Which are the most consistent asset managers?

Choosing a fund from all of the thousands of different products that are available on the market can feel like a bit of a lottery, but new research has shown that some groups have a more consistent track record of outperformance than others.

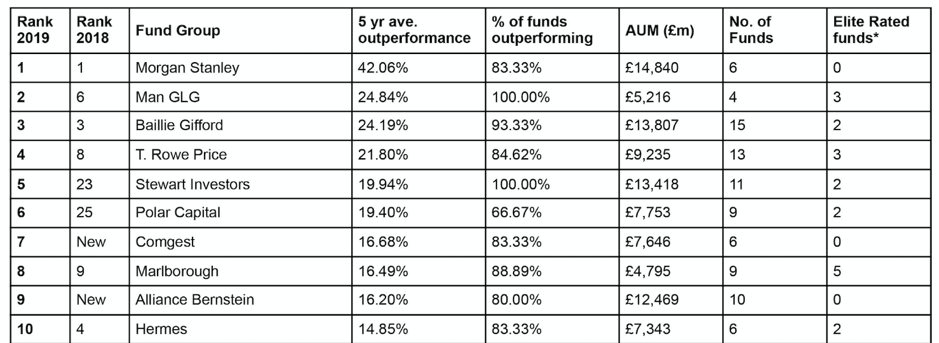

The annual study, which is conducted by the research specialist FundCalibre, compares actively-managed equity funds with their sector averages over a 5-year timeframe. Each group’s funds are then collected together to calculate the average outperformance over the period.

The top performer was Morgan Stanley

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

For the second year in a row the top performer was Morgan Stanley, whose six funds generated 5-year average outperformance of 42%. The company was strong right across the board, although its stand out product was Morgan Stanley Global Opportunities, which returned 90% more than the average global equity fund over the period.

Another star performer was Man GLG, which rose from fourth place to second in the rankings. All four of its funds contributed to the group’s average outperformance of 25%, with its best performer being Man GLG European, which was 44% ahead of its peer group.

Perhaps the most interesting finding is that five of last year’s best 10 groups have stayed at the top and two of them − Baillie Gifford and T. Rowe Price − have been in the top 10 in each of the last five annual surveys. This means that their funds have been outperforming for almost a decade, which suggests that the best actively managed funds can consistently add value.

Baillie Gifford and T. Rowe Price are two of the larger groups with 15 and 13 qualifying funds respectively, which makes their achievement even more impressive. The former had 14 products that beat their peer groups with the most notable being Baillie Gifford American, while the latter had 11 outperformers including its US Large Cap Growth fund and its Global Focused Growth Equity vehicle.

Massive difference between the best and worst groups

Another key point is the massive difference between the best and worst groups, with Morgan Stanley’s average 5-year outperformance being almost 70% higher than that achieved by New Capital. This suggests that investors who look at this kind of data might be well rewarded for their efforts.

It is also interesting to note that the size of the group doesn’t seem to matter, with the top 10 product providers consisting of four smaller equity franchises and six larger ones. The worst performers were similarly mixed, although they included several banking organisations such as HSBC and Barclays, which implies that investors should look elsewhere when choosing their fund providers.

The biggest climbers this year were Octopus, which is better known for its Venture Capital Trusts and Inheritance Tax products, and Newton, whose Global Income fund goes from strength to strength.

At the other end of the scale the biggest fallers included the likes of Standard Life Investments, River & Mercantile, Smith & Williamson, Legal & General and Invesco. River and Mercantile has struggled over the past couple of years as its value style has been very much out of favour, which is one of the limitations with this kind of analysis.

Top ten fund groups 2019

Source: FundCalibre: Data for the Fund Management Index 2018 is sourced from FE Analytics, using cumulative statistics % change bid to bid, net income reinvested, over 5 years to 31/12/2018.

Comments (0)