Is it time to replace growth and ‘meme’ for value?

Growth, as an investment style, has completely outperformed value during the last 10 years.

With ultra-low interest rates and continuous quantitative easing, investors have a free put in their hands, which they can use as protection against the downside of bolder investment decisions.

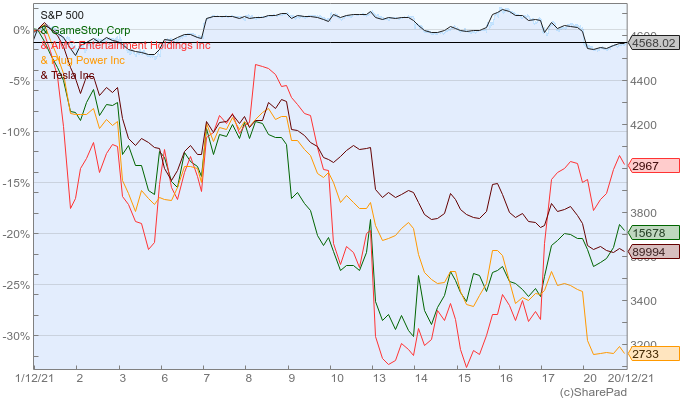

Why invest in the old Dow for dividends, when you can get a piece of nascent, disruptive technologies that promise skyrocketing returns? ESG, clean energy, cannabis, crypto and disruptive innovation are examples of investment themes that have been paying off, although these themes are now losing appeal. The sub-category of meme stocks, in particular, has been under fire, as reported earnings show severe weaknesses and the ’to the moon 🚀🚀🚀🌔’ momentum is losing its pace.

While growth seems to pay off well over the long term, the extremely favourable monetary conditions created by central banks around the world have certainly helped. Interest rates are an important component of equity-valuation models, as they are used as discount factors for expected future cash flows.

Growth stocks derive their value from profits projected way into the future and many of them are unprofitable at the moment. They’re like a 30-year Treasury, which has a long duration. If interest rates start rising, the discount on future cash flows becomes a heavy burden for growth stocks, exposing them to hefty price corrections.

Additionally, these stocks usually trade on very high price multiples, which tend to be stretched at times of low interest rates and optimism. However, if the outlook turns negative, investors usually revise the acceptable price multiples downwards, which leads to large price corrections. A more negative economic scenario mixed with potential interest-rate hikes acts as a double blow on the price of growth stocks.

The case of meme stocks is similar to that of growth stocks, in the sense that these stocks usually do not trade at anything near their fundamental values. Instead, they trade on stories about their potential future. Prices are then mostly driven by sentiment, if not fashion. During the pandemic, meme stocks gathered pace due to a mix of events, which included people staying at home, interest rates remaining at record low levels, central banks providing even more liquidity and the US government sending ‘free cheques’ to millions of households. Such extraordinary liquidity must go somewhere − and I believe it mostly goes in the direction of assets. Growth and meme stocks were recipients, as were crypto assets, which experienced ‘explosive’ returns.

While this is not a mainstream opinion, I believe that central banks have been contributing to asset ‘bubbles’, not consumer inflation. The consumer inflation we’re seeing seems more like a collateral effect of the pandemic − a disruption of supply chains. But the bubbles in growth and meme stocks are a direct consequence of excess liquidity. As soon as central banks tighten monetary conditions, investors will reassess growth prospects, downgrade price targets and lean towards value.

This is where value stocks come in. They don’t offer skyrocketing profit potential but sit on more stable profits and are better equipped to weather some turbulence. As they trade on conservative valuations, investors are not overpaying for the unforeseeable future and then have a kind of safety net in case the market turns unfavourable.

While ‘safe’ is a strong word to use when referring to stocks, at least value stocks trade closer to book values. The duration of a value stock is more in line with a five-year Treasury, to put things in perspective, relative to growth stocks. Interest-rate hikes cause a dent in the valuation of a value stock, but much less than they do on a growth stock. Meme stocks suffer from a tightening in monetary conditions, as these stocks thrive on the quick rise in inflows of money. Any retreat in inflows may contribute to extending price declines.

According to data from Morningstar, value investing has underperformed growth investing by five percentage points per year between 2011 and 2020. But most of the underperformance comes from the last three years, when value returned 15% less than growth per year. In 2020 alone, the underperformance was as high as 32%. These results are a reversion of what happened during 2001-2010, when value was the best performer.

The exact reasons for the disappearance of value are certainly complex but I would say that years of quantitative easing certainly played an important role. As central banks around the globe move to tighten monetary conditions, we may see a dramatic change, which may favour value rather than growth, in particular at a time when valuations are overly stretched.

With inflation moving higher and interest rates also expected to rise, value stocks, in particular those paying dividends, are very attractive. Unlike bond coupons, which are fixed and thus decline in real terms with inflation, dividends change over time. At the same time, high-dividend-paying stocks have a lower duration, which is a good characteristic to have when interest rates are rising.

There are some easy ways to get exposure to value, through ETFs. Here are three from the huge range on offer. The first is a broad-based, large-cap ETF, the second targets mid-caps and the third seeks to track value outside the US.

Vanguard Value Index Fund ETF (NYSEARCA:VTV)

One huge point in favour of VTV is that it delivers a diversified exposure to value, almost for free. With ongoing charges of just 0.04%, there’s nothing cheaper in the market. VTV tracks the CRSP US Large Cap Value Index, which classifies value companies based on price/NAV, forward price/earnings, historic price/earnings, dividend-to-price ratio and sales-to-price ratio. Currently, VTV manages $131.4bn in assets and includes 347 holdings. Its top holdings are Berkshire Hathaway, JPMorgan Chase, UnitedHealth Group, Johnson & Johnson and Procter & Gamble. Twenty two percent of the fund is exposed to the financials sector, which is favourable in the current scenario of rising interest rates.

Vanguard Mid-Cap Value ETF /NYSEARCA:VOE)

VOE is still very cheap, with an ongoing charge of 0.07%. It tracks the CRSP US Mid Cap Value Index and includes companies with market capitalisations between $1.5bn and $40bn. The fund manages $27.5bn in assets, which are spread across 211 holdings. The largest holdings include Carrier Global, Motorola Solutions, Keysight Tech, International Flavors & Fragances and Arthur J. Gallagher.

iShares Edge MSCI International Value Factor ETF (NYSEARCA:IVLU)

For investors looking for an international layer on the value factor, IVLU is a good option. However, it is more expensive than the above ETFs, with ongoing charges of 0.30%. IVLU invests in mid-to-large-caps outside the US. It seeks to invest in companies with low valuations. Currently, the average price/NAV is just 1.06, which is very low, offering a good safety net for investors in case the market starts cutting on price multiples. Top holdings include British American Tobacco, Toyota Motor, Novartis, Roche, Sanofi and Mitsubishi UFJ.

Vanguard Financials ETF (NYSEARCA:VFH)

My last suggestion is an ETF tracking the financials sector, which still fits a value investing style. This sector usually benefits from higher interest rates and has been in the shadows for 10 years due to ultra-low interest rates. With the prospect of rising interest rates, the outlook for financials stocks improves, as higher interest rates allow them to keep a proper interest-rate spread, which is the basis for their profit margin. VFH tracks the performance of a benchmark index that measures the investment return of stocks in the financials sector. It manages $12.2bn in assets spread over 399 stocks. Its expense ratio is just 0.10%.

Comments (0)