Bill Gross Vs the FED

Bill Gross from Janus Capital (ex:PIMCO) has heavily criticised central banks for failing to foresee the consequences of conducting a zero interest rate policy (ZIRP) for too long. They’re destroying “the savings function of capitalism, which is a necessary and in fact a synchronous component of investment”, as “accustomed to Taylor Rules and Phillips Curves, their commentary is almost obsessively focused on employment statistics and their ultimate impact on inflation”. Life insurance businesses, pension funds, 401k plans will all fail, he believes, as near zero rates will make it impossible to honour past promises and to achieve the expected “8-10% [annual return] to pay for education, healthcare, retirement, or simply taking an accustomed vacation… Model driven central banks seem not to notice”.

Bill Gross, the “king of bond trading”, is certainly concerned with the performance of his bond portfolio in a world were zero is the norm. Just a few days ago, on Tuesday, a sale of $15 billion US Treasuries attracted record demand, exceeding the amount on offer by 9.47x, and sold at a zero yield. That doesn’t certainly provide much return at a time the FED predicts inflation at 1.4%. But disclosures apart, Bill Gross has made several important points in his last Investment Outlook Letter sent to Janus Capital investors. He believes that central banks are delaying policy normalisation at a time when the economy needs it, as they seem too worried with the relations predicted by the Phillips curve and the rules proposed under Taylor rules. In an ageing economy where there are many liabilities outstanding, only a higher rate of return can avoid failure. Additionally, and against the models, there is no real investment despite the cost of debt being near zero, as companies prefer to repurchase shares or pay huge dividends to investors.

First of all, let me deal with Gross’s critique of the Taylor rule. Master Investor readers know that I often publish charts and tables using the Taylor rule to come up with a target rate for central banks to follow. But, against what Gross states, central banks often deviate from the Taylor rule, as they have discretionary power in setting monetary policy and are not committed to any specific rules. If the FED were following the original Taylor rule, its key rate would now stand between 3% and 4%, as I mentioned in my prior article commenting on the last FOMC decision. Not even by modifying and tweaking the original Taylor rule to adapt it to the desired outcome, as Ben Bernanke likes to do, could we explain the current 0% to 0.25% target. Additionally, John Taylor, who first introduced the idea of a Taylor rule (as the name suggests), is a fierce critic of the current FED policy, arguing the bank has been detaching itself from the rules.

Regarding the obsession with Phillips curves, central banks seem to be ignoring them too, at least in the FED’s case. With a projected growth rate above 2% and unemployment rate below 5%, the economy is near what is technically viewed by the central bank as the full employment state. The Philips curve predicts an acceleration of inflation under such conditions, which would require the central bank to step in with rate increases. That has not been the case.

In my view, central banks have rotten models, with missing links and broken relationships, that don’t allow them to understand what they’re really doing. They rely on transmission mechanisms that don’t play out as intended. When the economy is rotten and interest rates are near zero, no one wants to invest. Faced with the possibility of expanding capacity, by hiring and investing in capital, a company needs to project the expected additional cash flows the investment generates against its costs. There is no doubt that when interest rates are lower (or equity prices are higher), the costs are reduced. At the same time the present value of projected cash flows should now be worth more due to a smaller denominator (the interest rate that serves to discount the cash flows). That should make for better investment values. But what if the firm doesn’t see any extra cash flows coming from the investment? Then, no matter how small the interest rate is, it would never borrow money and invest, because the resulting NPV would always be negative. First they need to believe demand will grow, otherwise the installed capacity seems to be enough. No need to invest. Being that the case, the traditional transmission channel completely fails, as it did several times in the past. For data in support of this claim, please ask the Japanese.

At the current junction, and for the sake of creating jobs and inflation, it would be much better to put money in the hands of those who have the larger propensity to consume – the poor. They would spend every extra dollar earned and then seduce companies to invest more in the future. But what has been happening is exactly the opposite: the central bank puts money in the hands of those who have the smaller propensity to spend it and the larger propensity to save – the rich. The central bank does this through the wealth channel, as QE and low interest rates help to increase the price of assets, which are obviously mostly owned by the richer in society. In the absence of real investment opportunities and a decent rate of return, they then put the extra earnings into real estate, fine arts, collectibles, and anything else but productive assets (and of course almost nothing gets spent on consumption as their needs were already satisfied from the very beginning). This explains why there is no investment, why there is no consumer inflation, and why the central bank is creating asset bubbles. But while this happens, the central bank is trying to figure out why a zero interest rate is not creating inflation. The wealth effect channel fails.

Then we have the exchange rate channel. The central bank may expect an improvement in trade, as monetary easing usually leads to erosion in the price of the domestic currency. But, when all countries do the same at the same time, it is difficult to figure out which countries will see their currencies depreciate. Besides, recent studies demonstrate that countries like the US don’t suffer that much with an appreciated currency (and the opposite must also be valid such that it doesn’t gain much from this channel when the currency depreciates).

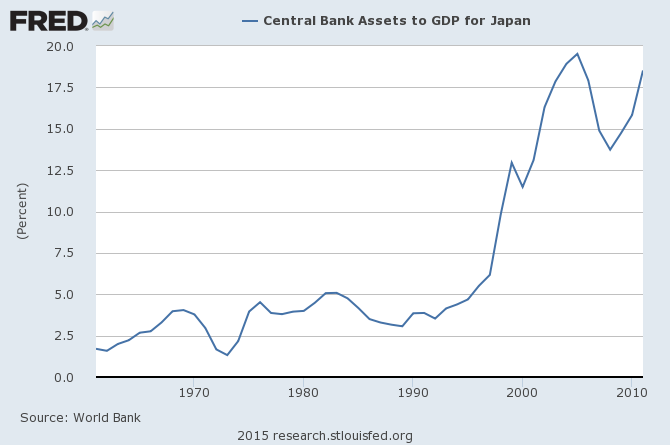

We still have the credit channel. Bank loans are an unimportant source of funds in the US, and evidence shows that the vast majority of loans granted by European banks are not for productive purposes. Basel rules make it easier to lend to a speculator, who can put forward collateral, than to a real investor or consumer, who can’t. We should also not forget that unlike what many still believe bank credit doesn’t depend on interest rates or on central bank expansion of base money, but rather on the high street banks’ will. In Iceland the central bank wasn’t able to contain a credit bubble even though it raised interest rates before that happened. In Japan, the BOJ was not able to induce any consumption or investment during the last 25 years despite allowing its assets to grow from less than 5% of the country’s GDP during the 1990s to the current 18.5% level.

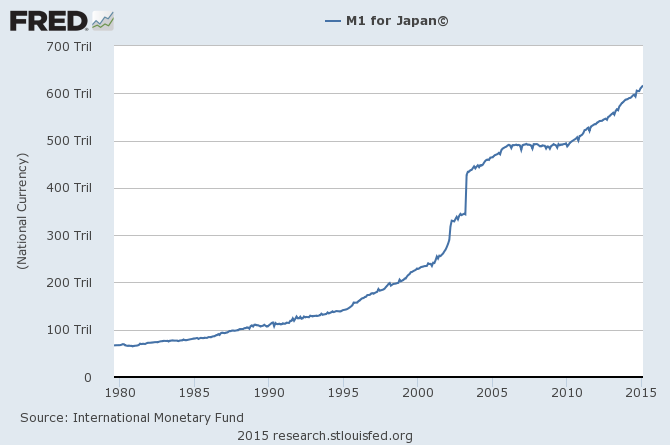

At the same time, GDP has been mildly growing while M1 grew from Yen 100 trillion at the beginning of the 1990s to more than yen 600 trillion today. There’s no consumer inflation, as captured by standard CPI indexes, which is certainly puzzling the central bank.

Most transmission channels seem not work as first believed. To solve the problem, instead of rethinking their models, central banks have been scaling up their policies, sometimes testing the limits of knowledge with negative interest rates, successive rounds of QE, several years of near zero rates, zillions injected into the economy, and delayed policy normalisation. The transmission mechanism is rotten; the models don’t explain the economy. It would be much better to stick to simple rules rather than elaborating on complex relations that don’t work in the predicted way. A simple rule would be to set monetary growth to the level of GDP growth, while allowing interest rates to adjust freely in the market.

In a world where money is created against liabilities, the current system is exposed to financial crises every time there is a slight contraction in business conditions. In the long term, monetary expansion needs to be unlimited and the value of money near zero. That’s why I believe it will be extremely difficult for the FED to act anytime soon without reversing its action soon after.

Comments (0)