Fund Manager in Focus – Paul Singer

As featured in this month’s Master Investor Magazine.

“We like to create value rather than merely identify it…if we just identify value, we can’t make money unless the market moves the security in the predicted direction.”

― Paul Singer

A Non-consensual Man

This month’s hedge fund manager in focus has some peculiar characteristics that make him a tenacious eagle for some and a hateful vulture for others. Paul Elliott Singer likes to be known as an activist that creates value where it doesn’t exist. Thirty-seven years of a stellar track record indeed corroborate his value-added claim. But, while creating value for his investors, Singer also leaves a trail of enemies along the way. Singer has been often criticised for his investment strategy and named as “the inventor of vulture funds” and a “financial terrorist”, as he often buys junk debt in order to squeeze the juice from it in judicial battles against bankrupt issuers. At one extreme we have those who invest in Singer’s funds, who have been enjoying the peace of mind of higher than average returns at lower than average volatility over the long and short runs. At the other extreme we have the governments of Argentina, Peru and Congo-Brazzaville (just to name a few) who take Singer as “persona non grata” and most likely have his photo distributed across their borders for him to be kicked out as soon as he puts a foot inside their borders.

In a world where asset classes are highly correlated and where it is ever more difficult to beat the market portfolio, hedge funds are refining their tactics to attain the much sought-after alpha. Like central banks, hedge funds are using ever more unconventional strategies to achieve their targets.

Learning the Hard Way is Always the Best

Paul Elliott Singer was born in 1944 in New York. His father was a pharmacist and his mother a homemaker. He attended the University of Rochester, where he obtained a Bachelor degree in Psychology. Later, in 1969, he also obtained a JD from Harvard Law School. In 1979, he accepted a job as attorney in the real estate division of the investment bank Donaldson, Lufkin & Jenrette. By that time, Singer had already developed an interest in financial markets. He read many books on investment and in his spare time he tried a few different strategies with his own money. But, unfortunately for him, between 1968 and 1974 financial markets were affected by a few odd events ranging from assassinations and riots, to political scandals, inflation, and the oil embargo; which culminated with bear markets in 1968-70 and 1973-74. None of his strategies really worked as desired and the money was lost.

While losing money is always unwelcome, it sometimes is a necessary step towards success. Only when an investor loses money does he realise that markets are a game where expected return is exchanged for risk. The unfortunate loss Singer took was eventually one of the most important ingredients for him to take a very conservative approach towards investment, one that is really market neutral.

Some of the actions taken by Singer during the 1970s were revolutionary and must be credited to him. At that time, almost no one knew what a market-neutral strategy was. But after taking the losses during the aforementioned period, Singer’s attitude was all about risk management and being market neutral. At the same time, he revolutionised the short-selling trade. By that time, when a share was borrowed and sold short, the bank kept the proceeds as collateral while keeping any existing interest. This didn’t allow for arbitrage and risk-neutral strategies. Singer and his first big client from the hedge fund he created in 1977 were able to persuade banks to act differently, such that it was possible for them to sell short shares while buying convertible bonds on the same share’s issuer.

Elliott Fund Management

From his past lesson regarding risk management, and after seducing banks to allow for his arbitrage trade, Singer founded a fund management business. He created the Elliott Associates LP fund, which takes its name from Singer’s middle name. He started with $1.3 million from family and friends trading in the most conservative way possible via adopting a market-neutral convertible arbitrage strategy. The idea was to profit from price differences without incurring market risk. While a convertible bond is a portfolio of a non-convertible bond plus a call option on the issuer’s equity, it frequently traded below the value of these two separate instruments. In general, the embedded equity option was under-priced. With the correct ratio, it would be possible to keep a market-neutral strategy buying the convertible while selling the shares at the same time. Such a strategy is expected to achieve just moderate returns, but it hedges against the market risk. In fact, Singer achieved positive returns during 10 years and was even able to surpass the 20% mark in four of those years.

When we talk about markets we generally like to reference two separate things: one is the theoretical price for an instrument, the other is its market price. Both can deviate for long periods depending on the prevailing animal spirits that we simply don’t control. In 1987 the market crashed. When that happens, investors quickly herd into the panic button, selling whatever they can. As Singer was short the shares while long the bonds, he was expected to be insured against just such a movement. But the liquidity in the convertible bond market is just a fraction of the same in the equity market, which interferes with the hedge trade. Under these circumstances, the price decline observed in the convertible market was more pronounced than expected and as a direct consequence, the loss in the convertible bond outpaced the gain in the equity short. Despite the unfavourable conditions, Singer was able to cut losses and end the year with a profit, but something changed inside his mind…

The 1987 crash along with the early 1990s crash made Singer rethink about how market neutral he really was. He decided it was time to move on and instead of waiting for the market to drive a profit to his portfolio he would create value by himself. “We like to create value rather than merely identify it” he stated, “if we just identify value, we can’t make money unless the market moves the security in the predicted direction”. The new strategy was to build value instead of waiting for it, which eventually would convert the fund into an activist one.

Activism or “Vulturism”?

Many hedge funds start with the least risky of all strategies – arbitrage. That was not only the case with Singer but also with John Paulson, just to give one example. Before Pellegrini joined Paulson for the “best trade ever” on the MBS market, he was investing in event arbitrage and merger arbitrage. But then, when money grows, greed always outpaces fear and fund strategies depart from arbitrage in the direction of real alpha (or leveraged beta). But unlike Paulson, Singer is very conservative. He never takes a leveraged bet and he always hedges everything. In the words of Lawrence Simon, founder of the New York-based Ivy Asset Management, Singer “is in the pantheon of risk-adjusted investment managers”, which means that when departing from arbitrage towards a multi-strategy approach, Singer certainly has a plan to keep risks under control.

During the 1990s, Singer adopted a more activist strategy. He started investing in distressed companies and sovereigns, buying large chunks of debt on the cheap and then selling at a profit or suing the issuer for full payment. From that point on, his enemies grew in number as he was seen more as a vulture fund than a real activist.

An activist fund usually buys enough shares of a company to take some control and force management replacements or changes such that it can interfere with firm operations to unlock shareholder value. It may then ask for special dividend payment, share repurchases, liquidation of assets, sale of the company or capital structure changes. An example of this type of hedge fund is Bill Ackman’s Pershing Square Capital. But what Singer and Elliot Management (the holding company that aggregates the whole business) were doing was not exactly unlocking value for shareholders, but rather extracting value from bankrupt companies after other bondholders had already lost their money and agreed on a renegotiation of bond terms. Singer was mixing his recently acquired financial knowledge with his law experience, to buy distressed debt at a few cents and then recover as much as possible, through a judicial battle if necessary.

In 1996 he spent $11.4 million on defaulted debt from Peru, only to successfully sue the sovereign and extract $58 million on his stake in 2000. Another successful episode occurred with the Congo-Brazzaville default. He bought a stake worth $30 million and was paid more than $100 million in interest in 2002 and 2003. In 2002, Argentina defaulted on its outstanding bonds. The country was in a bankrupt state. Singer bought the bonds for 6c on the dollar, spending around $49 million for bonds with face value around $830 million. Argentina offered to pay near 30c on the dollar for the defaulted debt but he didn’t accept. He was seeking full payment for a profit of more than 1,500%. But this has been a tough litigation extending for many years, resulting in several delays not only between Singer and Argentina but between Argentina and all other creditors. Singer led Argentina to a second default as he claimed he should be paid pari passu with other creditors owning the new debt resulting from the renegotiation, which prevented Argentina from paying the accrued interest. Argentina ended up being ordered to pay Elliott Management for its holdings but the country has been delaying the process. So far Elliott has been unsuccessful at collecting, despite having won the case in court. Argentina has condemned the attitude and claims that Elliott has harmed the prior bondholders only for the sake of extracting money through extortion. Argentina’s president Cristina Fernandez de Kirchner recently even referred to Elliott and its fellow plaintiffs in the on-going litigation as “financial terrorists”. This case was so extreme that in 2012, Elliott persuaded a judge in Ghana to hold the Argentine Navy ship “Libertad” in port until Elliot was paid the outstanding amount owed by Argentina. The ship was later released, without payment.

In general, if there is a debt renegotiation, then Elliot Management is most likely involved, as it was in the cases of Chrysler and Delphi. As always, the strategy is one of waiting for the majority of bondholders to renegotiate debt and accept a deal to then move and sue the country or company for full payment. When the dissenters are just a small percentage, the company or sovereign may decide on terms that are more favourable for this holdout group than for former bondholders. One can only consider such strategy as activist with a grain of salt.

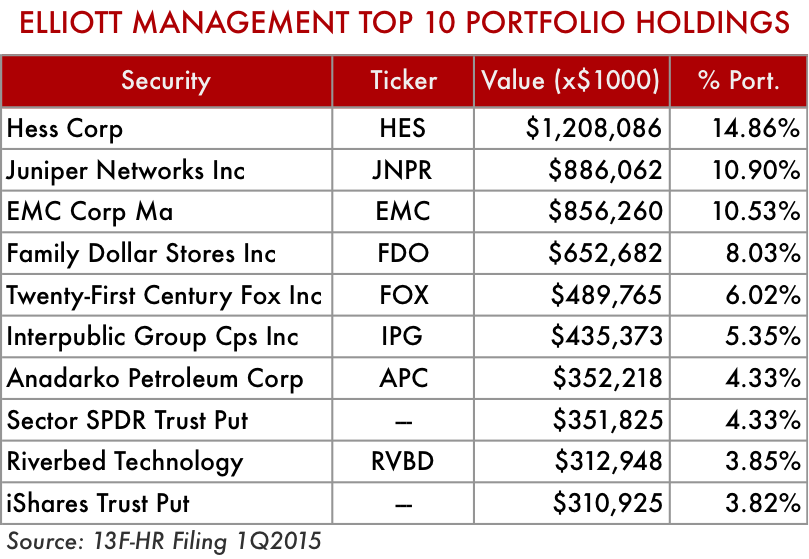

Real Activism

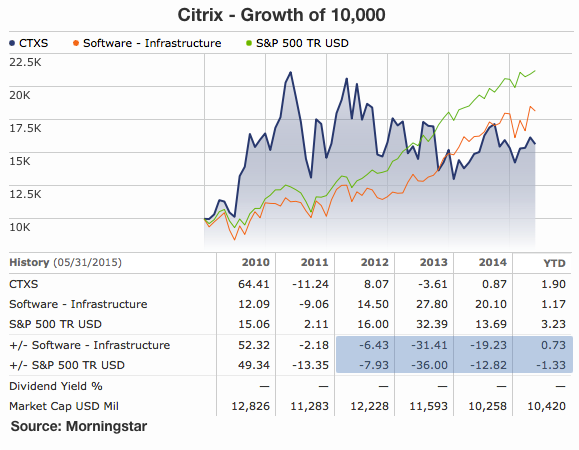

More recently Elliott Management has expanded its business to take stakes in equities instead of distressed debt. It purchases shares in order to acquire sufficient capital to suggest changes to a company’s operations. That has been the case with Interpublic, where Elliott was able to nominate two members to the board and push for a sale of the advertising giant. It has also been the case with EMC, where Elliott is forcing the company to spin off its VMware software virtualisation unit. Another example of activism occurred with Juniper Networks, where Elliott was able to force the company to add a few directors it nominated. It is also seeking for a few board seats on Family Dollar, an acquisition target which Elliott wants to force to reconsider a rebuffed buyout bid in order to drive more value to current shareholders. In June, Elliott acquired a stake worth 7.1% on Citrix and has been forcing the company to adopt several operational changes. In an open letter to the management, Elliott claimed that the multinational software provider could double its share value through operational changes. The company has been struggling over the last four years, having been clearly outperformed by its peers.

A Clear Outperformer

A hedge fund that lives on disputes with sovereigns and companies is certainly not the kind of business that everybody loves. In my own personal opinion, buying distressed debt at a few cents on the dollar just to force full payment thereafter is not exactly the activism that we usually know and love. When you wait for other bondholders to renegotiate, only to then force the issuer to pay you in full just to get rid of you, this does not exactly corresponds to value creation; it’s more the kind of opportunistic behaviour that extracts value from creating severe delays. But regarding the latest stakes Elliott has been taking in companies, these are aimed at creating value for the company’s shareholders.

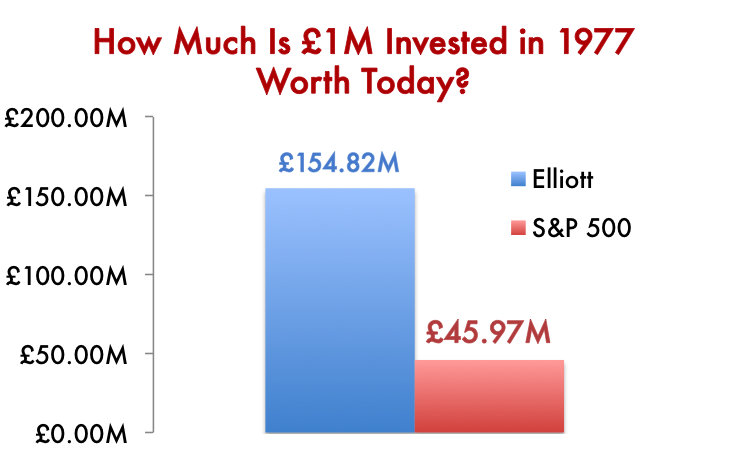

In any case, from the point of view of risk-adjusted returns, Elliott Management has a stellar record that is not easily attainable. Since inception, the net compound annual return for Elliott has been around 14.6% while the same for the S&P 500 has been 10.9%. At the same time, risk on the Elliott portfolio has been one third of the risk incurred by the benchmark, which is a clear outperformance in risk-adjusted terms. Starting with just $1.3 million from family and friends, Singer has paved a long and successful path towards the current $21 billion he has under management.

The Elliott Associates LP fund is the company’s flagship fund created in 1977, which makes it one of the oldest hedge funds. Later, in 1994 the company created an additional fund, Elliott International Limited.

It is rare to find a hedge fund with such a long track record of consistently outperforming the market on a risk-adjusted basis and with almost no negative year (only two years). That is the result of a very tight risk management in which the company waits for only the most favourable conditions to open positions and adopts a conservative approach whenever the situation is less clear. Elliott is driving real alpha to investors and protecting their money against the market. It is not a coincidence that Singer and his family have a large part of their wealth tied to Elliott Management.

Next Trade

“Bondholders continue to think that it is perfectly safe to own 30-year German bonds at a yield of 0.6 percent per year, or a 20-year Japanese bond (issued by the most thoroughly long-term-insolvent of the major countries) at a little over 1 percent per year, or an American 30-year bond at scarcely above 2 percent per year”, Singer states. He believes that the next big opportunity is in shorting long-term paper claims – that is selling bonds which are trading at artificially low yields because of massive central bank experimentation.

Paul Singer is a smart, rich, Asshole! see what the asshole did in Nebraska? I have 0 respect for a low life like him