Get back into gold with Caledonia Mining

Investors hoping that the 4.9% losses seen from the FTSE 100 in 2015 will be reversed quickly have been disappointed so far this year. The blue-chip index has fallen by over 300 points already as contagion from a stock market plunge in China has spread, caused by the ever present growth slowdown fears.

In reaction, the traditional “safe haven” investment of gold has sprung back into life, gaining 3.3% to $1,096 an ounce in the first few trading days of the year.

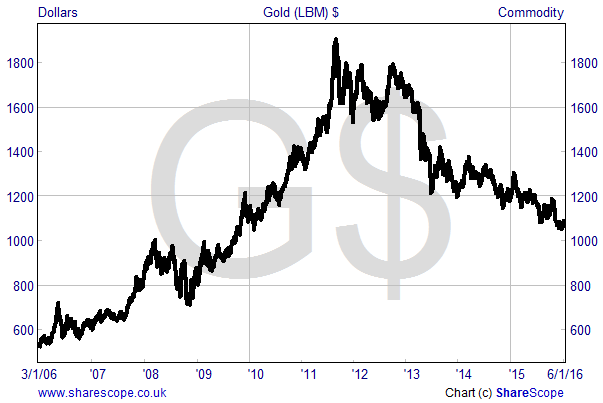

10 year gold

While the gold price continues to be depressed, still trading at a c.6 year low, I see some positive signs for the yellow metal heading into 2016 as the fundamentals of supply and demand should continue to improve in gold bugs’ favour.

Demonstrating this, recent figures from the World Gold Council showed that demand for gold outstripped supply by around 21 tonnes in the third quarter of 2015. The core jewellery market continued to perform well in the period, with demand up by 6% year-on-year. But the real market driver was a 33% increase in demand for physical bars and coins. Overall demand rose by 8%, with a significant slowdown in outflows from gold ETFs also helping the numbers.

On the supply side mine production fell by 1% due to falling output from older mines and as growth slowed at newer ones. Supply of recycled gold fell by 6% as the low price put off sellers. With the gold price hovering around the all-in sustaining costs of production of many producers, we are likely to see the closure of unprofitable operations, resulting in a further tightening of supply.

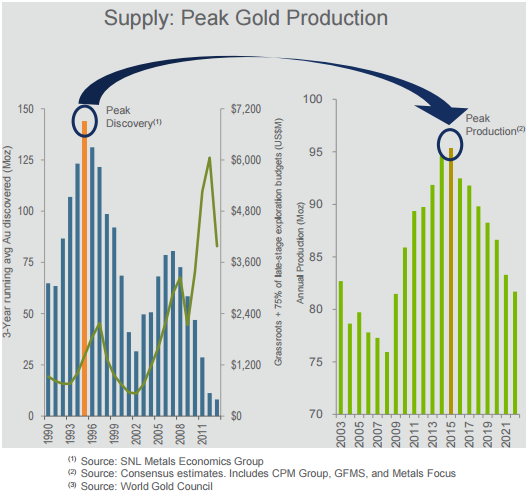

This excellent chart from a presentation by US listed miner Goldcorp further shows the medium- to long-term supply issue, with gold discoveries having fallen dramatically since 2007. What’s more the chart shows that production tends to lag discoveries by around 20 years. With peak discoveries being in 1995 this suggests gold production may have already hit its highest level.

Source: Goldcorp company presentation

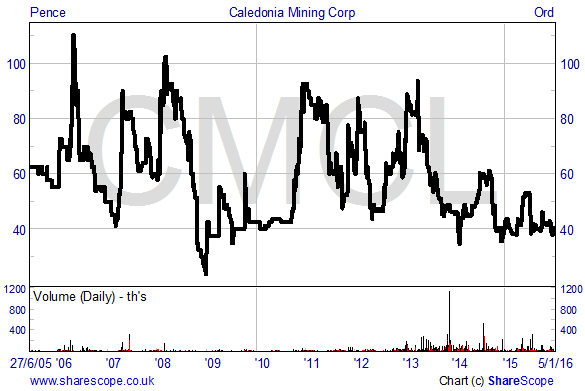

For small-cap investors who believe in the gold bull argument one way to play the situation is via shares in Caledonia Mining.

The Business

Listed on AIM, the TSX in Canada and the OTCOX market in the US, Caledonia Mining (CMCL) is not Scottish as the name suggests. Instead it operates in the more politically stable country of Zimbabwe, where it is the 49% owner of the Blanket gold mine. The operation was acquired by the company in June 2006 from Kinross Gold for $1 million plus 20 million Caledonia shares. Blanket is located in the south-west of the country, around 15 km west of regional capital Gwanda and 560 km from Harare.

Blanket has a gold production history going back to 1906, with total ounces produced passing over 1 million in 2005. The site is supported by good infrastructure, including roads and an educated workforce, which mainly live in the company maintained Blanket Mine village. While the firm has an uninterruptible power supply agreement with the state-owned electricity supplier it also has its own back up diesel generators – useful given the country has recently seen power outages.

October 2008 saw gold production at the Blanket Mine temporarily suspended due to problems with the Reserve Bank of Zimbabwe and other well-known economic difficulties in the country. However, production resumed in early April 2009 and over the past five financial years the mine has been producing an average of around 42,000 ounces per annum. Under local laws all gold produced is sold at a small discount to Fidelity Printers and Refiners, a company controlled by the Zimbabwean authorities which is responsible for the refining and marketing of all gold produced in the country.

Mining operations: Source: Caledonia Mining website

One of the most important developments in the firm’s history came on the back of Zimbabwe’s Economic Empowerment Act 2007, which requires that a controlling stake in all commercial enterprises be owned by indigenous Zimbabweans. Under this law, in February 2012 the firm agreed to sell 51% of the company to various local parties for $30 million, a price which was close to the firm’s market cap at the time. Caledonia was the first mining company to meet the requirements when the deal was finalised in September 2012.

The big plan

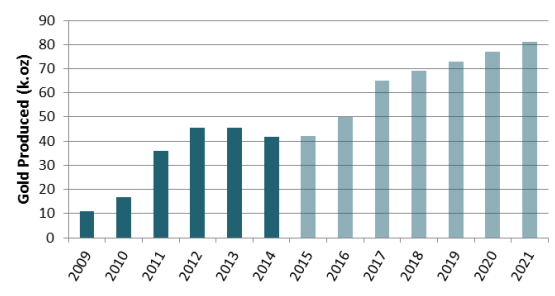

Caledonia’s operations at Blanket are currently being driven by its Revised Investment Plan, which was initially announced to the market in November 2014. Under the plan Caledonia is looking to invest around $70 million in the Blanket operations in order to ramp up production to c.80,000 ounces per annum by 2021. The focus is on improving infrastructure in the underground operations in order to increase gold production from below the 750m level. First production from this investment is expected in 2016 and will then accelerate significantly each year up to 2021.

Planned gold production under the Revised Investment Plan (ounces), Source: Caledonia Mining presentation

Significant economies of scale are expected to be achieved under the plan as the cost base is spread over more production ounces. Blanket’s metallurgical plant has significant surplus capacity, with increased production able to be processed with moderate capital investment and ore treatment costs. As such, while the all-in sustaining cost of production (the cost incurred in the complete mining lifecycle) was $1,011 an ounce for the most recently reported quarter, this is targeted to fall to below $900 in 2016 and to below $750 in 2018.

At the time of publication all capex for the revised investment plan was expected to be funded from Blanket’s internal cash flows, Caledonia’s unused credit facilities and existing (and significant) cash balance. Unfortunately, since then the gold price has fallen from the $1,200 an ounce price upon which the expansion plans were based. As a result cashflow from the operations has been lower than expected and Caledonia has agreed to pump an additional $5 million from its own reserves into the capital spending plan. Cash stood at CAN$22.4 million at the end of September 2015, so the balance sheet will remain robust despite this increased investment.

Work on Central shaft project. Source: Caledonia Mining website

Numbers

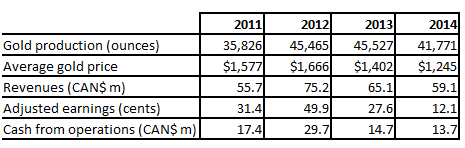

Since the troubles of 2008 Caledonia has been performing fairly well operationally. Production has varied, having hit record levels in both 2012 and 2013 but falling back in 2014 due to lower gold grades being mined. Revenues and earnings have been more erratic, however, due mainly to the falling gold price experienced since 2012 and its effect on the firm’s operational gearing – see table.

Caledonia Mining 4 year historic financials

More recently, production amounted to 42,806 ounces of gold in 2015, slightly ahead of the 42,000 target and 2.5% higher than in 2014. The target for this year remains at c.50,000, with steady increases in quarterly production expected as the No. 6 Winze capital project begins producing in mid-Q1. Production is expected to rise from 10,700 ounces in Q1 to 14,000 in Q4.

From the next set of results due in March Caledonia’s reporting currency will change from Canadian dollars to US dollars, which is a sensible decision given it is the firm’s functional currency. It will also make the accounts cleaner given the previous requirement to translate the numbers from Canadian dollars. The firm will also re-domicile from Canada to Jersey in order to simplify the business and enjoy certain tax advantages.

Risks

Of course, the main risk to the Caledonia investment case is a further fall in the gold price, along with operational risks over the revised investment plan. But one other concern which investors have is the firm’s country of operation, Zimbabwe. However, we believe that these are overdone.

The disorder seen in the country in the 1990s/early 2000s is now over, with the government stable and pro-business. Corporate income tax is charged at the reasonable rate of 25% and the royalty rate on gold mining was cut from 7% to 5% in October 2014. The hyperinflation of 2008/9 is now a distant memory following a move to adopt the US dollar and the country has in fact been experiencing deflation since the end of 2014.

VALUATION

At the current share price of 43p Caledonia Mining is capitalised at just £22.4 million. Net cash amounted to £10.9 million at the end of September, backing a significant portion of the market cap. Although this is expected to fall in the near term as further funds are invested into capital spending it looks substantially enough to support the investment plan. Overall, cash is expected to have reduced in 2015, to stabilise in 2016 and to start to grow from 2017.

Even if we ignore the cash, the shares still look good value, trading on a multiple of around 7.5-8 times market forecasts for 2015. That looks cheap in itself and then we have to remember that in the next few years production is expected to rise markedly and costs should also fall significantly.

What’s more, Caledonia has one of the most attractive dividend policies of any AIM listed gold miner. This week the company confirmed its ninth payment, which amounted to 1.125 US cents. That equates to an annual payment of 3.07p at current exchange rates and a yield of 7.14% at the current share price. While this policy was reconfirmed on 5th January it is of course subject to revision should the gold price fall further.

All in all, I believe that shares in Caledonia Mining look like a good way to play a potential medium-term recovery of the gold price.

Comments (0)