the government. Such behaviour looks foolish at first hand, but appears a little brighter when we take into consideration there is another fool buying from investors at even more foolish prices. The expected massive demand for government debt from central banks was a good justification for why bond prices were not reflecting fundamentals. The ECB, for example, had to cut its deposit rate several times to the current -0.40% target, to be able to find enough sovereigns to accomplish its demand aims.

In November 2016, with his bold promises, Trump changed everything. The America’s Shinzo Abe promised to make America great again by cutting taxes, making it easier for American companies to repatriate their cash, increase protectionism, and promote a renewed sense of nationalism and patriotic pride. In just a matter of weeks, a world plagued with deflation was turned upside down and the FED, which took an entire year to hike its key rate from 0.5% to 0.75% was able to hike it twice in a matter of just three months, whilst increasing the odds for further hikes. A mix of a reflation sentiment with rising oil prices led inflation numbers higher everywhere and also pushed up equities. Banks, in particular, have been among the best movers, while bonds seem to have lost their appeal.

The prolonged intervention from the FED, ECB, BOJ, BoE and many other central banks around the developed world, artificially lowered bond yields, and curtailed the spreads between safer and riskier bonds and between short-term and longer-dated bonds. When central banks are buying, no one perceives the risk in the same way as before, such that one shouldn’t expect prices (and yields) to be informative. If anything, bond prices signal the strength of the central bank action and nothing more. Trump’s fiscal plans weighed on the FED, which accelerated policy normalisation, pressing bond prices down and yields higher.

But later, Trump’s expected moves started fading out. The first blow came with the Obamacare bill – when Trump was unable to repeal it. Investors started reevaluating the chances of any fiscal excesses coming just short of expectations or being completely repealed by Congress. If that’s the case, then inflation may end rising slower than expected and normalisation delayed by the FED.

Take-cover, bond madness is returning

The madness that drove bond prices so high in the recent past is returning once again. A few years ago, a long-term bill was something between 20 to 30 years. But, with Microsoft and AT&T issuing 40-year debentures; Italy, France and Spain issuing 50-year sovereigns; Austria issuing 70-year bonds; and finally Belgium and Ireland issuing century bonds – the long-term has been stretched. What is really odd, is not the issue of a 70-year bond but the purchase of it by investors at a 1.65% yield.

In a world plagued with minuscule interest rates below free market rates, investors need to find income alternatives. Some have moved from the bond market towards the equity market (as the FED was willing them to do), others moved their money towards emerging markets (which will later come back and contribute to future currency crises), others ditched debt from developed markets to embrace higher-yielding debt from emerging markets. Unfortunately, there are also many others unable to move towards equities or riskier issues. The only alternative for institutional investors like pension funds is sometimes to increase the duration of their portfolio. By moving from 20-years to 50-years or more, they get the extra yield to meet their need to make future payouts to retirees.

Here’s the key question: In a world where central banks pursue an inflation target of 2%, how can all these people expect to profit from a long-term bond yielding 1.65%?

While I can understand that some investors buy bonds at these yields just because they believe they can speculate on short-term prices, I can foresee an unhappy ending for all those purchasing t issues with a long-term view. A portfolio where yields are low and the duration is high, is a portfolio where rewards are low and risk is high. A long-dated bond is nothing more than a leveraged bet on interest rates. A long position in such a bond is a leveraged bet on a decline of interest rates. Given that interest rates are already at record low levels, that’s quite a bet! When interest rates are near zero, they may remain at those levels for some time, or even turn negative for a while, but when you purchase a 70-year bond, you must foresee more than the next central bank move…

Let’s look at an example…

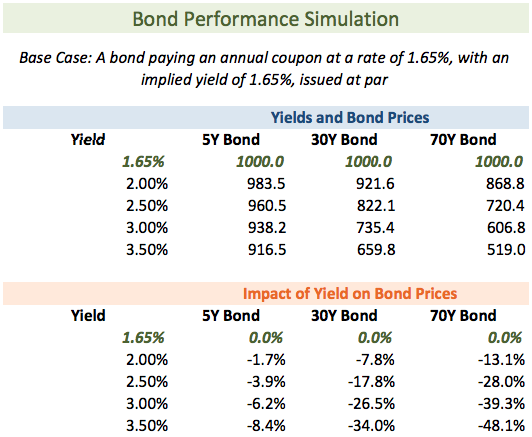

To have an idea about how leveraged a bet on a long-dated bond is, take a look at this example in the following table:

Let’s suppose a 70-year bond is issued at par yielding 1.65%. The bond promises to pay £1,000 in 70 years and is issued at £1,000 today, as it pays coupons every year (or every half year) at the rate of 1.65%. If the yield changes, eventually due to a rise in inflation expectations or an interest rate hike, bond prices must come down. In this simulated case, the price of the 70-year bond would decline to £868.8, a 13% crash in the price when the yield moves just 0.35%. If the yield comes to a more normal 3.5% (which in my view is still low for a 70-year bond), the price would crash to £519, losing almost half of its original value. It is true you can hold the bond until maturity, but at receiving a 1.65% coupon rate you would be giving income away and losing purchasing power over time. Now look at the 5-year and 30-year bonds to see what I mean when I say that a long-dated bond is a leveraged bet on interest rates. If the yield rises to 3.5%, the loss in the 5-year bond is 8.4%, much less than the 48% loss a 70-year bond suffers.

Outlook and final word

The reflation trade may be delayed for one reason or another, but one thing that is certain in this world is that inflation will return and will most likely overshoot central banks’ targets for a period. In a world where credit grows faster than savings, there is no other way to solve the puzzle than to accelerate money creation, and ultimately, generate inflation. Every time the economy enters recession, the central bank tries to reflate the economy and make it easier for those holding debts to repay them. At the same time, we should never forget that government is the biggest debtor of all. The only way for the government to avoid bankruptcy is to generate more inflation than expected. It is therefore unwise to expect a long-term yield of 1.65% to be a good way of preserving money over time when the central bank explicitly targets a 2% inflation rate and the government has an incentive to help boost it above that target.

Yields may go down for a while, but if there’s a potential trade at this point, that is certainly not in increasing duration of a bond portfolio. Go long on short-term bonds and short on long-term bonds.

Comments (0)