Is the forthcoming new Moon in early March the potential trigger for a sharp global equity market sell off?

Nasdaq 2000 vs. Nikkei 1989/90 vs. Dow 2013/14

The dot.com boom peak in 2000 occurred on a monthly sunspot spike at the ~11 year solar maximum, with the familiar topping process pattern of primary distribution – shake out – second chance – waterfall declines. The major declines and flash crash occurred in March/April, with associations of Mondays and the new moon (correlations that hold up in wider stock market history).

The Nikkei boom peaked on the last trading day of 1989 on a monthly sunspot spike at the ~11 year solar maximum, with the same topping process waves. The major declines were centered around March, with associations again of Mondays and the new moon.

The Dow peaked so far on the last trading day of 2013, on a monthly sunspot spike at the ~11 year solar maximum (11 years is average and this was a longer solar cycle), with a similar topping process so far.

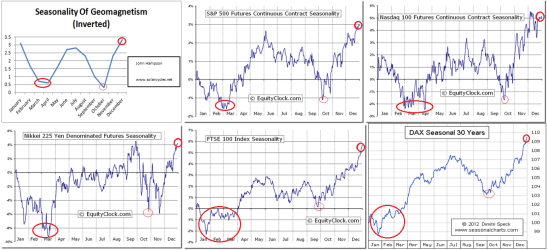

With the historic associations of Mondays and new moons, we have a potential major down day Monday 1st March, which is the new moon (CORRECTION: Monday 3rd March, 1st trading day after the Saturday 1st March new moon), and based on the percentage drops of the Nikkei and Nasdaq we could potentially waterfall to 11,000 by the end of April. The relevance of March and April is captured here:

With the historic associations of Mondays and new moons, we have a potential major down day Monday 1st March, which is the new moon (CORRECTION: Monday 3rd March, 1st trading day after the Saturday 1st March new moon), and based on the percentage drops of the Nikkei and Nasdaq we could potentially waterfall to 11,000 by the end of April. The relevance of March and April is captured here:

Just as the seasonal peak of geomagnetism (inverted) corresponds to peak stock market seasonality and a clustering of major tops having occurred at the turn of the year, so the seasonal lows of March/April and October have corresponded to worst seasonal stock market performance and a clustering of market crashes.

From www.solarcycles.net

Comments (0)