Sirius Minerals: an Update

AIM: SXX

Shares in issue: 2,295m

Market cap @19p: £436m

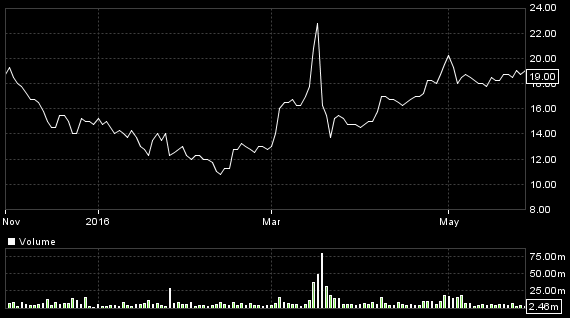

Back in March I advised not to chase Sirius Minerals, which had spiked on publication of the DFS for its planned potash mine in Yorkshire. As potentially a large, domestic, very long lived and profitable project it will, one day, loom large in the investment universe for major institutions. But it isn’t there yet, and it will be at least seven years before any revenues, and probably ten years before positive earnings. And it still has to raise the initial £1.1bn needed to get going.

After sinking back from the peak of 23p to 14p, the shares have been recovering, as more broker coverage has sung SXX’s praises on the basis of NPV forecasts showing extremely high values, even as of now – i.e. the future value from today, once finance has been raised in two stages, of its net revenues far into the future (50 years in fact) and not starting for nearly ten years. Shore Capital for example, on an assumption that the necessary equity financing will take place soon at only 5% above the present share price, says the shares have a NPV now, at a 10% discount rate, five times higher at 104p. That is twice the levels that brokers were going for, although before any ‘discount’ for risk.

Seems marvellous. So should one buy the shares?

We must also discount the fact that the shares have been rising on news of a certain amount of progress and on that broker report which, unlike many, has been put around on the bulletin boards. Should one still buy? Shore is not the company broker, so its analysis can be taken to be objective and not aimed at pushing the shares higher before the capital raise. On the other hand Shore wants to secure its place among the brokers that the institutions will want to deal with for the shares.

My short answer is, still, no. After all, if the equity raise really does take place at the assumed 20p price, there is only another 5% to go for and one can’t expect that there will necessarily be a stampede afterwards by other investors pushing the shares higher. The amount to be raised is pretty large and might mop up all latent demand, and those participating might trade out some of their shares if they see a profit, rather than that others will be killed in a subsequent rush to buy.

Here we have to look at the assumptions behind that 104p/share 10% NPV (At the 8% I find better accords with how the market is rating such project companies, the NPV would be 162p).

First of course is that 50 year life. I find it hard to believe that any institution will accord a value to a project that adds up revenues 50 years into the future. Anything could happen. Taking 25 years would take the NPV down by 40%.

Next is the capital raise price, which it looks fairly safe to take at face value. A raise price 10% higher would result in an NPV 5% higher – so not a lot there to affect the calculation.

But overall is the question whether an NPV is the best way to value.

Investors usually prefer to value on a PER or yield basis. It is easier to understand and to relate to others in the market than to adjust in one’s head for the big effect on an NPV that discount rate assumptions have. What rate does one take anyway?

In practice, yields and PERs are logically valid to use when an income is assumed to last forever. It is only for mining companies’ projects or other short-lived income streams that an NPV basis (which is perfectly logical in itself) has to be used, because applying a market PER value would overstate the real return to an investor over its life.

And in the case of Sirius, a PER basis now won’t work in any case, because there won’t be any income until 2023. Even then the EPS would only start at around 2p, and would take the next five years to rise to about 20p per share, even on Shore Capital’s more optimistic ‘base case’ scenario concerning the prices and volumes SXX will be able to achieve on its product (the scenario on which the NPV is based). So if you want to argue that the shares are cheap now, there is no alternative than to use that NPV argument.

But even jumping forward ten years and assuming SXX is being treated by the market as a reliable, high margin, cash generating business, on what PER would it stand or on what yield?

Shore says that by 2022 SXX’s ‘forward’ NPV 10 (i.e. taking in revenues from that point up to 45 years ahead – the initial capex having been made) would have risen to 400p per share. That would equate to a PER, on its forecast of EPS once fully up and running, of nearly 20 times – for a company entering a production plateau. Would that be reasonable? I don’t think so. I think a share price half that would be more likely.

So, if all goes according to Shore’s plan and no more shares have to be issued, they might rise from 20p now to 200p in ten years time. OK if you like locking shares away in a bottom drawer and you believe in no mishaps meanwhile. But I, personally, would avoid buying at times like this when the shares are being pushed, and especially when that £1bn (involving almost doubling present shares) still has to be raised. A move from AIM to the main market would make it easier, and might provoke another share spike. But it wouldn’t change my medium-term view.

Comments (0)