What Are The Prospects For The Energy Storage Trusts?

Energy storage is a relatively new area within the investment landscape and could have a key role to play in the transition away from fossil fuels. As renewable sources grow in importance, the intermittent nature of the supply requires some kind of storage solution so that the power is available as and when required.

The broker Investec says that the problem of intermittency can be addressed with flexible generation; technology that can produce energy − and in the case of batteries, import − at very short notice. Battery Energy Storage Systems (BESS) are part of this solution and provide a number of potential revenue streams.

These include: availability payments earned from frequency response contracts with the National Grid; offering import and export capacity, at prices set in the Balancing Mechanism; exploiting the intra-day volatility in electricity prices in the wholesale market; and capturing Capacity Market contracts, which are available to all forms of dispatchable generation.

Investment Trusts Lead The Way

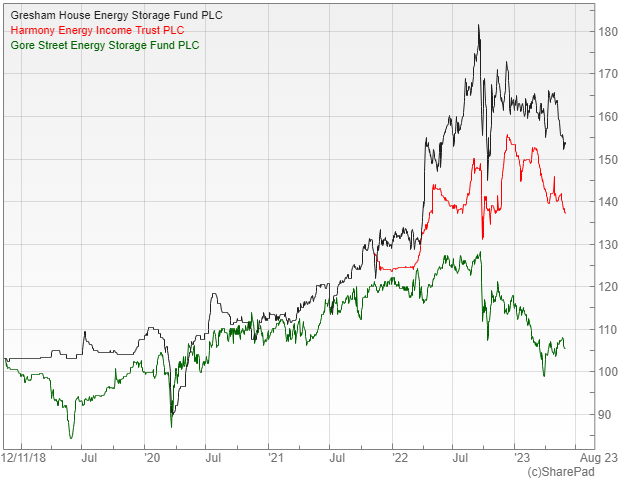

There are three investment trusts operating in this area that offer attractive levels of income and the potential for capital growth, although they are at the higher risk-return end of the spectrum. The target dividend yields range from 4.8% to 7.3% based on the current share prices.

Recent performance has been strong and Investec expect further NAV growth in the short to medium term, as existing pipeline assets under construction become operational and begin to generate meaningful revenues and cash flows. It is still a relatively new area though with the provision of ancillary services to the grid currently the dominant revenue stream in the UK.

The broker also makes the point that there is significant room for improvement in the disclosure and transparency provided by the sector. They say that there is a considerable amount of opacity regarding the valuations of the underlying assets and that the trusts need to provide more information on the cash flow assumptions underpinning the projects.

The Three Different Options

Investec has a buy rating on the Gresham House Energy Storage Fund (LON: GRID), which has a large, diversified operational portfolio in the UK and a well-covered dividend that allows the company to reinvest excess cash flows into its pipeline. It is trading on a small two percent discount to NAV and yielding 4.8% after strong recent performance.

They also have a buy rating on the Harmony Energy Income Trust (LON: HEIT) that has a focussed strategy on two-hour batteries in the UK, which should leave the company well placed in the event that trading − where charging or discharging takes place at full power to take advantage of prevailing prices − becomes the dominant revenue stream for BESS. The trust is yielding 7.1% and is available at a four percent discount.

The other option, the Gore Street Energy Storage Fund (LON: GSF), is rated as a hold, because of concerns over the dividend policy and level of cover. It is currently yielding 7.3% and is trading on a 10% discount.

Favourable Outlook

All three trusts have sizeable portfolios of assets under construction that Investec believe will drive NAV growth in the short to medium term. For example, GRID has an operational portfolio of 590 megawatts that is expected to increase to 1,267 by 2026, while the equivalent figures for HEIT are 109 and 494, on account of the fact that it only has two operating assets given its much shorter trading history.

The latter has sufficient capital to build out its six projects currently under construction, whereas the former will use existing funds as well as additional debt and equity capital. Obviously all of these projects involve the normal risks associated with construction including potential delays and cost overruns.

GRID and HEIT are targeting an absolute level of dividend of 7.35p/share and 8.0p/share respectively in 2023 and both have sizable debt facilities with a leverage limit of around 50% of NAV. It is an interesting area, albeit specialist and high risk, so do your research if you are thinking of investing.

Comments (0)