More Notes from Underground

NPVs Revisited – Spikes and Weasel Words

(Oxford’s definition of the latter: “an informal term for words and phrases aimed at creating an impression that a specific and/or meaningful statement has been made, when only a vague or ambiguous claim has been communicated.” Alternatively, Rationalawiki’s definition is “words or phrases used in an ambiguous manner in order to make a point.”

In this context some examples might be “Intrinsic Value“, “Unrisked Value” and “Target Prices“.

I keep banging on about this topic because it so pervasively affects market perceptions of miners with projects not yet funded. The confusion created is what is most responsible for share price spikes. It perfectly describes the tactics used by house brokers and company promoters to bamboozle the innocent investor – betrayed as he is by the FSA (as was) which has denied them the better broker research (what there is of it) aimed at the institutions, leaving them to the worst of those ‘retail brokers’ who inveigle with ‘bogus’ share valuations.

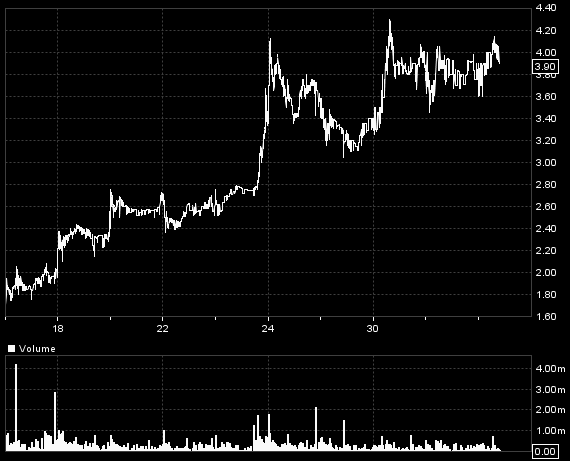

I revisit, because a current example, Asiamet Resources (AIM:ARS), has been using the term ‘intrinsic value’. It’s almost the same as a ‘target’ price, but both rely on a basic conceptual misunderstanding of what an NPV actually is. To see the fundamental point of that, let’s consider why the idea (held by many private investors) that a share value equals the NPV of an (unfunded) project is nonsense.

It is nonsense because it envisages that another party could come along and ‘buy’ the project for the NPV – but who, if he pays to buy it, will also have to fund it, so paying twice over. Every dollar he pays to buy the project reduces its NPV for him by a dollar. So what is the point unless the NPV is very much larger than the price he pays?

So yes, of course, the project might be saleable for some consideration, but never for anything like its NPV. The reason for the mistake lies in neglecting the need to fund the upfront capex, and as a result a project’s owner can’t sell it for its NPV. He can give part of it away to a partner in exchange for part of the capex. But owning an unfunded project has no value for him that equals its NPV.

That is why I’ve said ‘target’ prices based on NPVs are ‘bogus’.

However, what about “Intrinsic Value”? In the case I have in mind that I discussed last week, the broker has calculated a ‘value’ for its project assuming it is up and running and fully funded. The funding is assumed to be all by way of a 100% project loan, whose repayment is taken to be part of the overall capital and operating cost.

If such were possible, then of course the project would have a ‘value’ which can be sold to a third party. But in practice, no sensible financier would ever lend 100% on a risky mining project (no mining project can ever be risk-free). So account would have to be taken of the cost to the owner or a buyer of contributing some equity, and that cost to him would obviously depend on the amount he has to contribute in relation to his own size. For ARS 25% of the capex is about equal to its current market value, so at the very least shares in issue would have to double, making a nonsense of the ‘intrinsic value’ per present shares in issue that is being touted. (In case readers are asking, it is currently about double the current share price. So it looks as though the current share price – on a spike – might be about right, thus ‘spiking’ the hopes of those on the bulletin boards expecting it to double! Except for the fact that an enormous discount should be applied due to the project’s extremely early stage and tentative economics. I hope that’s enough said.)

Asiamet last ten days

It’s not all bad news for juniors

Although many mining investors don’t realise it, innumerable miners’ assets have actually cost them more than pretended – in the previous incarnations that many explorers have probably gone through. ARS for instance acquired its BKM concession for a song – unrelated to the more than $70m reportedly spent on it by previous owners. So shareholders might be getting more value than they realise. Or, alternatively, they don’t realise that mining exploration through to development is considerably more expensive than they thought. Much of the cost tends to be ‘lost’ in the written down accounts of those who have gone bust before, with their projects acquired subsequently at a knock-down price.

Just like now. As investors who used to rely on dividends from the Anglo Americans and Rio Tintos of this world have painfully learned, the majors are having to cut back, retrench, and sell. As a result, there are rich pickings for the sparrows hopping around!

Horizonte Minerals (AIM:HZM) has long owned an apparently attractive nickel resource in Brazil, its development restrained by a nickel price down by 2/3rds since 2011, although the project economics have been completed and it only awaits funding. Alongside it is a similar resource developed to a more advanced stage by Glencore who having spent some $75m on it has now (due to its own troubles) sold it to Horizonte for a knock down $2m in shares initially and only another $8m once it gets going. HZM is itself valued at a knock-down £12m, and given that McKinseys only recently thought that base metals’ demand supply balances are bound to turn towards a deficit soon and that Capital Economics has stated that “…we think that the pieces are falling into place for a significant rally in the price of nickel in 2016”, you might see HZM’s long share price decline

begin to turn during the coming year.

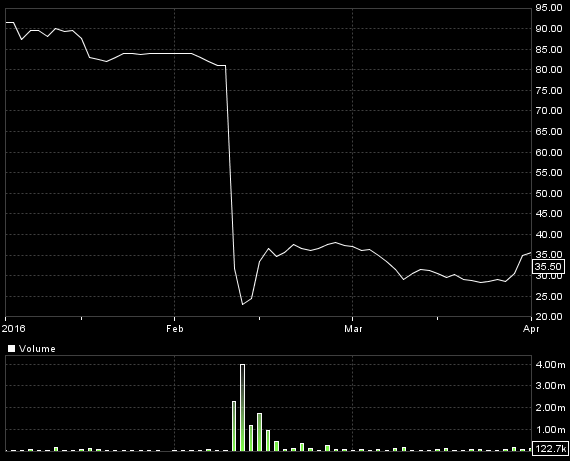

Solgold (AIM:SOLG), having raced up on anticipation of results from the latest drill hole 16, relapsed severely when it appeared to show the rich ores ending at less depth than expected, producing a possibly smaller resource. The reaction was particularly severe because the company is at a critical stage, with definition of the boundaries of its first ore body still tentative, and funding needed to continue its expanded drilling programme. So observers took a disappointment as meaning potential funding partners would be deterred and/or that the necessary funding would be at a lower share price. In addition, some large sales looked like coming from some of the contractors and creditors who took shares only recently in lieu of payment for services – and if that isn’t from a horse’s mouth what is?

Solgold last two years

In fact, this drill hole is only one of a number and the market ignored another hole (14) which added to the deposit’s width, while this ‘Central Alpala’ target is only one of five on the wider Cascabel property. Some are already making rough estimates that this central target alone (even if not extended by the ongoing drilling) contains metal worth £12bn (or, at a 1% valuation, 12.5p per Solgold share), and at grades making it worthwhile to extract using ‘block cave’ methods. But at this still early stage the argument will be between those who are hoping for a truly ‘world class’ long-lived deposit that will attract the majors, or one that just misses – making a big difference to the value the market will attribute to its ‘in-ground’ resources.

So shifts in opinion will continue to be reflected in violent share price reactions. I personally still think SOLG is worthy of a punt for the long term at every short-term setback in the shares. I still think that the chart demonstrates that a key point has been turned in the market’s perception of Solgold’s long-term potential, and in a few months’ time the first drilling on the other, promising, targets will be buoying them again.

Meanwhile, Hornby (AIM:HRN) has come out with a fairly reassuring statement to the effect that Barclays has extended its loan covenant deadline and that trading is going reasonably well. I pointed out how cheap the company looked after its shares had halved in February, especially given its position in its various industries and with its valuable trademarks, and given the little reaction in the shares so far, I wouldn’t deter anyone from investing for recovery right now.

Hornby last three months

Comments (0)