Tough year for Scottish Mortgage but is now the time to buy the dip?

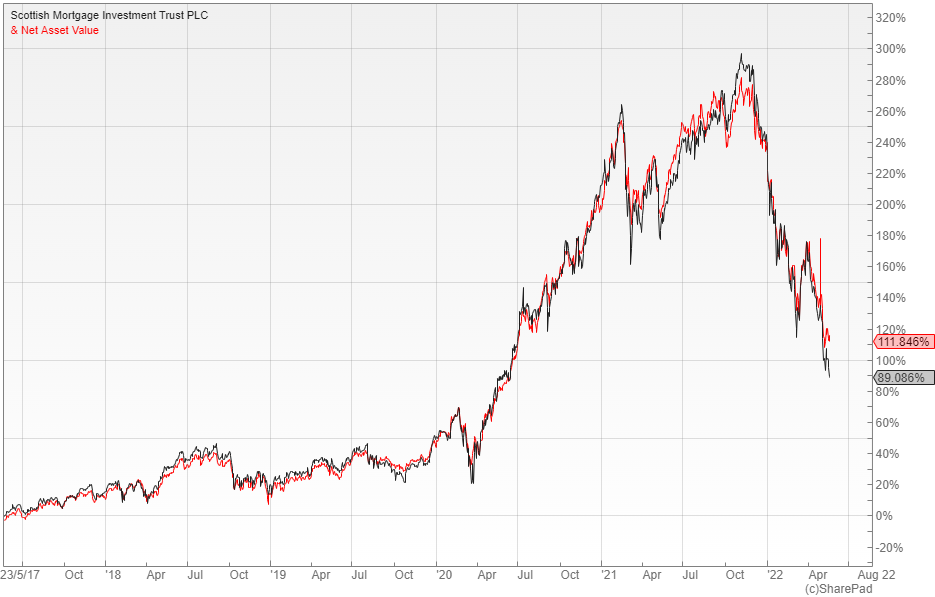

It has been hard going for investors in Scottish Mortgage whose shares have halved from the recent all-time high, yet whenever these sorts of setbacks have happened in the past it has always managed to bounce back strongly.

In the year to the end of March Scottish Mortgage (LON: SMT) made an NAV total return of -13.1% versus a gain of 12.8% for the FTSE All-World index. Rising inflation and the prospect of higher interest rates have dramatically reduced the value of its growth-oriented portfolio, while the regulatory crackdown has hit its Chinese technology holdings particularly hard.

The sell-off in growth stocks has continued after the year-end with NAV total returns down a further 19.7% versus a seven percent fall for the MSCI World index. Its share price has plummeted as a result, falling from an all-time high of £15.68 in October to £7.34 at time of writing and the shares are now trading at a nine percent discount to NAV.

Declines of this magnitude are obviously painful, yet the shares are still a little above where they were going into the market sell-off at the start of the pandemic in February 2020, which might suggest that the liquidity induced blowout is nearly over. Numis certainly thinks there is grounds for optimism and says that Scottish Mortgage has achieved an average share price return of around 40% in the year following a trough in performance.

Learning the lessons

The broker points out that the market volatility triggered a review of the fund’s investment cases and the scenario analysis and probability of success for its various holdings. This found that the overall operational performance from the portfolio remained strong with most of the constituents having delivered “exceptional levels of growth” over the last two years.

As a result, despite the recent share price falls, the probability of success has actually increased in cases such as Delivery Hero and Moderna, whereas positions like CureVac have been sold and there have been continued reductions in the likes of Tesla and Amazon. Commenting on the share price weakness, manager Lawrence Burns said that “we would far rather endure painful drawdowns such as these than too readily abandon the companies and founders that have the potential to deliver the rare outlier returns we seek”.

His colleague Tom Slater has acknowledged that it was a mistake to sell its western technology platforms in favour of Chinese, given the subsequent regulatory crackdown. He is now more cautious on China given the low but increased risk of US sanctions and the concern that the Chinese state may limit the upside for stock prices of breakthrough winners.

Looking ahead

Many of the fund’s new ideas are private investments and the managers say that they are likely to focus on more capital intensive opportunities in areas such as energy transition, rather than digital platforms. They are also looking for ways to drive progress, including “taking a more significant role in company formation.”

At the end of April the top ten holdings made up 43.6% of the assets with the largest, at between six and seven percent, being: the biotech giant Moderna; ASML, which is involved with semiconductors; gene sequencing company Illumina; and the electric car maker Tesla. Because of the falls in the listed share prices the unquoted element has recently exceeded its 30% limit and although the trust will not be forced to sell any of them it certainly adds to the risk and uncertainty.

Numis says that timing the bottom of the current sell-off is extremely difficult and it likely has further to go, but buying a manager or strategy which has a good long-term record at a time when it is out of favour is normally a profitable approach. They believe that Scottish Mortgage continues to warrant a significant place in a portfolio given its unique style and history of bouncing back from periods of weakness.

Comments (0)