To what extent can infrastructure trusts protect you against inflation?

Annual inflation as measured by the Consumer Prices Index is forecast to hit seven percent this year, so is it realistic for the core infrastructure investment trusts to keep pace?

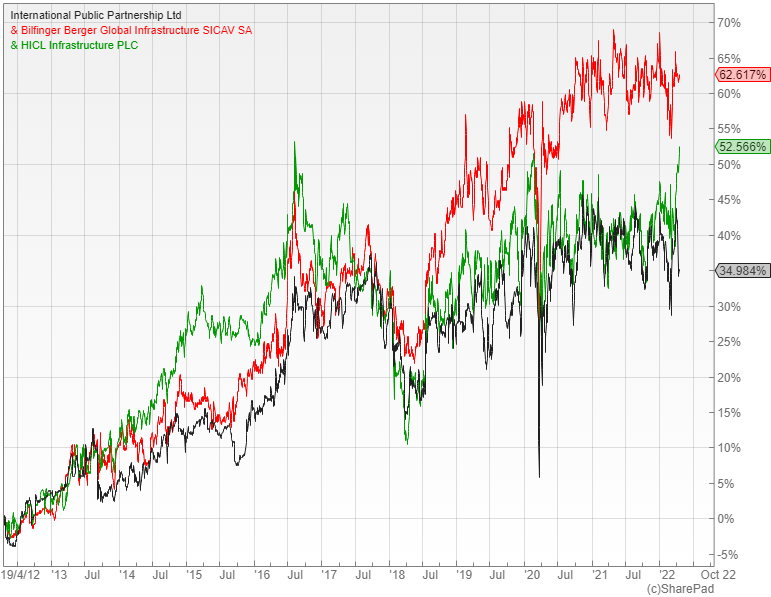

There are three core infrastructure trusts in this country that provide exposure to essential assets, many of which are structured as public-private partnerships with their revenues underwritten by the government. They have all recently given updates that clarify the sort of inflation-protection that they can offer and the sensitivity of returns in different scenarios.

The first of them is the £2.5bn International Public Partnerships (LON: INPP),which recently published its results for 2021. According to the accounts, the underlying cash generation was in line with projections and enabled the company to continue to meet its average historical annual dividend growth of 2.5%.

INPP revenues have a strong level of inflation-linkage, such that a one percent rise in assumed inflation is projected to result in a 0.7% increase in portfolio returns. The broker Numis calculates that the shares had a low correlation of just 0.22 to the FTSE All Share index over the last calendar year, which would be a useful diversifying effect if it also held true in a falling market.

Positive real returns

Next up is the one billion pound BBGI Global Infrastructure (LON: BBGI) that has announced robust results with the board committing to annual dividend growth of two percent per annum in 2023 and 2024. It has the lowest inflation-linkage of the three at 44%, although management guidance suggests that higher than expected inflation of five percent in 2022 and 2023 would add 2.6% to its NAV.

The other core option is the three billion pound HICL Infrastructure (LON: HICL) that is due to report its results for the year to the end of March in mid-May. It has the highest inflation-linkage of them all with about 80% of portfolio revenues forecast to increase in line with the general level of prices.

This ability to deliver real returns in an inflationary environment is highly sought after at the moment, which explains why INPP, BBGI and HICL are each trading at a significant premium to NAV, with the latest estimates being 12%, 25% and 18% respectively. These could make the shares vulnerable if the positive sentiment were to change, yet the yields remain attractive at 4.6%, 4.2% and 4.5%.

Inflation and gilt yields

It is important to keep in mind that inflation is a doubled edged sword, as it increases the cash flows, while also pushing up gilt yields that can affect the discount rates used in calculating the valuations. In recent years these rates have been compressed as investors have been attracted to the sector, which has resulted in higher portfolio valuations.

In its latest results, BBGI included the interesting observation that a one percent increase in discount rates, interest rates and inflation would result in a modest decline of 2.3% in its NAV. According to Numis, the other two trusts would both see modest increases in the same scenario due to their higher inflation-linkage.

The broker says that the core trusts have average discount rates of around 6.8%, despite the high level of revenue visibility. In their opinion there remains significant headroom over the comparable gilt rates – they match the length of the lease or concession to the equivalent gilt duration – which should give some comfort to investors.

Comments (0)