Are we past the market bottom and inflation top?

The short answer is: not likely. Historical data points toward increasing odds of recession amid growing inflation numbers, and the current profit projections for 2023 are still very optimistic and sitting on not-so-low valuations. If forced to guess, I would prefer to stay on the conservative side and prepare for further downside and a mild recession instead of a turning point.

After a miserable year in terms of stock performance, investors have been highly sensitive to any news of improvement, as they currently seem to fear missing the upside more than they facing a recession. The latest numbers for inflation, showing price rises of 7.7% in October, are the big news investors have been looking for, which they interpreted as signalling an inversion in the inflation trend. The slower-than-expected figure comes after an 8.1% rise reported in September and a four-decade 9.1% high recorded in June. However, I hardly see these numbers as a material sign of trend reversal, and the figure is still too high and volatile to take it optimistically. A detailed analysis of the numbers shows that inflation is spreading from the goods market to labour-intensive services markets and as the numbers are running near tow-digits for so long, inflation may very well become entrenched. Nevertheless, investors interpreted these numbers positively and pushed the S&P 500 by 5.5% on November 10, while bond yields declined massively across the spectrum, on decreasing odds for rate hikes.

The Fed is aggressively lifting rates to fight inflation, which is running at decades-long highs, hoping that higher borrowing costs will curb spending, hiring and investment without derailing the economy. After one decade of near-zero interest rates, one can’t blame investors for desperately seeking signs to guide an early entry to the market, as they see the current 4% level as a massive opportunity. However, the current rate is neutral at most, eventually not aggressive enough to revert inflation, as predicted by the Taylor rule. No matter how favourable the inflation numbers may be, the current 4% rate is not enough to create a positive real rate of interest, which is usually seen as necessary. During the inflation peaks of the 70s, the Fed funds rate hit 13% (1st crisis) and 19% (2nd crisis).

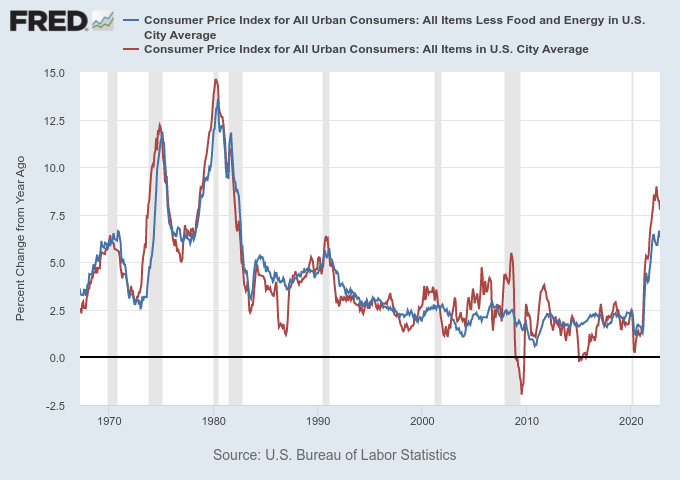

The chart above shows the evolution of inflation (core and full) for the last 50 years. One regularity observed is the connection between high inflation and recessions (grey areas). After periods of high inflation or during its run-up, a recession always occurred. Uncontrolled inflation usually forces the central bank to adopt hawkish policies, mainly through rising rates, which in turn contributes to cooling the economy and driving it into recession. With the unemployment rate sitting at a very healthy 3.7% and inflation at an aberrant 7.7%, there aren’t many reasons to believe the Fed will hit the brakes.

Stocks fell aggressively this year, as reflected in the S&P 500 (-17%) and the Nasdaq Comp. (-30%), but most of the correction came from lower valuations due to rising interest rates and bond yields. The latest recoveries further exposed stocks to interest rate risk. Moreover, there is another source of risk for stocks – profit growth. The market is expecting slower profit growth than months before. But, in comparison to previous periods when inflation was running high and/or there were increasing odds of recession, expectations are very optimistic. The S&P 500 is trading at an average price-to-forward-earnings of 16x, which compares to values below 10x during periods of trouble. These valuations leave stocks exposed to the downside.

The current Fed target rate between 3.75% and 4.00% appears high for the last decade but it is lower than neutral in historical terms and according to the Taylor rule. Current economic conditions allow the Fed to push for higher rates. But the yield rally reliefs we have been lately assisting too may add more to policymakers’ concerns than helping, as they’re offsetting part of the rate hike in an early phase of the tightening. For all the reasons exposed here, I believe the odds for a recession in 2023 are increasing, and we are still to see the market’s bottom. As for the soft landing, we didn’t see many on the past when inflation was high. Whether the Fed will be able to get one this time, remains to be seen. But I doubt it.

I also assume that this dead cat bounce will bounce lower in 2023. Save your cash for the January sales (in stocks) imo