The Latest Investment Trust Recommendations

The broker Numis has recently updated its recommended list of investment trusts for the year. It’s an interesting report that highlights two new additions, as well as several attractive discount opportunities amongst the funds already on the shortlist.

Their aim is to identify trusts where the share price will outperform the benchmark on a risk-adjusted total return basis. This could be through either a narrowing of the discount or outperformance of the underlying portfolio, with funds categorised as either core recommendations or trading opportunities.

It is important to appreciate that they are not looking to create a model portfolio, like some of the other brokers, but to highlight opportunities across the investment trust sector. Because of this they focus on the relative performance and don’t generally make explicit asset, country or style allocation calls.

Core Recommendations

The broker’s core recommendations represent buying opportunities in each asset class. Their timeframe for these is 12-18 months, although many funds are likely to stay on the list for an extended period as they take a long-term approach, selecting high quality managers who can perform in a variety of conditions.

Some of the core recommendations have been on the list for several years, with an average stay of around 78 months. The selections mainly reflect the quality of management, performance record and risk characteristics, although they also take into account the valuations.

Given this long-term approach a new core recommendation is quite a significant event so it is worth taking a close look at the two recent additions: Odyssean (LON: OIT) and AVI Japan Opportunity (LON: AJOT).

Odyssean

The £185m Odyssean investment trust has built an excellent track record by taking a private capital approach to investing in the public markets. It has a concentrated portfolio of 15-25 UK small cap stocks, with the managers looking for companies that are trading below their intrinsic value.

OIT’s strategy is more akin to a private equity approach, which is reflected in the typical ownership stake that ranges from two to twenty percent. The managers aim to build a position that is large enough to be able to influence the business, actively engaging with their holdings to address company specific factors and maximise returns.

Numis believe that UK smaller companies are an unloved and cheap asset class and say that Odyssean’s portfolio has the potential to outperform. They point out that the managers’ engaged approach helps to stimulate change and drive growth, while M&A has crystallised significant value with 10 acquisitions during the five year life of the trust.

Since listing in May 2018, OIT has produced strong performance with NAV total returns of 64% compared to three percent for its smaller companies benchmark. It has also demonstrated resilience in difficult market conditions and in 2022 rose by 5.9%, despite the asset class being broadly sold off by the market.

Before investing it is important to appreciate that the concentrated nature of the portfolio means that the performance can deviate significantly from the broader indices. However, Numis believe that the stock picking record speaks for itself and that Odyssean remains well placed to deliver an attractive and differentiated return profile.

AVI Japan Opportunity

The broker thinks that it is a compelling time to invest in Japan, with an evolving macroeconomic backdrop, improving corporate governance programme and a cheap currency. Japanese stocks also look undervalued as they are trading on an average price-to-book ratio of 1.3x, which is in line with China, but significantly below other markets.

The country is home to swathes of innovative companies that in many cases have been restricted by poor corporate governance and capital misallocation. Over the last decade the government has initiated a comprehensive programme to address this, which is having some impact.

AVI Japan Opportunity invests in a concentrated portfolio of 20-30 stocks that it believes are trading at a discount to their intrinsic value, with a particular regard for those that are sitting on significant surplus cash balances. The fund has developed a strong track record of unlocking the underlying value and has outperformed the MSCI Japan Smaller Companies index since launch, especially over the last few years.

AJOT has a strong management team and offers an attractive way to access the Japanese market and benefit from the increased focus on delivering returns to shareholders. It has started 2023 extremely well with a year-to-date return of 15%, with the shares currently trading at a small premium to NAV.

Numis believe that investing through an activist fund is an interesting way to access Japanese stocks. They say that trusts that follow this approach have the potential to benefit from a cheap market by unlocking the value from deeply discounted shares.

Value Opportunities

The value opportunities identified by Numis are typically based on a time frame of three to six months and their outlook can change relatively quickly depending on movements in the discount. Most are chosen because of discount anomalies, although the broker also highlights trusts where the valuation of particular asset classes or geographies is particularly attractive.

With these shorter term opportunities they put a significant emphasis on the valuation, by assessing the upside and downside to the discount based on the historic trading ranges and peer group averages. Where appropriate they will also take account of the discount control mechanism or other potential corporate action.

There are currently three value opportunities on the broker’s recommended list. They are: RIT Capital Partners (LON: RCP), which looks mispriced on a 19% discount; Witan (LON: WTAN) that is trading on an eight percent discount despite substantial share buybacks; and International Biotechnology (LON: IBT),an attractive area where the fund is available on a nine percent discount.

RIT Capital Partners

Investors in RIT Capital have had a tough time of it recently with the shares down 30% since the start of 2022. This is partly due to the fact that all asset classes struggled last year, although the decline in NAV was compounded by a significant derating as the discount widened to 19%.

The poor return is particularly disappointing given the fund’s aim of delivering long-term capital growth, while preserving shareholders’ capital. It has led to questions about the appropriateness of the risk profile and the significant 40% exposure to private equity – where doubts have been raised about the valuations – as well as the level of remuneration.

Numis think that the portfolio will be more resilient than some commentators are forecasting and have been reassured by several private transactions at or above the carrying value in the books. They believe that the 19% discount offers value for a fund with a long track-record of delivering a defensive return profile and say that the downside to the discount is limited by an active buyback policy.

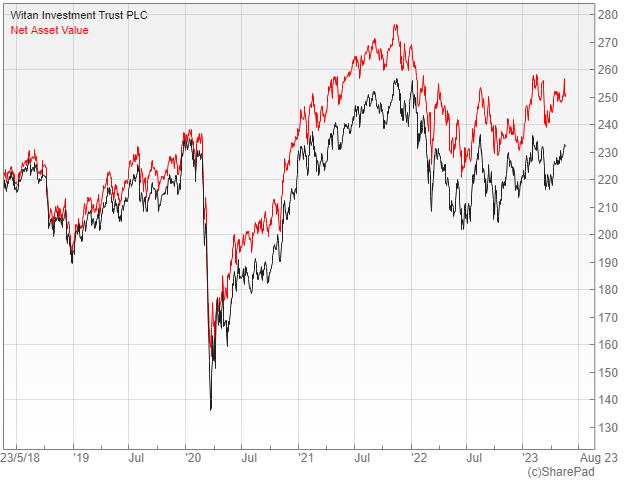

Witan

Witan uses a distinctive multi-manager approach and aims to invest in the best fund managers from around the world. It provides exposure to an actively managed global equity portfolio with 236 different holdings measured on a look through basis.

Numis says that the relative performance versus the benchmark has been unexciting in recent years, particularly in early 2020 when Covid caused a lot of market volatility and late 2021/early 2022 during the growth sell-off. Since then however the situation has improved with NAV total returns of 6.1% over the last 12 months versus 1.2% for the MSCI AC World index.

The broker believes that Witan shares look cheap as they are trading on an eight percent discount, compared to an average of five percent over the last five years. There is every chance that this could narrow when sentiment stabilises given the significant level of share buybacks.

International Biotechnology

Numis are positive on the outlook for biotech, as they think that innovative companies can continue to drive returns regardless of the wider economic conditions. When investing in this area they favour active managers who can select businesses with attractive risk/return characteristics, given that there are likely to be more failures now that the funding environment is so much tougher.

The broker believes that the £320m International Biotechnology Trust offers good value on a nine percent discount. It has recently experienced a derating following the announcement that SV Life Sciences is stepping back from running the fund to focus on its venture capital business.

Obviously there is a lot of uncertainty about the future management arrangements at the moment, but Numis think that there is scope for the discount to narrow when there is greater clarity on what is going to happen. This is particularly the case in view of the strong recent performance, with a total return of 9.6% in the last year compared to just 3.9% by the benchmark.

Baillie Gifford: Stick Or Twist?

The report also considered the question of whether investors should keep hold of their Baillie Gifford funds given the sharp reversal of fortunes in the last year or so. Many people will have built up a considerable exposure to the firm as a result of the spectacular performance, but will now be wondering what to do with their faltering holdings.

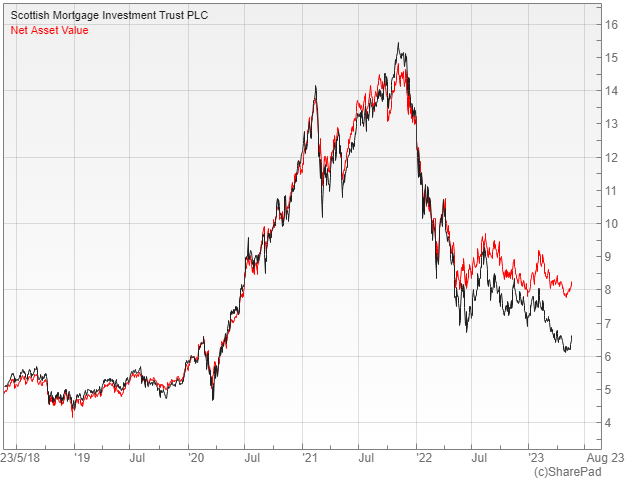

Things started to change in late 2021 when interest rates began to rise and investors reappraised their long duration growth stocks. Many of BG’s investment trusts have been hit hard including well-known names such as Scottish Mortgage (LON: SMT), Ballie Gifford US Growth (LON: USA) and Edinburgh Worldwide (LON: EWI).

The turnaround in fortune reflects their growth style of investment, which is currently out of favour, but the broker believes that these sorts of factors may be less dominant in the future, with company specific performance likely to be the bigger driver of returns. They think that we are entering more of a stock picking environment in which growth managers could potentially deliver outperformance.

Numis says that Baillie Gifford has a strong track record of identifying long-term trends, the value of which is often underappreciated by the market, particularly at times of weak sentiment. They believe that the wholesale growth sell-off, combined with the wide discounts on the associated investment trusts are starting to make the firm’s funds look attractive.

Scottish Mortgage

The one they highlight is Scottish Mortgage, which is on their recommended list and looks cheap on a 20% discount to NAV. They say that many of its portfolio holdings, both public and private, are making impressive progress and have the potential to deliver strong returns regardless of the interest rate environment.

It has been a tough year for the fund with the recently released annual results to the end of March revealing an NAV total return of -17.8%, which was well below the -0.9% achieved by its FTSE All-World benchmark. The share price was even weaker with a decline of 33.5%, as sentiment towards growth stocks nose-dived and the discount widened.

Scottish Mortgage is the flagship fund run by Baillie Gifford and dates back to the founding of the firm in 1909. Its managers aim to identify ‘the world’s most exceptional growth companies’ on an unconstrained basis, across the global listed and private investable universe.

Despite the disappointing recent performance the longer term picture is still impressive with a 10-year increase in the NAV per share of 432%, versus a gain of just 181% in the FTSE All-World index. The strong track record has given the managers a reputation for identifying high-growth companies that can transform society.

Comments (0)