The bestselling trusts and funds for income

A couple of weeks ago I wrote about the equity investment trusts with the highest yields, but the search for income has also extended into other parts of the market. It appears that investors who are concerned about the impact of high inflation on their standard of living have been looking for resilient sources of yield that can protect them against rising prices.

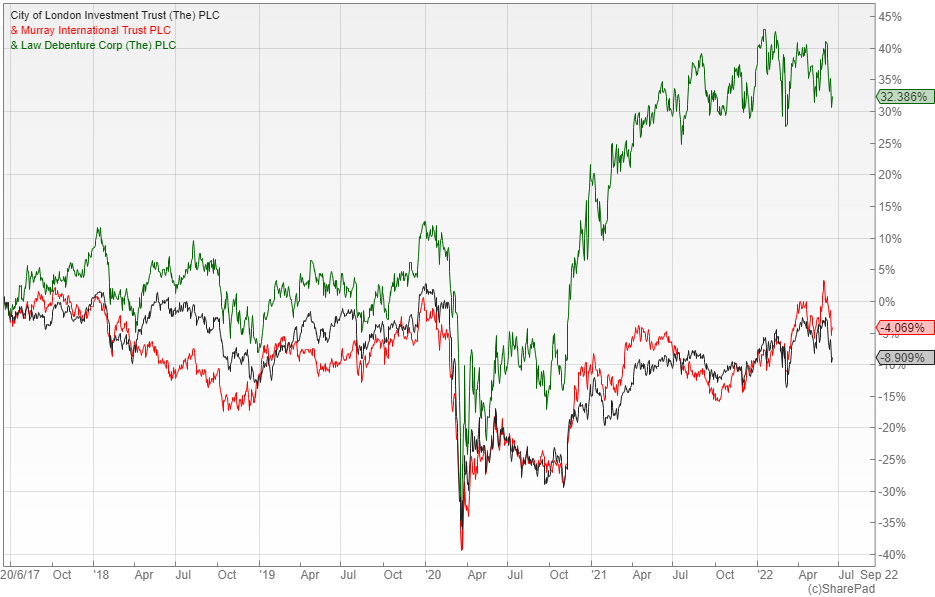

Recent analysis from interactive investor has highlighted the most popular income focused strategies on their platform in the three months to the end of May. These included a couple of mainstream equity trusts that I covered last time, namely City of London (LON: CTY) and Murray International (LON: MYI), as well as Law Debenture (LON: LWDB), a UK trust with its own professional services business that is yielding 4.8%.

One of the open-ended equity funds that has attracted a lot of interest is Fidelity Global Dividend, which is paying 3.5% and aims to deliver good long-term total returns with lower volatility than the stock market. The biggest selling passively managed option was Vanguard UK Equity Income that is yielding 5.1%.

Natural resources and logistics

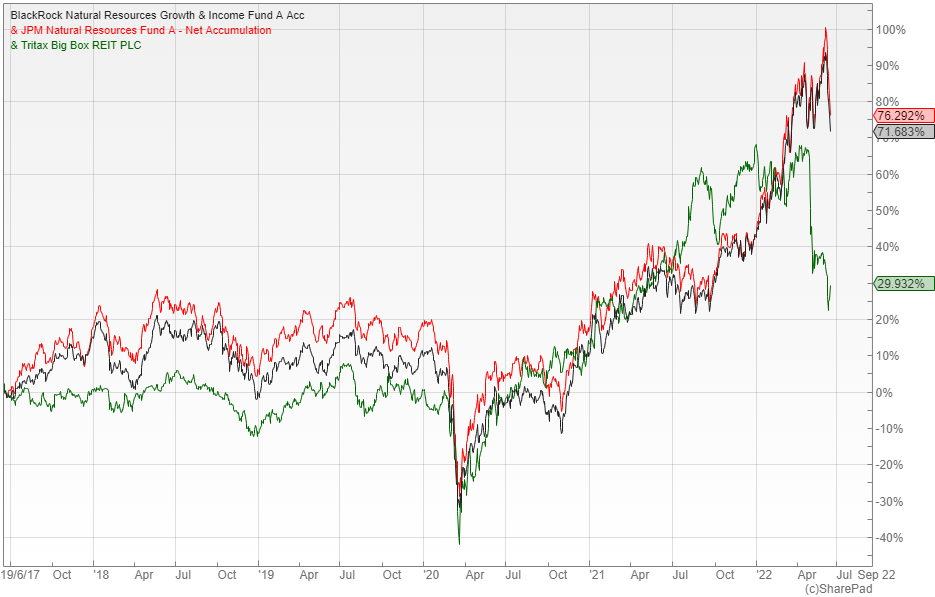

Perhaps the strongest performing area of the market year-to-date has been the natural resources sector, which has mainly attracted investors for the growth prospects, with the income likely to be a secondary consideration. The sector has been a direct beneficiary of the rising oil price and offers other inflation protection qualities.

Two of the most popular funds in this area that also pay a decent yield were BlackRock Natural Resources Growth & Income and JPM Natural Resources. These have returned 29.7% and 28.3% over the last 12 months and are yielding 2.9% and 2.7% respectively.

Another vehicle that has attracted investors is the Tritax Big Box REIT (LON: BBOX) that is yielding 3.5% and trading on a 14% discount to NAV. The trust invests in UK logistics assets, but has experienced a big drop in its share price in recent weeks after Amazon announced that it was scaling back investment in its delivery network, a move that could herald slower growth in the sector and negatively impact the rents.

Infrastructure

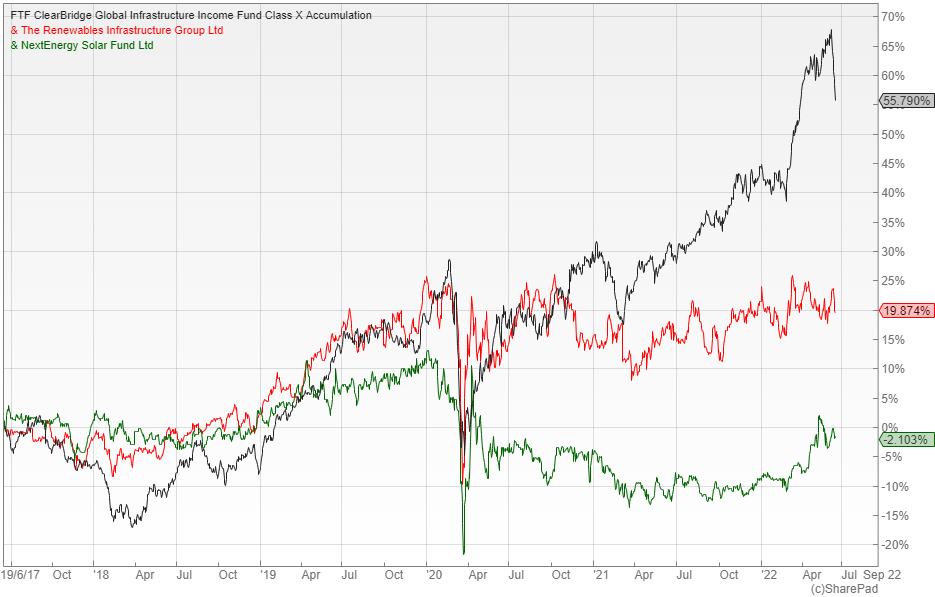

Probably the most obvious way to try to protect your portfolio against rising prices is to invest in infrastructure due to its exposure to government-backed and inflation-adjusted income. This has fuelled an increase in demand for several trusts and funds operating in the sector that pay high and potentially rising yields.

One such is FTF ClearBridge Global Infrastructure Income that invests in a diverse range of global listed infrastructure assets, over 90% of which are inflation-linked, that helps to supports a yield of 3.9%. Another popular sub-sector is renewable energy that has benefitted from higher power prices, although it could be affected by changes to the legislation as the government seeks to rein in the excessive energy costs.

Two of the bestselling trusts in this area were the Renewables Infrastructure Group (LON: TRIG) that is yielding 5.1% and trading on an expensive 11.4% premium to NAV and NextEnergy Solar Fund (LON: NESF) with a 6.5% yield where the shares are available on a three percent discount.

Comments (0)