The Dogs of AIM 2021

For four years I have been investing in the Dogs of AIM portfolio, which comprises 10 shares chosen based on the rules of the Dogs of the Dow trading strategy. Popularised by money manager Michael O’Higgins in his 1992 book Beating the Dow, investors put equal amounts of money into 10 individual companies. Known as “dogs”, the companies are the constituents of the blue-chip-focused Dow Jones Industrial Average Index with the highest historic dividend yields.

The strategy has had mixed results, having beaten the index in 11 out of 21 calendar years since 2000. Website dogsofthedow.com finds that since the turn of the century, the dogs of the Dow have had an average annual total return of 9.5%, slightly better than the index’s return of 8.4%.

Instead of referring to the Dow Jones index, my strategy applies the same approach to the Alternative Investment Market (AIM), using the FTSE AIM 100 Index to ensure that constituents are of a decent size and sufficient quality. However, with such high yields, there is also the risk that the shares are being lowly priced for a very good reason.

Under the original strategy the portfolio is periodically rebalanced, typically annually, with the previous year’s holdings sold and replaced with a revised, but again equally weighted selection based on the same criteria. I last did this on 17 July last year, so let’s look at how the portfolio has performed since then.

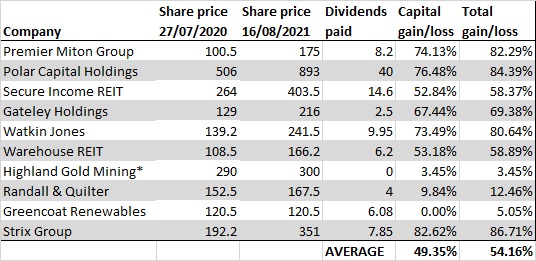

Data source: Sharepad

As the table above shows, the portfolio had a cracking 12 months as stock markets recovered from the coronavirus-generated sell-off in early 2020. All companies in the portfolio contributed a positive return, delivering an average capital gain of 49.35% and (including dividends) an average total return of 54.16%. This compares favourably with the 39.1% gain achieved by the AIM index over the same period.

Financial stocks performed well in the period, with investment managers Premier Miton (PMI) and Polar Capital (POLR) gaining the most. Their shares rose by over 74% and paid decent dividends. Residential-property manager Watkin Jones (WJG) wasn’t far behind. Its shares rose by 73%, with the dividend taking the total return to just over 80%. Top gainer however was kettle-safety-products maker Strix Group (KETL), delivering a total return of almost 87% after the shares recovered from an all-time low in March last year.

Of the lower performers, Highland Gold Mining only remained in the portfolio for a few months after being taken over by its largest shareholder Fortiana Holdings for only a small premium to its then share price. Wind-farm owner Greencoat Renewables (GRP) was the worst-performing share on a capital basis. While the shares remained flat it did manage to return a decent 5% dividend yield.

It’s worth noting that since I started the AIM dogs portfolio on 28 March 2017 it has doubled in value, with the initial £10,000 now worth £20,292 (not taking dealing expenses into account). That makes a total return of 103% or a compound annual return of 17.44%. In contrast, the AIM index has only gained 38.3%, or 7.6% on a CAGR (compound annual growth rate) basis.

Rebalancing the rovers

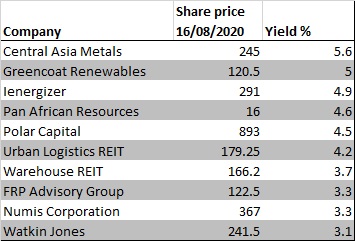

It’s time again to rebalance the portfolio, liquidate the current holdings and replace them with the current top-10 yielding AIM 100 companies. Staying in the portfolio for another year are Greencoat Renewables, Polar Capital, Warehouse REIT and Watkin Jones. Exiting are Premier Miton and Gateley Holdings (which have fallen out of the AIM 100); Secure Income REIT; Randall & Quilter and Strix, whose dividend yields are no longer in the top 10; and Highland Gold, which has delisted following its takeover.

New entries this year include technology-services company Ienergizer (IBPO), property investor Urban Logistics REIT (SHED), miners Central Asia Metals (CAML) and Pan African Resources (PAF), professional-services firm FRP Advisory Group (FRP) and financier Numis Corporation (NUM).

As always, identifying these companies via their historic yields is an easy administrative task. The investment challenge comes from identifying the reason why the yields are so high. This may be due to the company being in decline. Analysis may also raise questions about whether dividends are sustainable. For those investors who don’t want to risk following the dogs of AIM strategy to the letter, here are two of the constituents which I believe look most attractive.

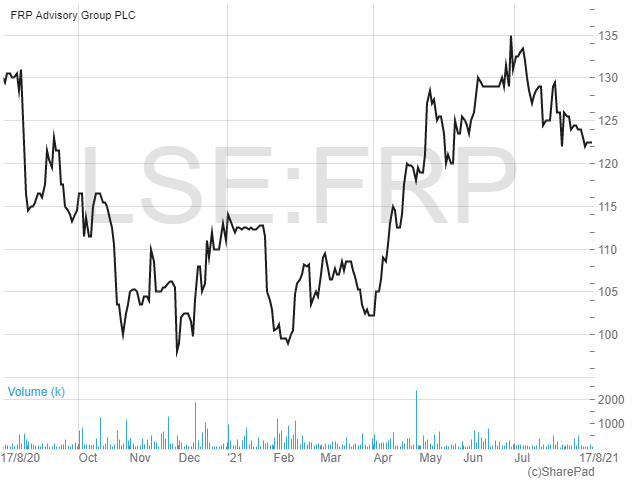

FRP ADVISORY GROUP

Having a relatively high yield doesn’t mean that a company isn’t growing any more. In fact, this company has been growing strongly since being founded just over a decade ago and has plans for further growth.

FRP Advisory Group (FRP) is a professional-services firm established in 2010 which offers a range of advisory services to individuals, companies, lenders and investors. These cover the whole range of the corporate life cycle, with the core restructuring and insolvency-advice activities supported by areas including corporate finance; mergers and acquisitions; raising and refinancing debt; pensions and forensic services.

Over the years, FRP has grown organically and by acquisition to become one of the largest restructuring-advisory firms in the UK by number of corporate-insolvency appointments. Notably, despite year-on-year declines in the number of formal, UK company insolvencies between 2009 and 2016, FRP successfully managed to expand and increase profits. While they grew again in 2016, insolvencies have slowed recently due to government support introduced during the pandemic. However, the latest figures from The Insolvency Service show UK company insolvencies up 7% in May this year to 1,011.

FRP joined AIM in March last year, raising £20m for itself along with £60m for prior shareholders that added their shares to the offering. The money was earmarked to fund further opportunistic acquisitions and the organic-growth strategy which involves opening offices in new regions, attracting new fee-earning staff, taking on larger deals and attracting more overseas clients. Like most listed, professional-services firms, FRP has a high percentage of shares owned by its employees, with around 50% held by its partners following the initial public offering (IPO).

Solvent business

The year to 30 April 2021 was another good one for FRP as revenues grew by 25% to £79m. Of this, 15% came from organic growth and the rest from acquisitions, with four deals completed during the year. This was completed in the context of a total, formal, company-insolvency market which saw a 26% fall due to the government support available. However, FRP grew its own market share from 11% to 13%. Helping the organic growth, the team was expanded by 106 employees to 457, with the corporate-finance business expanded to offset any challenges in the insolvency market.

This remains a highly profitable business despite large partner fees, with pre-tax profits for the year reported at £16.6m. The balance sheet showed net cash of £16.4m at the period end, remaining strong but down from £24.4m after spending a net £10.6m on acquisitions and paying down £15.4m of IPO liabilities relating to profits owed to partners and related tax.

Trading since the period end was said to be in line with expectations, with several initiatives expected to boost growth this year. Adding to the increase in headcount, two new international alliances have been formed, which will enable FRP to access new networks of highly experienced international advisers and support the UK component of international transactions.

Good administration

FRP has had a good start on the markets, with the shares rising from the IPO price of 80p to a current 122.5p. At that level the historic price earnings multiple is 17 times − on the high side but reasonable in my view given the historic growth and expansion plans. What’s more, at IPO FRP set out a policy to pay out a generous 70% of its net profits as dividends, with quarterly payments being made. That target was met for 2021, with the 4.1p payment equating to a modest yield of 3.3% at the current price. Analysts at Liberum have a 180p target on the shares, suggesting 47% upside from the current price.

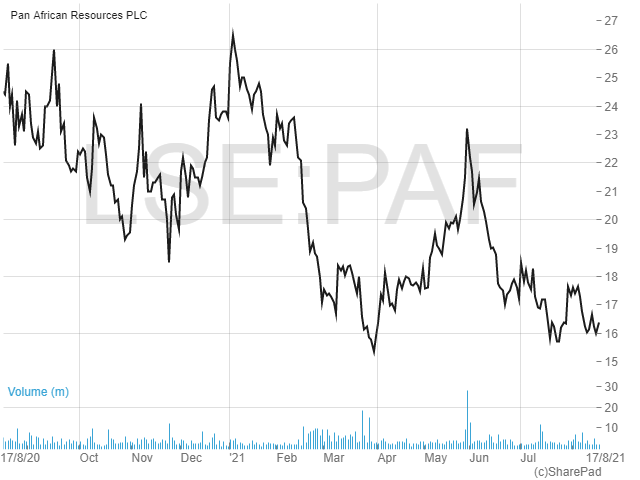

PAN AFRICAN RESOURCES

Previously a constituent of the portfolio in 2017, Pan African Resources (PAF) is a mid-tier gold producer with its major assets in South Africa. These are the Barberton underground mine, the Barberton Tailings Retreatment Project and Elikhulu, which incorporates the Evander Tailings Retreatment Project and Evander mine. Listed on AIM and on the Johannesburg Stock Exchange, the company is one of a rare breed of AIM-listed miners which pay an attractive dividend.

Pan African made the move from being a junior explorer to a mid-tier gold producer in 2007 after it acquired the Barberton Mines. Consisting of the Fairview, Sheba and Consort mines and the Barberton Tailings Retreatment Plant, this remains the company’s flagship asset, with a combined 90,000 ounces or so of gold produced in the last fully reported financial year. The company effectively doubled the size of its operations in 2013 after buying the Evander gold mine from Harmony Gold, supported by a tailings-retreatment plant which was commissioned in February 2015. Combined, these assets also produced around 90,000 ounces of gold in the year to June 2020.

There are growth ventures in the pipeline, including the Egoli Project, a long-life, high-margin, brownfield project that will capitalise on the Evander mine’s existing established infrastructure. The project has an initial life of mine of nine years, with annual gold production of around 72,000 ounces of gold expected to be produced 20 months after construction commences. Meanwhile, in November 2020 Pan African announced it had conditionally agreed to acquire certain tailings storage facilities that contain an estimated 2.36m ounces of gold. Initial studies on the so-called Mintails project have indicated the potential to produce some 533,000 ounces of gold over an estimated 12-year mine life, with a pre-feasibility study expected during Q3 2021.

Precious metals

Following a tough year in 2018, when large-scale underground mining was ceased at Evander Mines’ underground operations, Pan African has steadily grown production, with revenues also boosted by a rising gold price.

The company recently announced an operational update containing an excellent set of figures for its financial year ended 30 June 2021. Despite continuing challenges presented by Covid-19 restrictions, gold production increased by 12.3% to 201,608 ounces. Notably, the figure was 3.4% higher than revised production guidance of 195,000 ounces given in May. The performance was driven by an increase in production of around 25% at Barberton, to some 85,000 ounces and a 74% rise at the Evander underground mine to about 36,000 ounces.

While no revenue or profit figures were released in the update, the company mentioned that group net senior debt decreased by an impressive 45.5% over the year to $33.8m. Production guidance for the current financial year is expected to be maintained at 195,000 ounces, with further information on the growth projects expected to be provided in due course.

Golden opportunity

Pan African shares hit an all-time high of just over 27p around this time last year but have slipped back to 16p at the time of writing. The fall has been influenced by the gold price falling from over $2,000 an ounce to just under $1,800 over the same period. At the current price the shares trade on a very low multiple of just over five times earnings expected for the year just gone.

In terms of the dividend, the payment was reinstated in 2019 after being suspended in 2018 due to the cessation of mining at Evander and spending on construction of the Elikhulu Tailings Retreatment Plant. Before 2018, Pan African consistently yielded over 5%, and with a payment of around 0.73p expected for 2021 that takes the yield just short of historic levels at 4.6%.

Analysts at research house Edison see significant upside in the shares. They recently pointed out that if the company’s historical average price to earnings ratio of 9.1 (seen from 2010 to 2020) is applied to its forecasts then the implied share price in 2021 is 27.9p, rising to 34p in 2022. While Pan African investors are exposed to changes in the gold price as well as to fluctuations in the value of the rand against the US dollar and sterling, the diversified nature of the business, along with the attractive valuation make it look worthy of a buy.

Comments (0)