Is silver’s slump finally over?

Veteran trader David Jones looks at silver and how investors can profit from a recovery in the price of this precious metal.

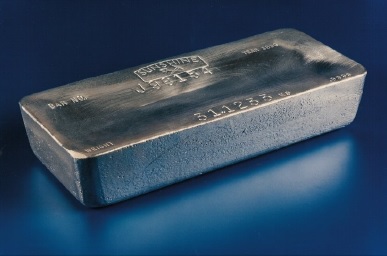

Last time around we took a look at the price of gold – and I make no apologies this month for focusing on what’s happening with silver. The casual observer would assume −quite reasonably −that gold and silver follow similar paths. But that really has not been the case over the last few years, with silver losing around 70% of its value from the 2011 highs. However, all of this started to change during July, which has put it back on my radar for the first time in a long time.

A painful time for ‘silver bulls’

To put things in perspective, let’s take a look at the history of the price of silver.

Silver price September 2008 – July 2019

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

It has been something of a ‘wild’ decade for silver – particularly the five years from 2008. The price ran up from around $9 an ounce back then, to almost touch $50 in April 2011. As is often the case with these drastic moves, there is no concrete explanation. There was talk of people with very deep pockets trying to corner the market – similar to the story of the Hunt brothers in 1980. And as is also often the case, the return to more normal market conditions was painful for some. The price of silver lost more than a third of its value within a month of that April 2011 peak.

Bringing us back to the present day, at the beginning of this year, the price of silver was trading around $15 – down almost 70% from those highs eight years ago. It had made various attempts over the years to stage a recovery, but these had come to nothing, and it had lagged behind its precious metal stablemate gold. But it did appear to be forming a base in the $13.50/$14 area, with this zone successfully stopping any deeper sell-offs over the past three years.

Silver price December 2015 – July 2019

What’s driving silver?

It can be a source of confusion why gold had done relatively well, but silver was still languishing in the doldrums. After the financial crash in 2008, gold rallied strongly, but it was a while until silver picked up the pace. Much has been made of this by ’silver-bugs’ this year – and in recent weeks they may feel their patience has finally been rewarded. However, the reason behind the recent strength is somewhat clouded. The silver market loves a conspiracy theory, usually around how the price is being controlled by JP Morgan et al. But I always think spending too much time on market conspiracy theories is a waste of energy. Let’s say the mythical ’they’ are going to take the price of silver back to $50 – are you not going to get involved just because you object to conspiracies? For me, it’s about going back to the basics of technical analysis and looking at what the price is doing.

Silver price July 2016 – July 2019

The price has been in a clear downtrend since the latest significant peak just above $21 in July 2016. In February this year, things looked to be getting interesting as the price pushed through that trend line – was this finally the start of a more sustainable recovery? ‘No’ ended up being the quick answer – the price had dropped back by 10 percent by May of this year.

But the price action has got interesting again in July. Silver has made another attack on that trendline, and by the third week of the month, it was trading at its best level since June of the previous year.

It is early days – a one-week break of a trend line does not guarantee the ‘mother of all rallies’ is just around the corner. But to give the silver bugs some hope – every journey starts with a single step.

How to profit from a silver recovery?

It is all well and good talking about a resurgence in silver, but, understandably, some private investors may be scratching their heads thinking about how they can position themselves to profit from it. Never fear −there are easier ways than traipsing around antique shops and flea markets trying to snap-up silver spoons before any expected surge –for instance via a product that tracks the silver price, such as iShares Physical Silver (SSLN), which is quoted in pounds sterling.

iShares Physical Silver July 2016 – July 2019

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

For the more adventurous investors, there is also the world of derivatives such as futures, contracts for difference (CFDs) and spread betting. These alternatives let you use leverage so you can magnify your initial investment, but this goes hand-in-hand with larger losses if the silver recovery does not materialise. You also pay a financing charge for having that leverage: this is admittedly fairly small at the moment given that interest rates are so low, but it is still a cost of carrying a leveraged position. Regardless of your risk appetite, there are several alternatives out there for you to add some silver to your portfolio if desired.

Before getting too carried away, it needs to be borne in mind that there have been plenty of false dawns in the silver price since the 2011 $50 highs. A little patience seldom goes amiss, therefore, when trying to spot major turning points in financial markets. As a comparison, the price of gold made an important bottom in August of last year, but it was arguably not until December that it really found some momentum. For the more prudent investor and trader, giving the price of silver a little time to see if it can build on these recent gains would be the more cautious approach. However, the poor relation to gold is certainly looking a little more exciting than it has done for some time.

Comments (0)