Follow the fund managers for a profitable 2021

As we enter a new year it’s that time once again for my annual review of how the UK small cap markets have performed and to provide a few investment ideas for the next 12 months.

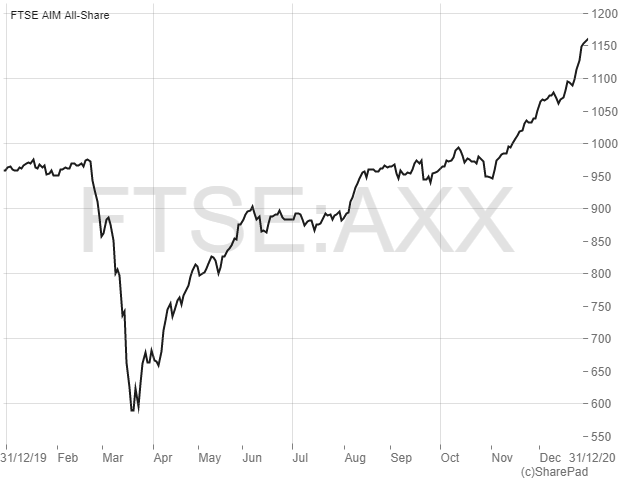

Despite one of the worse equity sell-offs in living memory seen in February/March, in the end, 2020 turned out to be a good year overall for small cap shares. Leading the way was the AIM All Share index, which rose by 20.7% to reach levels not seen since just before the last recession in 2007. After bottoming out at 590 in March the index almost doubled to hit 1,160 by the year end, significantly boosted by the vaccine approval news in November. The FTSE Small Cap Index meanwhile added a modest 4.5%, recovering from six-and-a-half-year lows at the height of the pandemic-related slump.

Smaller companies massively outperformed blue-chip shares during 2020, with the FTSE 100 having its worst year since 2008, falling by 14.3%. That’s not a bad performance in the end considering at one point it was down by just over a third. Only 42 of the 100 constituents finished the year with a higher share price. The UK focussed FTSE 250 fared a little better but still closed the year down by 6.4% after plunging to a seven year low in March.

AIM big boys boost returns

With their significantly larger index weighting, AIM’s biggest companies continued to make a significant contribution to the All Share’s growth in 2020. But not to the same extent as in recent years. The AIM 100 was up by 19.6% in 2020, around a percentage point below the All Share. Following the graduation of a number of mid-sized business, there are now 26 companies listed on AIM with a market cap of over one billion pounds, up from 15 at the start of the year.

At the top of the tree, online fashion retailer ASOS (LON:ASC) retook the crown as AIM’s biggest company from rival Boohoo Group (LON:BOO) after rising in value by 42%. The company, now valued at just over £5 billion, attracted investors’ attention after customers flocked online during the various lockdowns, helping to boost profits by 329% for the year to August.

Other major movers in the billion pound club included miner Greatland Gold (LON:GGP), up 1,950% following a string of excellent drill results from its Havieron gold-copper deposit in Australia; hydrogen specialist ITM Power (LON:ITM), which enjoyed a 626% gain as a result of increased investor interest in the alternative fuels industry; and games industry service provider Keywords Studios (LON:KWS), up 91% as it continued its rampant acquisition spree and reported profits ahead of expectations.

At the other end of the AIM 100 the biggest loser was oil & gas producer Jadestone Energy (LON:JSE), down 34% on lower oil prices. It was also a bad year for property investor Secure Income REIT (LON:SIR), the shares down by 31% as two-thirds of its tenants had to shut down their operations during the pandemic. Textile services business Johnson Service Group (LON:JSG) was not much better off, down 29% due to its exposure to hospitality industry clients.

Equal weights

The largest AIM companies by value continue to make up a disproportionate amount of the market cap weighted AIM All-Share index. According to my calculations, the top 10% of AIM listed companies currently make up 63% of the market’s total value. That means the All Share Index’s performance is highly dependent on these select few stocks. Therefore, as in previous years, as an alternative way of reflecting small cap performance I have used an equal weighted approach – assuming that an equal amount of money was put into each qualifying AIM company at the start of 2020.

To complete this analysis I take all AIM companies (included those not-listed in the All Share) which were listed on the market at the beginning of 2020 and remained listed for the whole year. New listings during the year or those which left the market are excluded. There are 796 qualifying companies, to which I give each an equal weight in my theoretical index.

Of these, 384 companies (48.2%) finished the year with a higher share price, 11 (1.4%) were flat and 401 (50.4%) lost value. Therefore, choosing an individual stock at random at the start of the year, there was a slightly higher probability that it would have lost value rather than gained value over the course of 2020.

However, my headline metric shows that on an equal weighted basis the average gain per AIM share in 2020 was in fact an astounding 56%. In other words, if you put the same amount of money into each of these 796 stocks at the start of the year, you would have made a 56% overall gain. This is well ahead of the broader AIM All-Share rise as the smaller capitalised companies put in a better performance.

Soaring small caps

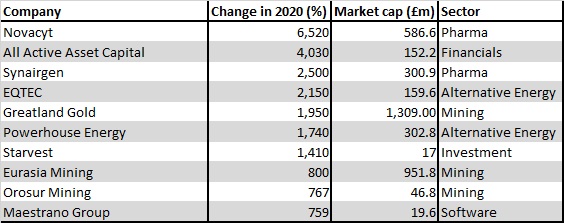

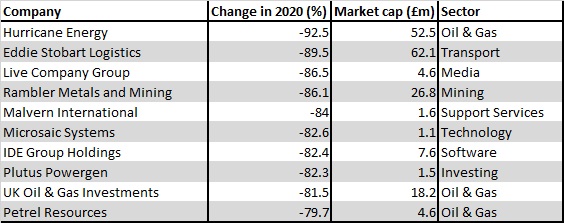

The reason for the performance above comes as seven AIM shares rose in value by over 1,000% in 2020 and another 110 doubled in value or more. The best performer, with one of the highest annual gains ever seen on AIM, was clinical diagnostics firm Novacyt (LON:NCYT). Investors latched onto the potential of its COVID-19 tests and sent the shares up from 13p to 861p, a gain of 6,520%. Also in the health industry, respiratory drugs businessSynairgen (LON:SNG) saw its shares rise by 2,500% after announcing positive results from a trial of its SNG001 drug in hospitalised COVID-19 patients. Elsewhere, green energy stocks were in favour, with EQTEC (LON:EQT)gaining 2,150% and Powerhouse Energy (LON:PHE) up by 1,740%.

Sinking small caps

At the bottom of the market was oil producer Hurricane Energy (LON:HUR), which fell by 93% after experiencing a perfect storm of production issues, a reserves reduction and lower oil prices. Also in the resources sector, Rambler Metals & Mining (LON:RMM) was down by 86% as it was forced to arrange a string of financing deals. In the technology sector, mass spectrometry instrument developer Microsaic Systems (LON:MSYS) plunged by 83% after it put itself up for sale but failed to find a buyer.

Follow the fund managers

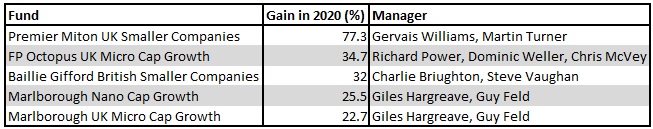

The volatile markets provided some excellent opportunities for active small cap fund managers to outperform the markets in 2020. However, according to Trustnet’s universe of 51 UK focussed small cap funds, only five managed to beat the AIM All-Share over the year, with 16 showing a negative return. By far the star performer was Premier Miton’s UK Small Companies fund which soared by 77.3%, boosted by holdings in companies such as Jubilee Metals (LON:JLP) and Corero Network Security (LON:CNS). This was way ahead of second best performer, Octopus UK Micro Cap Growth, which delivered a 34.7% gain.

As is traditional for my January tips, here follows two growth stocks which some top fund managers are hoping will perform well in 2021.

IXICO

Making up 2% of the Marlborough Nano-Cap Growth fund is IXICO (LON:IXI), an artificial intelligence (AI) dataanalytics company delivering insights in neuroscience – the study of the nervous system. Its suite of medical image analysis services includes a proprietary portfolio of software algorithms used to identify biomarkers associated with a diverse range of neurological diseases, including Alzheimer’s disease and Parkinson’s disease. These algorithms analyse images from brain scans, converting raw clinical trial data into clinically meaningful information and helping pharmaceutical clients to measure the efficacy of potential new therapies, monitor patient safety and enable better trial design.

IXICO has a remote access business model, whereby clients use its proprietary TrialTracker platform for the collection, analysis and interpretation of large image files and other data that may be generated in the course of a clinical study. The model is attractive, with gross margins running into the high 60% level and multi-year contracts which run for the life of a trial providing good earnings visibility. In addition, repeat business opportunities come from success in earlier clinical trials being carried through into later, larger scale phases.

Growth is being driven by an increasing adoption of AI technology within the firm’s global client base, along with the need to address the effects of neurological disorders on an increasingly ageing global population. The broad strategy is to deploy the data analytics to improve the return on investment in drug development and reduce risk and uncertainty in clinical trials for pharmaceutical clients.

Multiple contract wins boost profits

Growth has been strong at IXICO over the past few years, with 2019 being the first profitable year since admission to AIM in 2013. More recently, the 2020 numbers reported on a fourth successive year of top line growth being more than 25%. Despite being affected by the pandemic, with a number of clinical trials being delayed, revenues for the year to September grew by 26% to £9.5 million, driven by increasing traction within Phase III clinical trials. That helped EBITDA to more than double to £1.3 million on strong gross margins of 66.6%.

Operational highlights of the year included the signing of £15.4 million worth of additional multi-year contracts across all phases of clinical development, including the company’s single largest contract in April for £10.5 million over four years. The balance sheet was strong at the period end with no debt and cash of £7.9 million, boosted by a net operating cash inflow of £1.5 million over the year.

The outlook for the new financial year was broadly positive, with the contracted order book standing at a record £21.7 million at the period end, up 36% year-on-year. While ongoing COVID-19 disruption to clinical trial start-up times is anticipated to impact growth rates in the short term, IXICO was cautiously optimistic over its medium and long-term prospects.

Following the release of the results, the last few weeks of 2020 brought a further string of contract wins. The highlight was a £3.4 million deal with an existing client, running over 4.5 years, for a trial of neurodegenerative condition Machado-Joseph disease, for which there is no treatment. Under the deal, IXICO will provide operational services and advanced AI neuroimaging solutions. There was also news of a £1.9 million contract for a Huntington’s disease study with an existing biopharmaceutical sponsor and an unvalued contract for neuroimaging solutions with a new, large global pharmaceutical company, again for a trial looking at a treatment for Huntington’s.

Buy for growth

There is lots to like at IXICO, especially the cash rich balance sheet, high margins and consistent growth in revenues and profits. What’s more, the strong order book, consisting of multi-year contracts, equates to over two years’ worth of revenues on a historic basis, providing good earnings visibility and limiting downside potential.

The shares have had a good run over the past two years as investors have started to recognise the company’s potential. They rose from around 25p at the start of 2019 to a peak of 123.5p in December last year before slipping back to a current level of 94p. On the historic numbers the shares are currently on a high price earnings multiple of around 46 times. But earnings are growing rapidly here from a low base and on the more relevant PEG (price to earnings growth) ratio of 0.38 times the shares look attractive. Other big institutional shareholders alongside Marlborough include Octopus Investments, Gresham House and Amati Global.

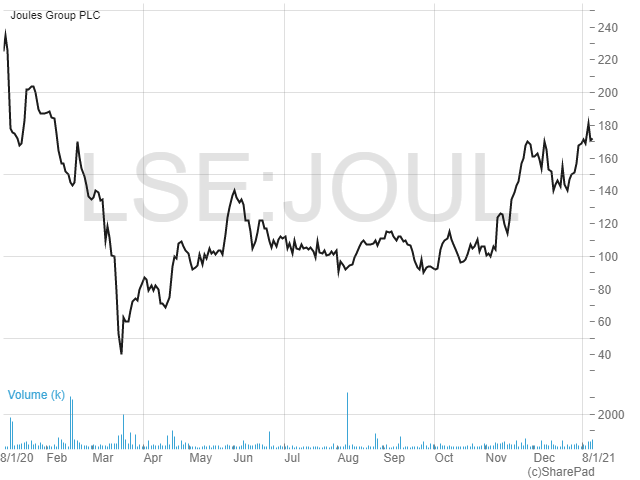

JOULES

While non-essential shops around the country remain closed for an indefinite period, investors have been returning to the retail sector with hopes that the current vaccination programme will send consumers flocking back to shops again soon enough. That’s been reflected in a 4.6% rise in the FTSE All-Share General Retailers sector in the first week of the new year. One company that looks set to bounce back once the doors are open again, as well as having some defensive characteristics, is Joules (LON:JOUL), a holding of the Octopus UK Micro Cap Growth Fund.

With a history dating back to 1989, when founder Tom Joule had a stand at a country show in Leicestershire, Joules is a premium “contemporary country” lifestyle brand. Today, the business designs and sells a range of branded clothing, footwear (including wellies) and accessories, along with collections of homeware, toiletries, lifestyle and pet product ranges, designed and developed through selected licensing partnerships. These are complemented by digital marketplace Friends of Joules, which offers over 10,000 products curated from 300 third-party sellers.

At last count, the business had over 1.5 million customers, serviced through the company’s digital platforms, a portfolio of 128 retail stores in the UK, several in-store concessions and at country shows and events. While all the company’s stores are currently closed, this is one retailer which does digital right, with e-commerce making up more than 70% of retail revenues during the most recent half-year financial period. The firm also has a wholesale business, selling products to other retail businesses or distributors for onward sale to their customers. While the core market is the UK, there is also an international presence, mainly in the US and Germany, which brought in 15% of sales last year.

Kick in the Joules

Joules came to market in May 2016 with a strong track record, having grown revenues from £78 million to £116 million between 2013 and 2015. Sales peaked at £218 million in 2019, with record EBITDA of £20.9 million, before the 2020 numbers were inevitably hit by the pandemic-induced store closures. Results for the full year to May that year reported sales down by 13% at £190.8 million, with the revenue impact of COVID-19 estimated at a painful £31 million for the final quarter. Before some largely non-cash exceptional costs, the pre-tax loss for the year was £2 million but at a cash level the business remained profitable, seeing an £11.4 million inflow.

Regaining some confidence amongst investors, a trading update for the half-year to November 2020 announced that sales were ahead of expectations for the period, driven by strong e-commerce growth of 35%. However, total group revenue was down by 15.3% to £94.5 reflecting the impact of enforced store closures and the cancellation of country shows. At the bottom line, pre-tax profits for the half are expected to be between £3.5 million and £4 million, down from £8.4 million in H1 last year.

A more recent Christmas update revealed that website retail sales were up by 66% in the seven weeks to 3rdJanuary. However, physical store sales fell by 58%, reflecting enforced closures and reduced footfall when shops were open. Encouragingly, total retail revenue for the period was up by 0.3%, with the growth in e-commerce sales more than offsetting the decline from stores. Net cash was £13 million at the period end, with total liquidity headroom of £63 million. On the outlook, Joules said that if its stores are forced to remain shut until 1st April then the potential loss in sales is expected to be between £14 and £18 million.

Joules in the crown

As with most retail stocks, investors are hoping that in a year or so Joules will get back to levels of trading and growth it was experiencing pre-pandemic. Given the strong digital business here, profitable operations and net cash position, this doesn’t look like an unreasonable proposition. If achieved, investors will be buying into a company delivering c. 20% earnings growth per annum at a (2019 peak) earnings multiple of just 12 times.

Following the interim trading update analysts at house broker Liberum raised their target price on the shares to 225p noting the group’s “… resilience, growing brand strength and financial health”. That implies upside of 31% from the current price of 172p. It’s worth noting that at their peak in June 2018 the shares were trading hands for 387p.

At present there is no dividend here as the payment was cancelled last March in order to preserve cash. It’s been announced that no payment is expected for 2021 either but the intention is to return to a progressive dividend policy as soon as is viable. In 2019 the divi was 2.1p, making for a modest 1.2% yield if returned at this level.

Comments (0)