Chart Navigator: ABDP, Bushveld Minerals and Amigo Holdings

In this monthly charting column, full-time trader Michael Taylor reveals three stocks that he reckons could see fireworks in the month ahead.

When I first started trading I thought it (and I) was brilliant – mainly because I did so well. Although this was due to a bubbly market rather than any actual skill on my part. But humans have a tendency to overestimate our skill when performing well, and attribute failure to rotten luck.

I am hesitant to name any actual companies in this period as 1) they sucked, and 2) I am aware that even four years later after delisting, these cults still persist on bulletin boards where they genuinely believe they will get their money back and may attack me should I say anything bad. I like my life, and see no reason to have it disrupted.

However, I began to have unrealistic expectations about what was possible, began to take higher and higher risks, and eventually learned a painful lesson when reality and I were no longer strangers.

No doubt that this is something that everyone can relate to.

In many areas of business, a long-term view and success are often the best of friends. Warren Buffett is famous for saying his favourite holding period is “forever”, and Jeff Bezos also recently said he plans for quarters several years in advance.

Considering that most CEOs are planning for the next quarter, in order to titillate Wall Street and analysts, having this long-term advantage may go some way to explaining why Amazon is one of the most successful listed companies on the planet (although this does include an element of survivorship bias as Amazon raised a load of capital before the collapse of Dotcom).

Being able to think longer term offers an advantage, and as a trader this can be difficult when one is focused on short-term profits. As I wrote last week, it pays to know what the trade is. If it’s a longer-term trade, make sure you’re not tempted to snatch at shorter-term gains. Stick with the strategy.

My own trading improved when I moved from trying to have a positive week every week to having positive months. I found that if I was flat Monday and Tuesday, I’d then take on higher risks and chase in order to close the week blue. Rather than chasing now, I wait for the setups to appear – and if there are no trades, I don’t try to force them.

ABDP plc

ABDP (LON:ABDP) feels like it has been on my watchlist for an eternity. I’ve always kept an eye on it, as I bought and sold it for 30% when it was around 200p. Even now, after the Covid-19 crash, if I hadn’t sold any shares from that original buy I would’ve been 9x my money up even though the price lost well over half its value at one point this year.

On a side note: I wonder how many of the people who call themselves investors are actually investors.

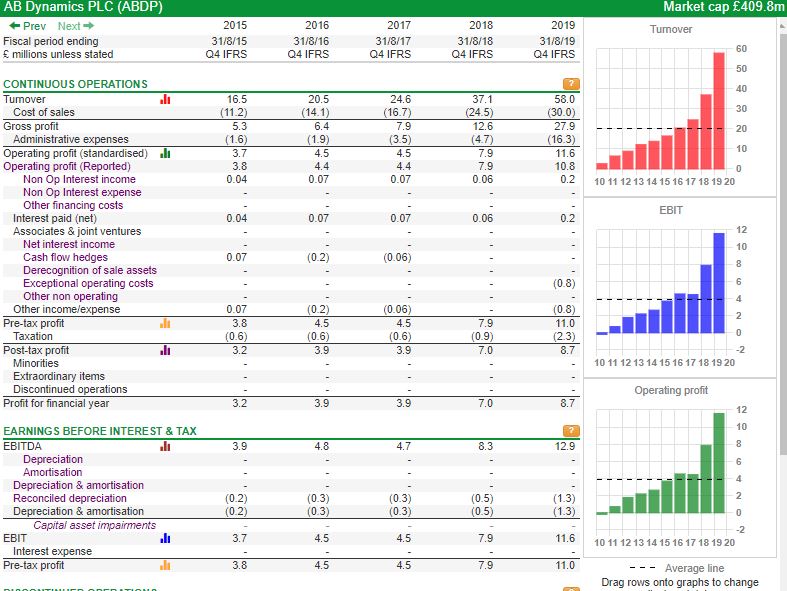

If any holders had focused on these results only – would these historic results alone be enough to make one sell?

Of course, these are just the headlines and there is more to a company than what is listed here. But there is an example of Pfizer in one of Peter Lynch’s books where it didn’t move for around ten years, and then afterwards went on a monstrous rally. But who can afford to wait ten years these days, when there is so much noise and information?

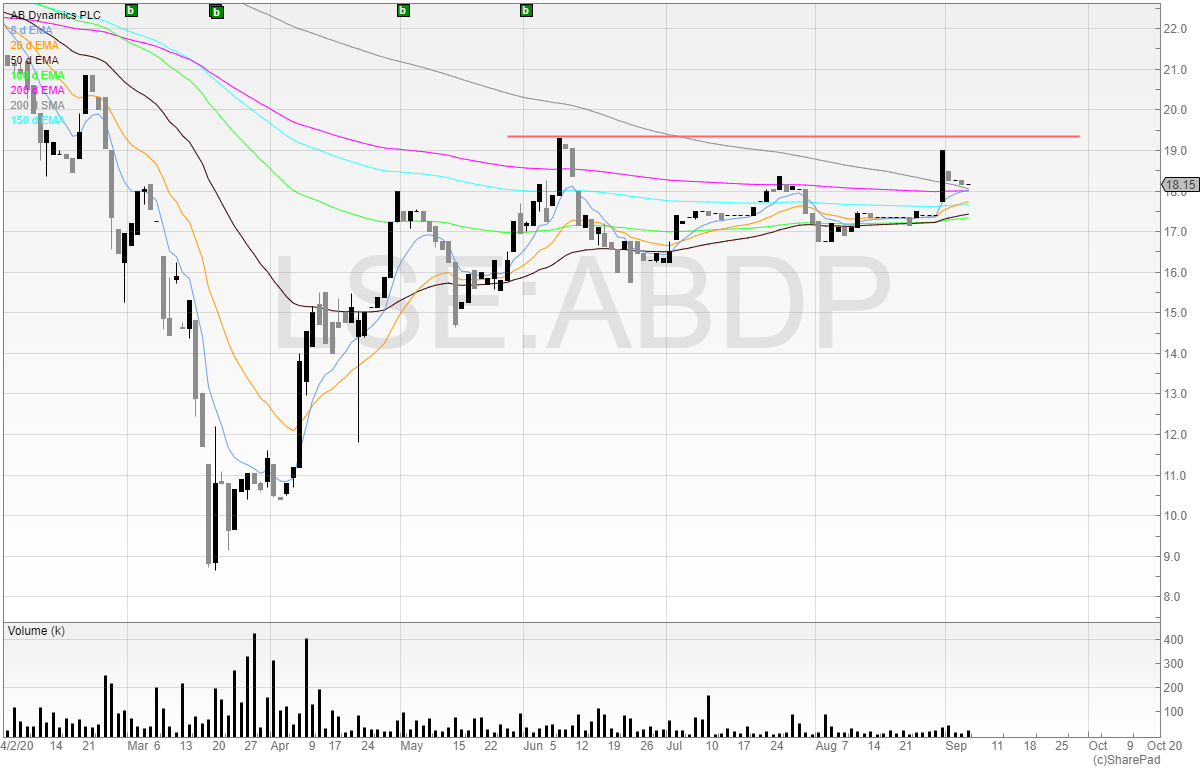

Looking at the chart below, ABDP has put in a long and drawn out base from around May. We can see that higher lows have been printed, and volume in the stock has come right down. This to me shows that the stock is reaching towards its equilibrium point, whereby both buyers and sellers have come to a rough agreement of where the price should be.

For a reason that escapes me, the stock gapped up today and has continued, and it is still on my watchlist to see if it can break the resistance zone around 1,900p.

I like ABDP because it is a quality stock, and technically it is potentially setting up for a cup and handle pattern. Technical analysis is always going to be more important and a priority – the most undervalued stock on the planet could have a terrible chart and I wouldn’t buy it – but finding fundamentally attractive stocks alongside strong technical alignment can prove powerful.

This is also something Minervini looks at to an extent. He wants stocks that are aggressively growing and accelerating their top line over several quarters. These companies are often growth companies and the prices may follow and set up in the charts.

Bushveld Minerals

Another similar chart I am looking at is Bushveld Minerals (LON:BMN).

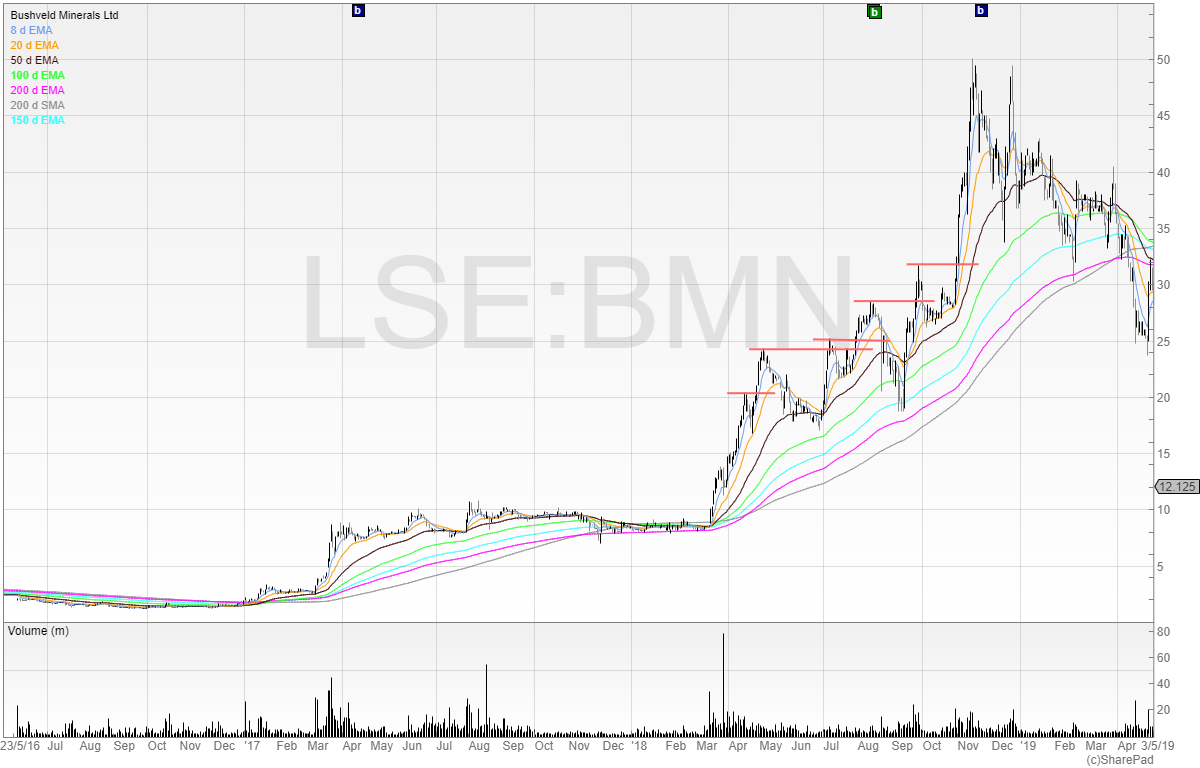

This was a real scorcher back in 2018. Here’s the chart.

It offered plenty of breakout opportunities, and the stock eventually hit 50p, which was to be the high. Since then, it’s hit as low as 8p this year which is back to its February 2018 price. It just goes to show that one shouldn’t ever take a rising stock price for granted.

Below is the most recent chart.

15.75p appears to be recent resistance in the chart. We can see a scruffy cup and handle, with a very deep and brief cup, and a long and drawn out handle. This doesn’t bother me, as I see it as consolidation and a greater increase in volatility should the stock break out.

Amigo Holdings

A final stock I think that has potential for plenty of volatility for traders is Amigo Holdings (LON:AMGO).

This is a company that offers access to credit and loans to those who struggle to get capital elsewhere due to their credit histories. It also offers a service of allowing borrowers to rebuild their credit scores and improve their ability to access credit from mainstream providers in the future.

There has been a boardroom bust-up at Amigo. Founder James Benamor was holding around 60% of the stock and the board placed an injunction on him preventing him from voting in the GM.

He then decided to provide shareholders with a choice. He would not vote, but if the board was not removed then he would sell 1% of the company every day until he was down to 0%.

So far, he has been doing exactly that, and the stock doubled on speculation that he would then continue buying.

Personally, I am not sure how he is allowed to comment on the stock given that he is actively selling. If you are an active seller, then talking up the stock can be seen to be market manipulation, as you are trying to entice others to buy in order to give you a much better price. In my opinion, James should be careful with what he says, as he has claimed there is nothing to stop him buying 1% of the company again per day once the sell order is finished.

To me, this seems silly, as everyone can front run him. But then he’s also not obliged to do so – and still working his sell order!

Through his holding company Richmond, James is now down to 6% of equity and will have completely sold out within days.

Here is the chart.

We can see the huge volume surge and spike in the price. If James is going to start buying again, we may see the stock surge on good volume and increase.

This stock offers plenty of opportunity, but it is incredibly volatile and traders should approach it with caution. Never put in any amount of money that you are not fully prepared to lose.

- Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. Investors Chronicle readers can take advantage of an introductory offer by visiting shiftingshares.com/online-stock-trading-course

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael

Comments (0)