Brexit Puts a Shine on the Goldies – But Will It Last?

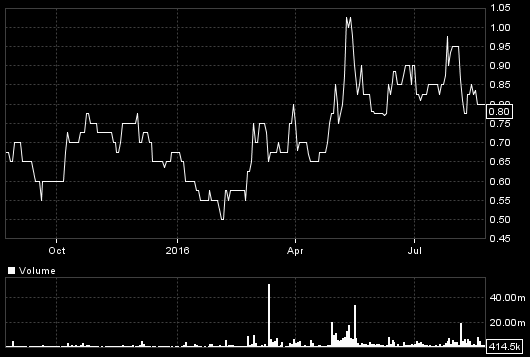

Scotgold Resources (LON:SGZ)

When I wrote up Scotgold back in November, it was to highlight how constant share dilution is ‘hidden’ from investors in the only charts available to them – i.e. the share price. When a company’s fundamentals haven’t changed, it’s the market cap that indicates whether or not its value per share has changed. Unfortunately, no-one produces such charts, so investors can’t check it out – and companies, naturally, don’t point it out.

I therefore worked out that due to Scotgold’s unfortunate dilution history, its shares weren’t likely to go anywhere even though its market cap kept expanding, so that funding for its near-term 200,000 oz Cononish gold mine would not be possible at much more than the then 0.73p share price. Since then, Scotgold has been diluting just as heavily, and so its shares have been left behind in the gold rush (see chart).

Scotgold – 1 year to August 2016

But last November gold was at $1,100/oz and the $/£ rate was 1.5, meaning that Cononish would see £733/oz for its gold. Now, with those figures $1,350 and 1.3 respectively, it will see a 41% jump to £1,038/oz, and with the mine’s ‘cash costs’ estimated at £322/oz, ‘profit’ per gold ounce sold should rocket by nearly 75% (depending, of course, on whether sterling stays low and bering in mind that some of those costs will rise with a higher $).

That the news hasn’t benefited the shares may be the result of yet more dilution to buy a blue-sky prospect in Portugal not connected with Cononish, not to mention that Scotgold is small and that other news is pending – particularly a bankable feasibility study being revised compared with the July 2015 one I used. It will affect Scotgold’s chances of raising the £18m (although it might be in stages) that it needs to get Cononish going.

But companies never seem to learn that when a near-term project needs start-up funding, they are shooting themselves and shareholders in the foot by damaging that prospect’s per share value to buy an unconnected longer term one.

Even so, Scotgold is stepping up its search for Cononish funding, and if, as I expect, the new BFS is much better than the old and ‘value’ really has expanded by 75% (the NPV will have doubled on the higher figures), investors might look again, notwithstanding that shares in issue have expanded another 20% since last November. Potential investors have recently been shown Cononish ‘Scottish Gold’ recovered from a bulk processing trial, and more visits to the mine are due. So I wouldn’t deter anyone from buying the shares now.

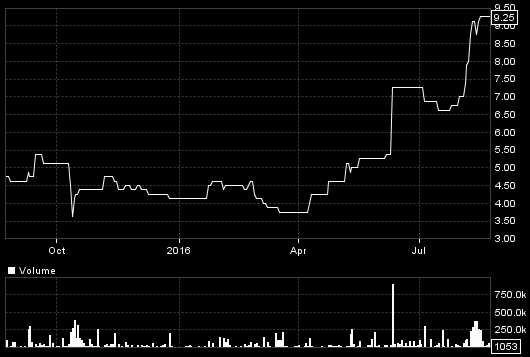

Dalradian Resources (LON:DALR)

Judging by its shares’ 50% rise in the last two weeks, Canadian backers of Dalradian Resources might also have been slow off the mark to recognise the Brexit shine, but were certainly reassured by the company’s 10th August update: “Following Britain’s recent decision to leave the European Union, Dalradian reaffirms our commitment to Northern Ireland and the Curraghinalt Gold Project – one of a handful of undeveloped high grade gold systems in the world.”

Dalradian Resources – 1 year to August 2016

When I briefly mentioned Dalradian back in February (at 42p, now 87p) it was to flag up in advance the feasibility study due by the end of this year for Curraghinalt’s high grade, likely 4.4 Moz resource (i.e. medium sized by gold mine standards, yet in a benign jurisdiction) – on the same gold-belt as Scotgold – which I felt would spark much more interest in London. However, practically all the recent buying has come from Canada, where all its eight analysts are based, reinforcing my view that, before long, steps will be taken to raise its profile here. The main listing is currently on TSE as DNA, but over here the AIM listing (DALR) hasn’t sparked much bulletin board interest yet.

It should do, and DALR didn’t need a higher gold price in March for me to highlight its attractions then. Subsequently, the same factors as those for Scotgold will have been working in its favour. But even in 2012 before much drilling (which subsequently has almost doubled the resource) a Preliminary Economic Analysis worked out an after tax NPV8 of around $400m, and an IRR over 35% at the then $1,300/oz gold price for a more than 15 year mine life producing over 145,000 oz/yr. That was subsequently improved to a 162,000oz per annum operation over an 18-year mine life, increasing the NPV to over US$504 million.

I expect the upcoming update will show even better results. Canadian investors have always backed promising miners much more astutely than London, such that DALR is currently well financed up to the end of the year. But planning permission (the NI Government rates Currighinalt as of national strategic significance) will take two years, and more funding will be called for until mine construction starts.

With 219m shares the market cap has shot up by 50% in only the last two weeks to £190m, or $250m, so maybe the best of the surge has been seen for the moment. But publication of the Feasibility Study, along with a project design and planning application, might well spur the shares on a bit more, making them a medium-term investment idea while, as some market observers are suggesting, other goldies pause for breath.

Galantas Gold (LON:GAL), Connemara Mining (LON:CON), and Conroy Gold & Natural Resources (LON:CGNR)

The ‘Dalradian’ gold belt doesn’t only host Scotgold and Dalradian itself, but also some smaller prospects in Ireland, particularly Galantas Gold’s Cavanacaw mine, not far from Curraghinalt; Connemara Mining’s Inishowen project; and that old chestnut (having been roasting for 20 years, so investors treat it as too frazzled to bother about any more) Conroy Gold and Natural Resources (CGNR), who claims to be ‘conceptually’ targeting over 5Moz of gold at its Clay Lake and Contibrec properties.

Leaving CGNR aside, Galantas Gold (on TSXV, and AIM) could merit a look (well known mining expert and financier Ross Beaty has acquired a 22% stake) having lost its licence for an existing, small, open pit mine a few years ago but now on track to recover it for an underground mining operation targeting a 0.5Moz high grade resource, perhaps at a low capital cost of only £12m (compared with its current £10m market cap). In return, a 2014 economic study (at then gold and cable rates) has estimated a more than 70% IRR, so I may well write about Galantas and its targeted more than 3Moz resource in more detail at some stage.

Galantas Gold – 1 year to August 2016

As for Connemara Mining, it is still at an early stage exploring multiple deposits for gold, silver and zinc (for which Ireland has always been highly prospective, with the recently worked out world-class Lisheen mine owned by Vedanta closing last January, and Tara still owned by Swedish miner Boliden which was among the largest in the world). Current majors such as Glencore, Antofagasta and Teck are still all actively exploring for zinc in Ireland, and Connemara has farm-in exploration joint ventures with Teck. But its recent emphasis has switched to the gold it is finding at Inishowen, although it is still early days there.

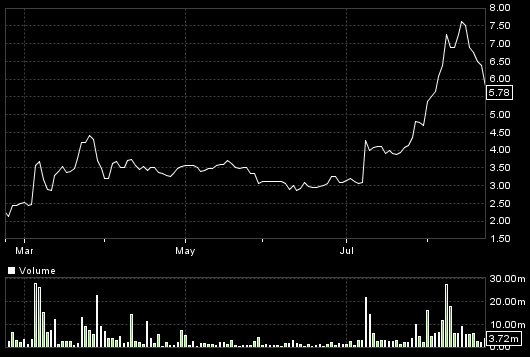

Solomon Gold (LON:SOLG) – a buying opportunity?

Unlike DAL, SOLG’s main listing is in London. But its shares can still be controlled from Canada, where one of its partners (Cornerstone Capital) is located and where there are far more knowledgeable mining investors (and analysts) than in London.

Since I flagged it in March enough further drilling showing an expanding resource at Cascabel in Ecuador was completed to keep investors interested, but not enough to satisfy those who wanted more drilling but couldn’t see that SOLG had enough cash to pay for it. So when on July 8th the company announced a funding breakthrough whereby Canadian investment advisor Maxit Capital LP had agreed a $20m private placement at a higher share price than the then 3p, the shares surged. Only to surge even further on August 1st when Maxit had had a closer look and agreed to increase the placement to ‘up to $36.5m at 8 cents per share’ (6.1p) compared with the then 5.5p.

Since then the shares have been dominated by the traders who initially took them up to a peak of 7.6p but have subsequently taken them back down close to the anticipated final placing price and possible disposals by placees taking a quick profit.

Solomon Gold – 6 months to August 2016

But that, of course, is to have taken eyes off the main picture which is that SOLG has the funds to expand its drilling campaign at Cascabel to confirm the tasty hints it has been finding of yet more porphyry targets (14 in total so far) on the site, some of which might be at less depth than found so far, offering the chance of earlier and cheaper initial mining. And (not that it should be taken as a guide) the Maxit deal includes the issue to them of warrants to subscribe for more shares over the next two years at 14p and 28p.

Meanwhile SOLG is on track for a maiden resource at just its first target, Alpala, by the end of the year and might by then also have completed ‘a conceptual early stage mine and plant design and a scoping study for an economic development at Cascabel’.

The final size of the placing won’t be known until it closes tomorrow (Aug 24th), after which the shares should emerge from their recent abnormal trading, making them, I feel, a strong buy.

Maxit Capital claims to be the leading Canadian mining finance advisor / merchant bank and (with its clients) will hold over 20% of Solgold’s shares, so will have a seat on the Board.

Comments (0)