Why is the Australian economy in better shape than many other nations?

The last two weeks have been tough mostly because of the Brexit outcome, as it created volatility where peace was previously found. But, speculators, spread bettors and investors all find the best opportunities during panic situations like this. The world has been turned upside down: the 43-year British EU membership is at risk, the pound is at a 31-year low against the dollar, 20-year JGB hit the ground for the first time ever, and central banks are happily paying lenders to get their money. Under such a scenario it is not always easy to digest all of the variables and output a model predicting the macro implications for our economy. In fact, the best is to hedge all positions as much as possible instead of betting the whole farm in a single direction. Today I’m rebuilding the bullish Australian dollar case and taking profits on the unstoppable yen. I’m not sure about the yen but I suspect the BoJ may soon try to prevent further appreciation, which limits its short-term upside potential.

On May 18, I wrote on How to Play the Bounce in the Aussie. By then I was suspecting that the previous rate cut the RBA had conducted was the first and the last, much against market expectations.

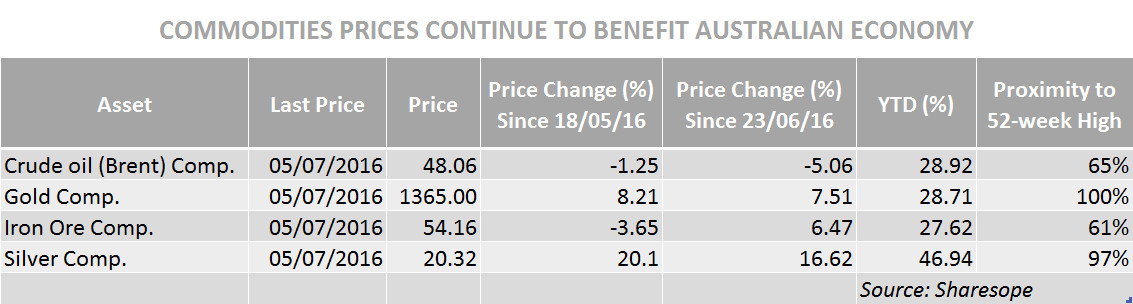

The Australian economy is not growing at the fastest pace and has been negatively impacted by a slower global growth. For the last few years, commodities experienced a large slump, which is a major blow for an economy like Australia, depending significantly on exports of raw materials. But, lately, commodities inverted their negative trend and the Aussie saw its value decline from 1.10 in 2011 to 0.70s this year, which both contributed to an improvement of economic conditions in the country. While certainly not at its best, the 5.7% unemployment rate and the 3.1% year-on-year annual GDP growth, are both stunningly better than what is happening in much of the developed world. However, one thorn in the shoe is the current account deficit, now standing at AUD 20.8 billion. But with a depreciated currency and an improving commodities market, this balance may improve during the next year or so.

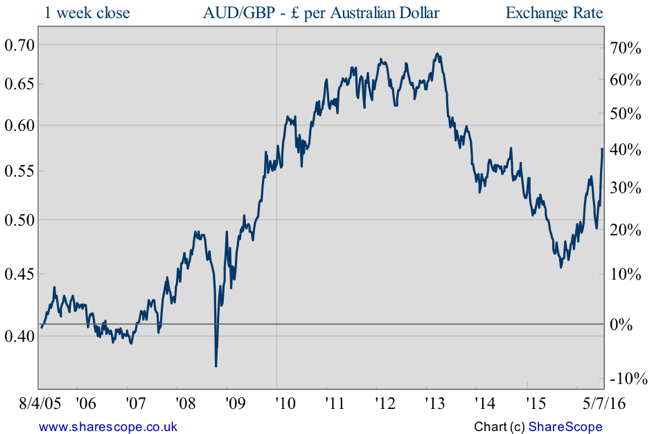

On May 18, the Aussie was trading at around 0.7335 when I was buying the ETFS 3x Long AUD Short USD (LAU3:LN). By then the ETFS was trading at $23.70 while the GBP/USD was nearing 1.4500. The ETFS is now trading at $25.36 (+7.0% in US dollar terms) and the GBP/USD is trading at 1.2975. British investors had a great advantage in buying non-pound denominated assets like the above one, as their final profits would be boosted by a declining pound. I believe the pound will continue to be pressed down until the political situation clears in the UK and until we know a bit more about what is going to happen to the future of UK-EU relation, in particular regarding the “passporting” rights the City currently holds. In the meantime, I’m keeping the above ETFS in my portfolio and I’m risking a bit more by adding a new one: the ETFS 3x Long AUD Short GBP (AUP3:LN). The pair AUD/GBP is already at its 2016 high but I suspect it may continue rising, at least until September, when the political conditions may become clear in the UK. I’m adding this at £46.49.

When the RBA cut its key rate to 1.75% on 3 May, the decision has been far from unanimous, with almost half of the monetary policy committee voting to keep rates unchanged. After that, we already assisted to two new meetings when the RBA kept rates unchanged. The next decision will be on 2 August. But, with some private measures of inflation expectations at a high since December 2013 and GDP numbers coming above expectations for Q1, at 3.1% (YoY), I wonder whether there is any reason for the central bank to act. A quarterly report on inflation is due on 27 July, which will be an important decision material for the next RBA meeting. A better-than-expected reading will just erase any remaining rate hike expectations and boost the Australian dollar higher.

Regarding the impact commodities may have in Aussie business, it seems that things continue to play positively as iron ore and gold (two important commodities for the Aussie economy) continue on a huge uptrend.

The AUD has been negatively impacted over the last few days by uncertainty regarding the general election results. But, over the next few days, as this situation clears, volatility will be minimised, and I expect the Australian dollar to continue its uptrend.

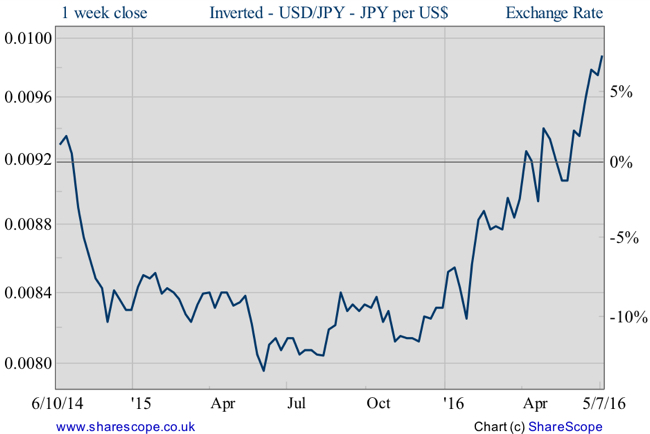

A few last comments go to the yen. On 13 April I opened a bullish trade in the yen when it was trading at 108.7 against the USD. Today, that the yen is nearing 100, I believe there is an increasing risk the BoJ does something. The trade was conducted using the Proshares Ultra Yen and opened at $65.73 (£46.62 when translated into GBP). I’m closing it at $74.94 (£57.76 when translated into GBP). That makes for a 14.0% USD profit (a 23.9% profit when translated into GBP).

I believe that over the Summer nothing serious is going to happen, as investors are waiting for developments in the Brexit case and in the EU, which are unlikely to advance significantly before September. In the meantime, the idea is to keep a hedged portfolio instead of betting aggressively in any one direction. And, unlike what usually happens, investors must be aware this time of currency movements. While in normal times, the major currency pairs don’t change much over short time intervals, this time it is everything about currencies. In the above case of the Proshares Ultra yen, the gain in the original currency for a period of less than three months has been 14% but almost 24% when translated into GBP. Now, think about the opposite situation… just be careful with exchange rates.

Comments (0)