One commodity that doesn’t leave a bitter taste in the mouth…

“On a typical day, one billion people around the world eat chocolate”

– in “A taste of the future”, KPMG June 2014

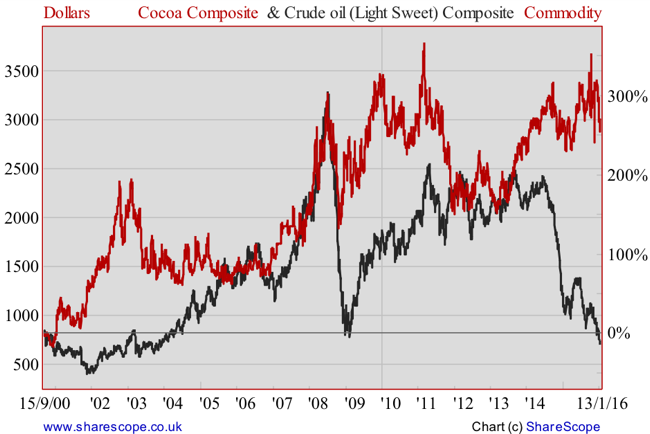

Financial news has recently been dominated by the epic crash that is haunting the oil market. What at first seemed like good news for consumers is now turning into a nightmare from which the world seems unable to wake up. The once high-flying commodity is surprising the most pessimistic of investors by hitting low after low. Many dollars have been spent trying to guess a floor for oil prices, but so far the best guess seems to lie at $0, the only price at which I’m confident oil won’t go any lower. Light sweet crude oil is down 17.1% YTD on top of a 31% decline last year. Performance for the last three years is around -72.5%, which puts prices back at their 2003 levels… a lost decade and a major headache for the Saudis…

Much sweeter has been the market for cocoa, which has enjoyed a 260% rise since the start of the century and has been particularly bullish during the last few years. In 2015 all but two commodities closed deep in the red. The two commodities in question were cocoa and sugar. While the numbers would certainly make the case for some contrarian traders to back oil and eschew cocoa, the fundamentals continue to provide clues in the opposite direction. Despite the rapid price changes, the oil market continues to show excess supply and weak demand growth, while the cocoa market still shows extremely tight supply conditions and rising demand.

Strong Demand

They say that stressed/depressed people usually eat more chocolate than others. Chocolate acts as a kind of Prozac, it seems! That being true, I understand there is a good reason for cocoa prices to rise when the rest of the market declines, as traders try to calm their nerves! Increasing the scale a bit, when the overall economy is weak (as it has been in recent years) there are plenty of reasons for demand for chocolate to increase.

But chocolate is more than a mere cure for stress. More than anything, it is a joy, a pleasure. People consume chocolate because they love its taste. Chocolate certainly has strong mood-altering abilities, but its most important feature is its social characteristics. Chocolate is connected with personal income and social status. In the developed world there is plenty of chocolate on supermarkets’ shelves to fit all kind of tastes and pockets. But that isn’t the case in emerging markets, where chocolate has been (and still is) a rare luxury delicacy, not available to all.

As personal income increases in emerging markets like China and India, demand for luxury goods also increases. The Chinese want the same phones and stereo systems the Europeans have, they want the same perks and lifestyles, they want chocolate…

A decade ago, chocolate demanded by emerging markets represented 30% of global demand. Today, the same represents almost 50% of total demand. Demand for chocolate has been growing globally, but it has been growing faster in the emerging world. Countries like India, Algeria, Nigeria, Saudi Arabia, Turkey, Costa Rica, Bolivia, Brazil and Thailand have seen demand rising particularly fast as living conditions improve in these countries. This trend is expected to continue for years to come, assuring that demand for cocoa will continue to rise at a fast pace (unless Mondelez or Nestle find a way of making chocolate without cocoa).

Weak Supply

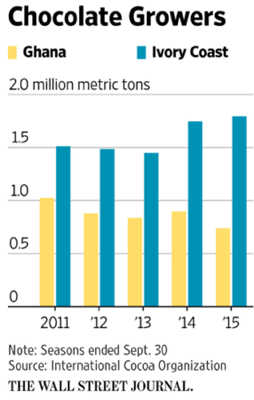

To make chocolate, cocoa is needed. If demand for cocoa rises, then supply must also rise. More than two-thirds of the global supply of cocoa comes from West Africa – and from Ivory Coast and Ghana in particular. These are among the few countries that have the tropical conditions needed to raise cocoa. Unlike gold or oil, which are extracted by a few big companies, cocoa comes from many small holdings, usually family businesses.

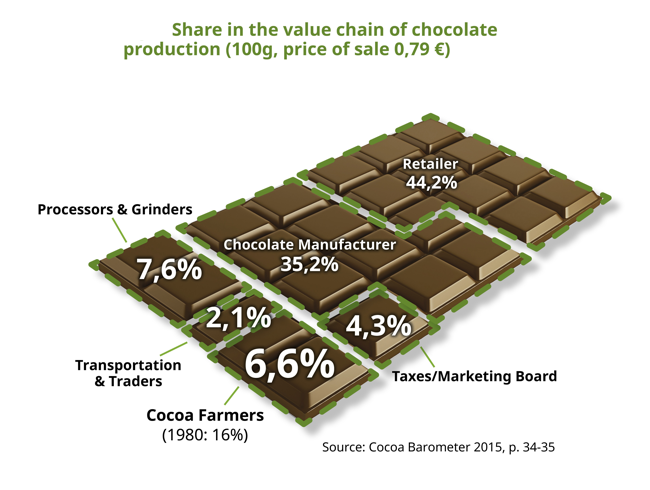

The commodities markets are known for the time lag in the response of supply to demand incentives. It takes time to shut down production and to explore new sites, such that price is the primary adjustment mechanism in the short term. But the situation is particularly worse in the case of cocoa, because supply is relatively disconnected from demand conditions. One could think that, with the demand for chocolate rising, production of cocoa would rise over time. And, in the meantime, farmers would become rich, as prices rise. But that is certainly far from the truth. The distribution of income from the sale of a chocolate bar is largely unfair, with the farmer providing the most part of the final product while just getting 6% of the final price. Income is in the hands of manufacturers and retailers, which in conjunction get almost 80% of the final price.

But the problem for farmers is not only about getting a low share of the final price; it is also about not getting the full commodity price. They are being paid just 40% of price we see quoted everyday on our computer terminals. Intermediaries get their share of income from purchasing at very low prices, which farmers accept due to their weak conditions and production risks. Under these conditions there is no incentive for farmers to increase production of cocoa. On the contrary, new generations tend not to follow in the footsteps of their family and prefer to abandon the rural life or to produce alternative commodities. The current picture is framed by poverty: farmers have no money, no education, no access to health, and no way of keeping their crops productive. They just don’t have the resources to replace the old unproductive trees, or to purchase pesticides. Over time, production tends to decline and farmers abandon crops. If this picture isn’t addressed, cocoa may all but disappear from the earth and chocolate would become more valuable than gold.

Rising Price

Luckily for those of us with a sweet tooth, Mondelez, Nestle, and others are financing programmes to improve the productivity of crops and ensure farmers get a fair price for their product. The steps being taken will help stabilise production in the medium to long term, but the current fundamentals continue to point to a very tight supply of cocoa on a rising chocolate appetite. These facts favour long positions in cocoa. At the same time, manufacturers with good penetration in markets like China (Hershey (NYSE:HSY)) and India (Mondelez (NASDAQ:MDLZ)) will benefit from growing demand in these countries.

YTD, however, cocoa is in trouble. Just a few days into 2016, the commodity is now down by 10%. Many analysts attribute the decline to computerised trading based on algorithms and to the low volume that characterises the market. Rather than constituting a turning point, the recent decline seems more like a good entry point, as fundamentals remain very good… and much sweeter than for oil.

Comments (0)