The Saudis want everyone to go bust

It would seem that the Saudis want everyone to go bust in their attempt to tear down the shale oil revolution, only to push oil prices back up again in future. But do they still have control of this market? Judging by the persistent weakness observed in the market, it seems that everything is falling apart, including Saudi Arabia.

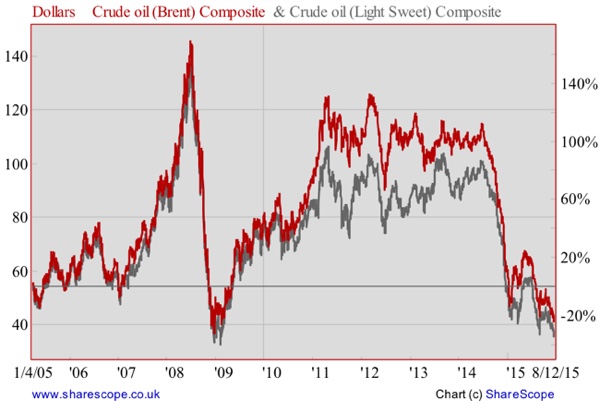

Oil prices just hit a low not seen since the peak of the financial crisis (in February of 2009). If the trend remains in place, the market will soon settle at 2004-2005 prices. On one hand, this is exactly what the Saudis want, in order to regain their market share and push other producers out of the market; on the other hand, given that the worst of the recession is behind us and that a price near $50-$60 would already be below the marginal costs faced in many oil exploring areas, one could question whether such low prices are just the result of OPEC’s output decisions or whether they hide other developments. Saudi Arabia’s task has been easier than first thought due to a mix of international developments. Unlike what happened in 2009, when oil prices were boosted by a declining US dollar driven by the FED’s massive asset purchases, this time there’s no QE and the interest rate is on the verge of being hiked. Anticipation of this event alone has been driving the dollar higher, which has had a negative impact on commodities prices in general, and of course on oil in particular.

While a change in US interest rates should have a direct negative impact on oil prices, the final effect is usually positive. The reason for this is the fact that a rate hike usually comes at times when the economy is improving. A rate hike usually comes with higher aggregate demand, which should boost the appetite for energy products, as suppliers attempt to increase production to fill the higher demand for their products. But this time, not even an improving US economy has been able to pare oil losses. Many say that the excess oil production has been so large and for so long, that stocks are piling up everywhere and more than offsetting the positive effect stemming from aggregate demand. But that may be just half the story.

One month ago, the IEA predicted a rise in demand for oil of less than 1% per year at least until 2020 and modest growth rates thereafter. If these predictions materialise, it may take years for the current stockpiles to normalise and, unless OPEC cuts production, the bearish trend for oil prices may continue for years. But while a bearish oil market, as the consequence of depressed demand and over-production, is reversible, the same may not be true about the current situation. We are living in an unfavourable growth scenario, with the US running at the front of the developed world pack, but with Europe still fighting the aftershocks of the global recession. At the same time, the threat of rate hikes in the US is hitting oil prices and leading to capital outflows in the once high-flying emerging economies.

But it seems that the world is also shifting away from oil. China is no longer angrily demanding raw materials to grow its economy, as it is changing its investment-driven economy towards a more consumer-orientated one. Given the China dimension, any small change in demand is enough to lead commodities into a bearish market. Because the production/extraction of raw materials takes time to plan, past decisions to expand capacity will take years to be reversed, as countries and companies adjust to the new reality. In the meantime, prices will take care of the imbalances and huge volatility is expected.

But there are other important shifts in the world, concerning the development of alternative energies and increases in efficiency. Faced with high oil prices and being dependent on a small group of countries, governments and companies in oil-dependent countries invested in the development of new energy sources and in the improvement of the efficiency of the existing ones. Cars, household appliances, consumer gadgets, and many other products today need just a fraction of the energy they once needed. This means that for the oil market to remain stable it needs ever higher global GDP growth rates. Unlike what many predicted decades ago, it won’t be the supply side controlling this market, leading prices higher, but rather a dependency on ever decreasing demand. Saudi Arabia may already not be in control of this market and may run into trouble, along with any other entity that is dependent on petrodollars.

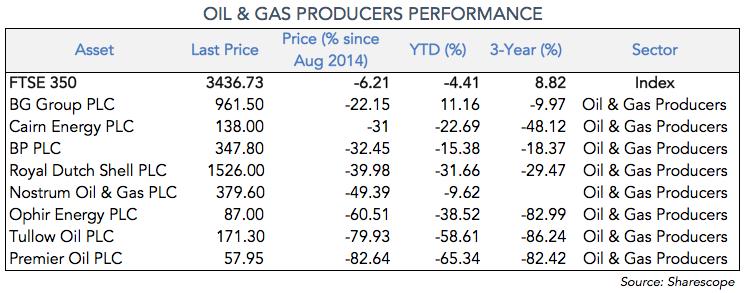

The outlook for the oil market is grim. Shares in the biggest oil companies trading in the FTSE, like Royal Dutch and BP, have accumulated losses of between 20% and 40% for the period running since July of last year until today. In less than a year, oil prices retreated 60% and these companies couldn’t avoid the downturn. Smaller companies face an even darker outlook, as share price declines surpass 80% in many cases. Companies operating in the shale oil revolution have been decimated and many won’t be around by the middle of next year.

But if OPEC has in the past helped to boost a number of energy alternatives and to drive gains in user-efficiency (via higher oil prices), they are now contributing to the development of improved technology in the supply side, as the low price is a great incentive for the remaining companies to increase cost efficiency. A low price will certainly drive many companies towards bankruptcy, but will also allow for the surviving companies to become highly efficient. Oil projects in remote areas or regions with high risks (being economic, political, or of any other type) will be delayed indefinitely, but part of the shale industry in more productive areas will remain. That industry has effectively placed a cap on oil prices. OPEC won’t be able to drive prices above a certain level, because many companies would enter the market again and force prices down.

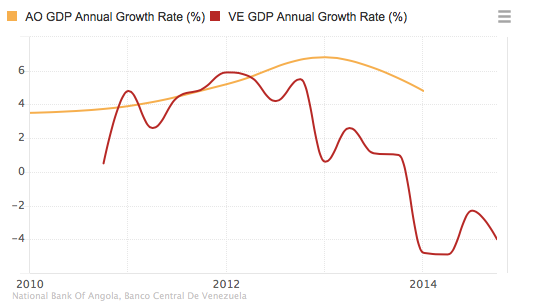

The strategy followed by Saudi Arabia has severe shortcomings. This is no longer about the shale oil industry but also about OPEC members. The high production strategy is crippling growth, leading to capital outflows and increasing budget deficits in all OPEC members. Venezuela and Angola are heading towards complete economic and social chaos, with growth spiralling down and oil income not enough to finance government spending.

At the beginning of the year, one US dollar could buy 100 Angolan kwanzas. Currently the exchange rate stands at 1 to 135, as a result of declining oil prices. But the official rate doesn’t even reflect the observed reality in which people aren’t able to get US dollars from banks, and instead are forced to exchange them on the streets at a rate of 1 to 270. Many construction companies are already shutting down their business in the country, as the government is delaying payments.

Angola and Venezuela are the weakest links in the OPEC group and are thus expected to be the first to experience a deterioration in their financial positions following oil price declines. But they won’t be alone in the medium term. Take the Saudi Arabia case, for example. The country had a debt-to-GDP ratio of less than 2% at the end of 2014 and foreign reserves of around $738 billion (at today’s exchange rate). In a country where people don’t even have any experience of taxes, there seems to be a lot of margin to drive all others bankrupt before feeling the heat. Nevertheless, the country lost $90 billion in foreign reserves in the year to October. If this pace is maintained, the country will run into trouble in a matter of just a few years. From a balanced budget the country is going to hit a deficit of near 20% this year and another 20% next year (as predicted by the IMF). Oil-producing countries in the Gulf are already tapping money from their sovereign wealth funds to keep afloat.

OPEC long ago shot itself in the foot and will never recover from the damage. While Saudi Arabia tries hard to bust everyone, let’s enjoy the lower oil prices as consumers. As investors, it may be time to look for something sweeter than oil like cocoa and wait for the market to stabilise, as price declines aren’t over yet. In the meantime, any play in the market should be in larger caps, as many of the smaller caps just don’t have the financial firepower to survive this market in the meantime.

Comments (0)