Will Apple surprise the market in the New Year with a massive stock buy back?

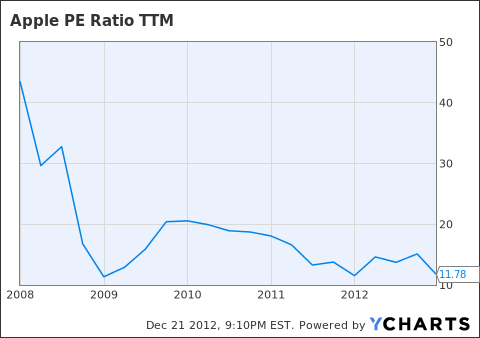

As we can see in the chart below, AAPL is now trading at historically low valuations with some $250bn lopped of its market cap over the last 10 weeks. In fact, ex cash, the stock is trading on around 8 times earnings – almost a 40% discount to the S&P 500. If the company were to deploy some of its $120bn+ cash in buying back its stock it would be incrementally earnings enhancing and so making the stop even more attractive and the company would be buying back stock at what is historically one of it’s cheapest valuations for almost 15 years.

Since hitting an all-time high above $700 per share in September AAPL shares have fallen by almost 30% now and have made what is known as a “death cross”. The magnitude of this decline has given AAPL a golden opportunity to act by repurchasing significant amounts of its own stock and sliencing some of the company’s critics who believe that Tim Cook is presiding over an inefficient balance sheet and that simply sitting on such a cash pile is actually hurting the company’s valuation. Additionally, a buyback could reverse the current downward momentum in the stock which has led to significant tax related selling.

It is often argued that monetary policy, such as QE announcements, are most effective when they come as a surprise. Similarly, a surprise, massive share repurchase program will likely be more effective than a predictable increase in the dividend and buyback. Right now, given AAPL’s cash position, most investors are expecting AAPL to increase the annual dividend, pay a special dividend, or increase the buyback by a small amount. However, almost no one is expecting AAPL to announce a massive buy back of say $50bn that would still leave a large cash pile to make an acquisition(s). AAPL would still have plenty of cash to invest into the valuable R&D needed to come up with products such as iTV for example too

Should AAPL announce such a program, investors would likely rush to buy shares in an effort to get ahead of the massive buying program. This process could lead to a multiplier effect from the buyback. This is no different than the buying that has occured ahead of Federal Reserve buying in the Treasury and Mortgage securities markets.

Given current circumstances surrounding AAPL, its historically low valuation, tax related selling and a record $120bn+ in cash, a massive stock buyback program is the best way for AAPL to return money to shareholders. We called AAPL a Trading Buy at $533 2 weeks ago with a view to buying down additional position increments towards $500. We added last week on the dip to $503 and remain resolutely long.

If you’d like be ahead of the queue with the launch of our sister company Titan Inv Partners professionally managed spread betting servce in the spring of 2013 then email TITAN to editor@spreadbetmagazine.com to register your interest.

Comments (0)