Value versus growth: the great rotation?

In the last six weeks global value has outperformed growth by around ten percent and with inflation taking hold this really could be the start of something big.

One of the most amazing aspects of the current global equity cycle has been the huge outperformance by growth. This has been fuelled by the record low interest rates ushered in after the financial crisis more than a decade ago, which makes these long duration stocks with the promise of high future returns much more valuable on a discounted cash flow basis.

The tech companies that dominate this part of the market were given fresh impetus during the lockdowns in the early stages of the pandemic, but while the discovery of a vaccine in November 2020 ignited a spectacular value rally, it turned out to be relatively short-lived and in recent months growth has again led the way. In the last few weeks however things seem to have changed.

There has been a growing acceptance in the US, UK and elsewhere that the surge in inflation is not transitory and will take active intervention to bring under control. The removal of central bank stimulus and higher interest rates will make the stretched valuations of longer duration growth stocks extremely vulnerable and provide a more favourable backdrop to value.

A seismic change in the landscape

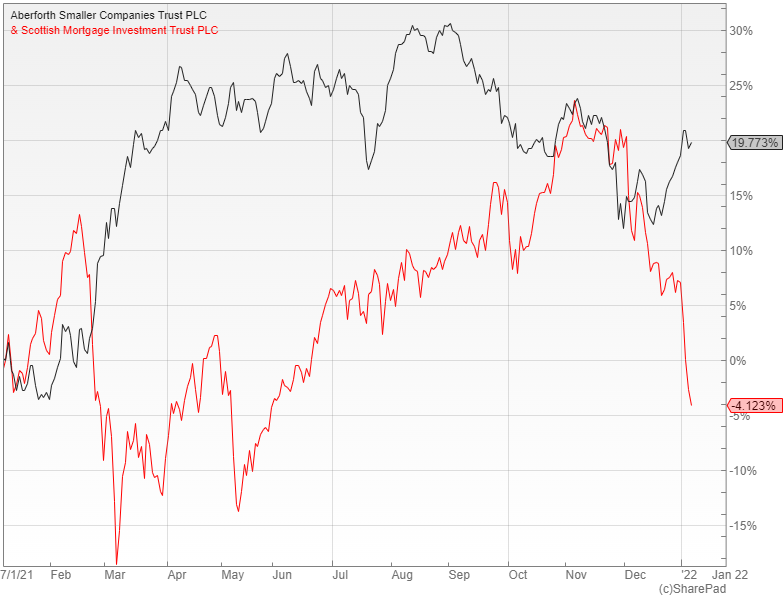

One way to visualise the change is to compare the performance of Scottish Mortgage (LON: SMT), a fantastically successful investment trust that holds large cap growth disrupters and Aberforth Smaller Companies (LON: ASL), which invests in small cap UK value stocks. These provide exposure to diametrically opposite parts of the market and offer the closest thing to a pure growth and pure value play.

Over the last ten years the low interest rate environment has helped SMT to achieve an exceptional cumulative return of over 900%, whereas ASL is up around 280%, a highly creditable performance given that it has comfortably beaten its benchmark and achieved more than double the gain of the FTSE All-Share. In the last six weeks however Scottish Mortgage has sold off sharply and ASL rallied hard.

If the high inflation persists and monetary conditions are tightened as expected then the supportive backdrop should enable Aberforth’s portfolio of UK small caps with strong balance sheets, good returns on equity and low valuations to outperform. There is also plenty of room for the 13% discount to NAV to tighten.

Time to buy

The broker Investec, which has recently brought out a buy note on ASL, highlights the attractive valuations and points out that UK equities are close to historic all time high discounts relative to their global peers. They say that this was a major factor in the marked increase in M&A activity last year.

Value stocks tend to do better when bond yields rise and we have recently seen a marked shift higher in the key government bond rates. Aberforth offers the nearest thing we have to a core value, small cap exposure in the investment trust universe, which makes it especially well-placed to benefit from this change in the macro landscape.

It has been a long time since value has outperformed growth in any meaningful way, but it does finally feel like we have reached the tipping point. If so I would expect ASL to prosper, although it would still be sensible to keep SMT in your portfolio to provide a well-balanced exposure, but it might be prudent to trim your allocation and take some profits.

I would love to know how to define value. Is it reasonable PE, plus net tangible assets and a dividend or some other definition. I know Dimson and Marsh have said that small cap value outperforms growth according to their studies over the long term, but I have never seen the definition. Can you help?

Hi Robert, thanks for getting in touch. There are lots of ways to define value. For example, the MSCI world value index uses three variables: book value to price, 12-month forward earnings to price and dividend yield. Dimson and Marsh mainly focused on the ratio of book value to market value. You can see the full text of their paper here: https://www.researchgate.net/publication/241501818_Capturing_the_Value_Premium_in_the_United_Kingdom