The best trusts and funds for income

| First seen in Master Investor Magazine

|

Funds expert Nick Sudbury scours the markets for the funds and trusts that offer investors an above average level of income.

The increasing likelihood of a global economic slowdown will probably mean that interest rates will stay lower for longer. Income investors have already had more than a decade to get used to this ‘new normal’ and the pressure it puts on market yields, but there are still some funds and investment trusts that offer an attractive dividend.

We have been in a low interest-rate environment ever since the financial crisis of 2008 and with inflation having recently fallen to less than two percent and UK interest rates at just 0.75%, it doesn’t seem like this will change anytime soon:

“It was previously considered possible to hold a balanced and diversified investment portfolio consisting of equities, property, fixed interest and cash that could generate a natural income of around four or five percent per annum, but this is no longer the case,” explains Patrick Connolly, a chartered financial planner at Chase de Vere Independent Financial Advisers.

He says that it is still possible to achieve a higher level of income, although it would entail focusing on less secure fixed-interest assets like high-yield bonds and emerging-market debt, and using equity income funds that take more risk:

Mr Connolly concludes: “The best approach for many income investors is to focus first and foremost on long-term asset allocation by holding a diversified investment portfolio with an acceptable level of overall risk. If this doesn’t generate enough natural income, then investors can top it up by making capital withdrawals rather than looking for riskier higher yielding options.”

What to look for in an income fund

The key when looking to invest in funds or trusts that seek to deliver an attractive yield is to ensure that the income is sustainable. This is particularly important when you are relying on it for your everyday expenditure, as big fluctuations can make financial planning very difficult:

“It’s important not to get mesmerised by a high quoted yield and to understand what it’s investing in to achieve this, as the general rule of thumb is that the higher the yield, the higher the risk,” cautions Ryan Hughes, head of active portfolios at AJ Bell.

There’s no magic formula for guaranteeing a sustainable yield, although the investment structure is an important element, as open-ended funds are required to pay out all of their income each year, whereas investment trusts can hold some of it back in good years to boost income in the tougher times.

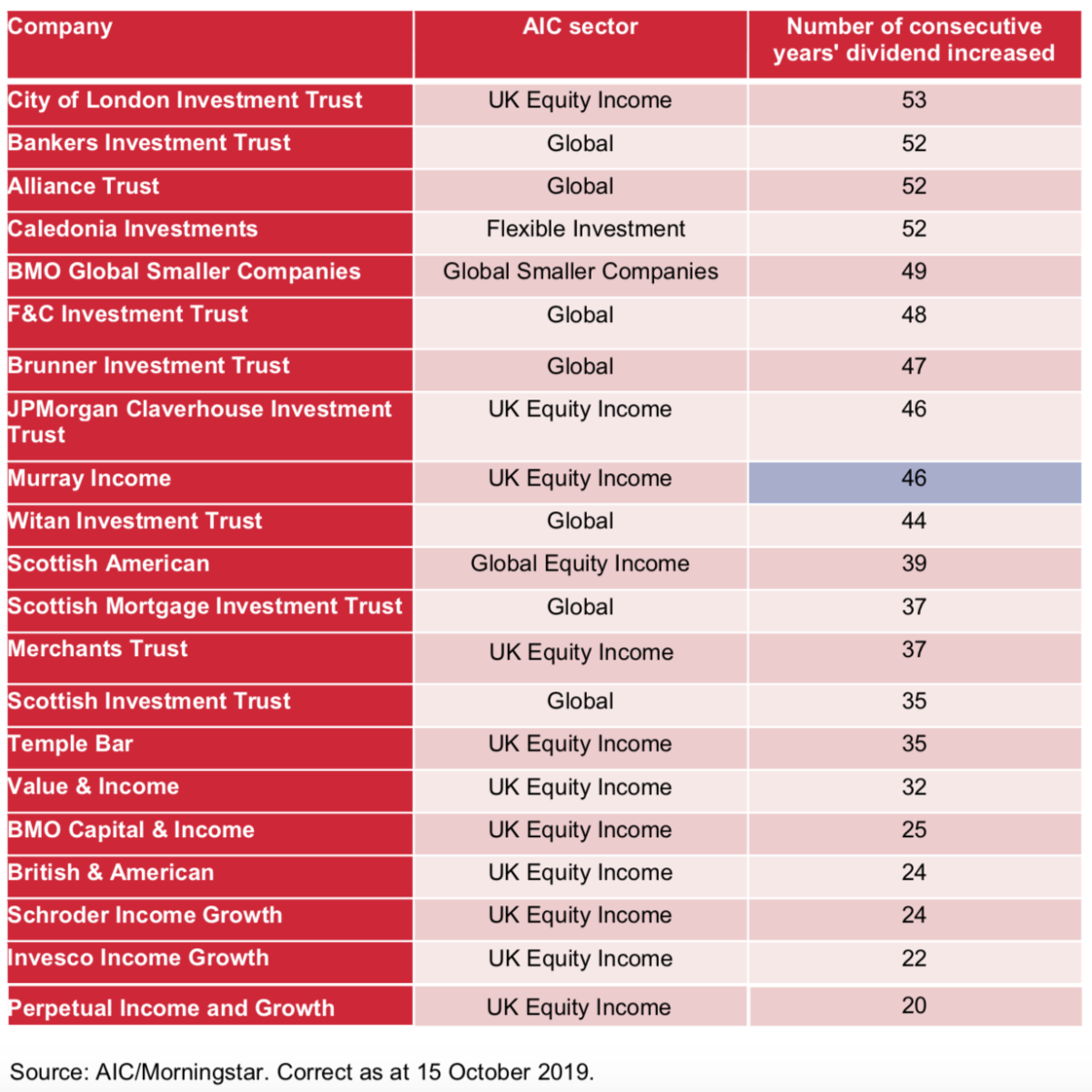

As a result, some trusts have many years’ history of growing dividends and it is therefore worth looking at the list of ‘Dividend Heroes’ published on the website of the Association of Investment Companies (AIC), which highlights those that have increased their dividends for 20 consecutive years. While it’s not certain that the trust will keep increasing its dividend, there is certainly a good chance that it will.

Emma Wall, head of investment analysis at Hargreaves Lansdown, says that investment trusts are able to use their cash reserves to smooth dividends out, but as with many elements of fund investing, it is down to the skill of the manager:

“Judging income sustainability varies from fund to fund; it will depend on how diversified the underlying portfolio is and whether the manager uses derivatives to boost the income. Investors should look at how the fund fared in the last downturn. While past performance is no guarantee of future returns, it can help to indicate how a fund manager may deal with future challenges.”

Another key point to check is the timing and frequency of the distributions. Some funds pay monthly, whereas others declare quarterly or semi-annual dividends. It should therefore be possible to put together a diversified portfolio of funds and trusts that pays a consistent monthly income. When using open-ended funds, it is important to make sure that you buy the income units, otherwise the dividends would be automatically reinvested.

Open-ended income funds

Mr Connolly recommends the Royal London Short Duration Credit fund, which invests at least 70% of its assets in company bonds that mature in five years or less. He says that it has provided consistent positive returns that aren’t affected much by short-term market noise or interest-rate movements, although it can get left behind when fixed-interest markets are performing well. It has a modest yield of 3.3%.

He also likes Fidelity Extra Income, whichhe says has an excellent long-term track record and pays a consistent yield, which is currently 3.3%: “This is a diversified and defensively managed bond fund that aims to deliver lower volatility than you would typically expect from a portfolio of investment- grade and high-yield bonds.”

Alternatively, he suggests Schroder Income Maximiser, which holds most of the same stocks as the Schroder Income fund but sells covered call options on selected shares.This means that the growth potential of these stocks is sacrificed, with the proceeds from the option sales being used to boost the income. The current yield is 6.9% and it has been at this sort of level in all of the 13 years since it was launched.

Ms Wall recommends that conservative investors try Morgan Stanley Sterling Corporate Bond, which invests in high-quality corporate bonds. She says that the distribution yield is only about 3.2%, so while it isn’t particularly high income, it is more defensive than some higher income options and offers good diversification for a portfolio that already has a large equity allocation.

Another option is Royal London Sterling Extra Yield Bond, whereinvestors who are comfortable with the volatility receive a higher distribution yield of 5.4%.

For more adventurous investors, Mr Hughes suggests the Legg Mason RARE Global Infrastructure Income fund that offers a yield of nearly six percent: “It invests in infrastructure equities around the world and has a big focus on gas and electricity generators, as well as other infrastructure investments such as ports, toll roads and water companies. These areas all pay attractive yields with many backed by government contracts with inflation-proofed increases built in.”

High yielding equity investment trusts

Research conducted by Stifel in May identified 31 equity investment trusts that had a dividend yield of four percent or more.Many of them have also built up meaningful revenue reserves that can be used to smooth out the distributions as and when there are dividend cuts at the portfolio companies in which they invest.

One such is the £560m Murray Income Trust (LON:MUT), which has been recommended by the analysts at Investec Securities and which is currently paying four percent annual income.The manager aims to identify good-quality companies, with strong competitive positions and robust balance sheets that are under the stewardship of experienced management teams, while remaining disciplined about valuations.

It has now increased its dividends for 46 consecutive years and has revenue reserves that are more than sufficient to pay out a whole year’s distribution. The company generated excellent performance in its latest annual results to the end of June and has strong income characteristics with an attractive yield.

Concerns over Brexit have pushed many UK share prices down to such low levels that they now pay extremely attractive yields. If you want to benefit you could try the £472m Dunedin Income Growth (LON:DIG) trust, which is yielding 4.7% and trading on an eight percent discount, or the £949m Perpetual Income and Growth (LON:PLI) trust with a 4.5% yield and a 12% discount, both of which have been recommended by the analysts at Winterflood Securities.

Other high yielding trusts

There are also plenty of investment trusts operating in other parts of the market that pay a decent yield, with a good example being the £565m TwentyFour Income (LON:TFIF) fund, which has been recommended by Winterflood Securities.

| First seen in Master Investor Magazine

|

TFIF was launched in March 2013 and invests in European asset-backed securities. These pay attractive floating-rate coupons, which enables the fund to target a net total return of six to nine percent per annum, with quarterly dividends totalling at least six pence a year. This gives the shares a prospective yield of 5.5%.

Winterflood says that the fund has performed well since launch and has achieved its annual net asset value (NAV) total return and dividend targets. It has an experienced management team and has typically traded at a premium to NAV, although the shares are currently available on a small discount.

The analysts at Investec Securities have recently issued a buy note on the £118m Middlefield Canadian Income Trust (LON:MCT).This isa unique fund that gives investors exposure to a broadly diversified portfolio of North American equity income securities, with the main focus on Canada, where the minimum allocation is 60%. It pays an attractive yield of 5.1% and is available at an 11% discount to NAV.

Manager Dean Orrico believes that the Canadian economy is gradually becoming more diversified and less dependent on natural resources, but says that this is generally under-appreciated by international investors. To guard against the global economic slowdown, he has tilted the portfolio to being more defensive, with an emphasis on real estate, utilities and pipelines. Gearing has also been reduced.

Attractive alternatives

The analysts at Numis recommend the £1.4bn BioPharma Credit (LON:BPCR), which aims to generate sustainable income distributions from exposure to the life-sciences industry. It mainly invests in corporate and royalty debt securities secured by cash flows derived from sales of approved life-sciences products.

BPCR targets an annual dividend of seven cents per share and a net total return on NAV of eight to nine percent per annum in the medium term. The shares are currently yielding seven percent with equal quarterly dividends.

Some of the real estate investment trusts (REITs) are interesting at the moment as they are out of favour because of fears over Brexit. A good example is the £1.4bn BMO Commercial Property Trust (LON:BCPT), which is yielding five percent with equal monthly distributions. It has a 34% weighting in the struggling retail sector, but this is already reflected in the discount of 10 percent.

Another is Real Estate Investors (LON:RLE), a £101m Midlands-focused REIT that is yielding 6.5% and trading on a 20% discount to the latest published NAV.

The peer-to-peer sector has had a tough time of it with one fund after another running into difficulties, yet the £1.1bn Pollen Street Secured Lending (LON:PSSL), formerly known asP2P Global Investments,might be worth a look.

Its new manager is repositioning the legacy portfolio (now down to 10 percent of the assets) into more specialist and secured asset classes, which experience lower volatility and a better ratio of income to expected credit losses. At the end of June, two-thirds of the fund had been moved into property-backed and structured loans where the originator has first loss equity.

PSSL has been recommended by the analysts at Investec Securities, who think that the current discount of 14% would narrow in the event of an improvement in the underlying performance. They also say that any such pickup should ultimately enable the fund to increase its quarterly dividend from 12p to 15p, which would give the shares a future prospective yield of 7.2% on the current share price.

Even though interest rates are likely to stay lower for longer, it is still possible to put together a diversified portfolio of funds and investment trusts that will generate a decent level of income. The key is to do what you can to make sure that the distributions are sustainable and don’t get drawn into the higher yields if you are not comfortable with the risk to your capital.

FUND OF THE MONTH

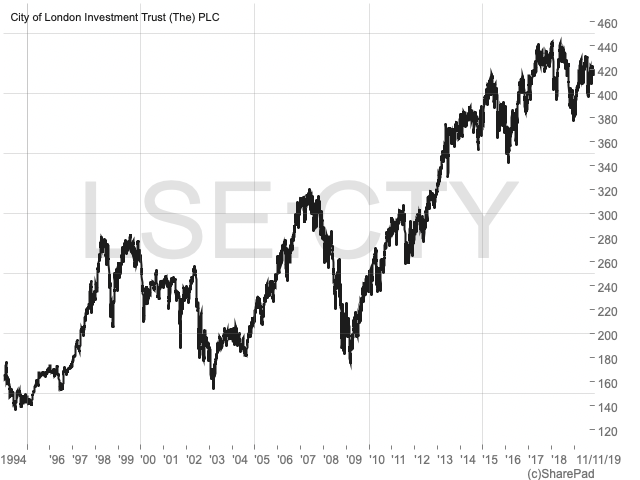

The £1.7bn City of London Investment Trust (LON:CTY) is yielding an attractive 4.5% and has built up revenue reserves that are equivalent to about 10 months of the annual dividend. It has been managed by Job Curtis since 1991, during which time the NAV total return is 1,100% versus a FTSE All-Share total return of 828%.

Portfolio construction is based on a valuation-focused stock-selection process, although the manager also takes into account macroeconomic factors. He has a conservative approach and aims to identify companies that can generate cash to support dividends and capital expenditure, but that also have strong balance sheets and can offer a margin of safety.

CTY has now increased its dividend every year for the last 53 years and has extremely competitive fees with ongoing charges of just 0.39%.The analysts at Investec Securities have recently issued a buy note on the fund and say that it has justifiably established itself as a core holding for investors.

Mr Hughes also likes it and says that it is a good option for those with a more defensive mindset: “City of London currently yields 4.5% from a portfolio predominantly made up of high-quality UK equities and has a remarkable 53 years of consecutive dividend increases. While higher yielding trusts are available, this one benefits from long-term management and a real commitment to income.”

Never miss an issue of Master Investor Magazine –

Never miss an issue of Master Investor Magazine –

Comments (0)