Sensible steps to boost an ISA – SPONSORED CONTENTSPONSORED CONTENT

When investing for your future, ignoring the tax advantages of an ISA is like releasing banknotes into a storm – but you can improve on their potential to provide shelter.

For those who have taken advantage of the considerable benefits of ISAs over time, and accumulated a meaningful pot, it makes sense to ensure that your efforts are not undone.

Be watchful of fees

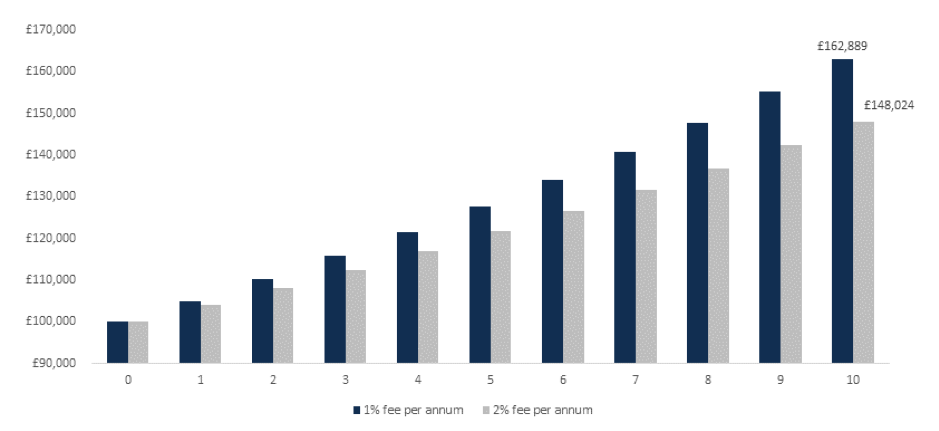

Fees make a big difference over time. If you hold an ISA worth £100,000 with Netwealth – and without contributing more to it – over 10 years this could be worth £162,889 when a fee of 1.0% a year is included. By paying a fee of just 1.0% more over the decade, the value of your ISA would only be worth £148,024.

The Compounding Value of Saving 1% in Fees

Source: Netwealth. Assumes gross investment returns of 6% per annum.

Create a diversified ISA

The mantra of being aptly diversified is well worn – for good reason. Different assets perform better at different times: US stocks could outperform one year, emerging market shares could outshine the next and UK government bonds the year after. It’s very difficult to predict which assets will do better or worse over a given period. A diversified portfolio can help you to capture the gains, while minimising the losses.

Understand your risk tolerance

By understanding how much risk you are comfortable taking, you can take enough risk to maximise your returns. For example, younger investors may want to target higher growth – and therefore higher risk – knowing that in the event of a downturn there is time for asset prices to recover. More risk averse investors may prefer a portfolio with a higher percentage of government bonds. Once you know what your risk tolerance is (whether low, medium or high) you can then choose investments that make the best use of your preference (https://www.netwealth.com/account/register).

Use your full allowance – each year

The ISA allowance of £20,000 cannot be carried over to the next year. Where possible use your full allowance – doubled to £40,000 for a couple – every year to help maximise the size of your ISA pot.

Capture the benefits of investing early

The earlier in the year you can contribute more to your ISA, the better. This allows your ISA to benefit from the potential of a full year of growth, although there is no guarantee that the value of your investment will rise. Even if you do not have the full amount you would like to invest you can invest monthly or regularly, to also take advantage of your money spending time in the market.

The next step to boost your ISA

As we have examined in a previous article (https://www.netwealth.com/OurViews/2018/2/8/why-it-is-essential-for-investors-to-control-the-controllables), there are several aspects of investing – and therefore your ISA – you can control. These valuable steps may be worth considering sooner rather than later.

If you would like the prospect of lower fees, effective diversification and a risk level that suits your goals better, please get in touch (https://www.netwealth.com/HelpHub/contact) about transferring an ISA to us.

About Netwealth

Netwealth is a wealth management service that brings together a highly qualified team, a powerful online service and a robust investment framework.

Clients have access, for a fraction of the industry cost, to experienced financial advisers and portfolio managers while benefiting from cutting edge financial technology.

Not what I expect (independent opinion) from Master Investor.

I wonder how many “master investors” will feel better educated for reading this article?