The Best Real Estate Investment Trusts

Last year was a challenging one for Real Estate Investment Trusts, with rising interest rates and the prospect of a recession casting a shadow over the whole sector. The average discount to NAV is now around 28% and the average annual yield is over six percent, which suggests that much of the downside risk has been priced in.

Many areas of the commercial property market experienced significant falls in their capital values during the second half of last year. This was a direct result of the sharp increase in interest rates, with prices moving lower to establish a new acceptable risk premium.

Falling valuations and rising debt costs have meant that the balance sheets have come under closer scrutiny. However, a number of Real Estate Investment Trusts (REITs) have hedged their interest rate exposure to protect against further increases, while most have a high proportion of fixed rate debt and significant loan-to-value headroom.

There are some really tempting discounts on offer with figures of 30% or 40% quite common across the various property sub-sectors. Yields of five to ten percent are typical, with the high income able to offset further potential capital losses.

Despite the poor sentiment, occupancy levels are still high with many lessees looking beyond the near-term uncertainty. It is also worth noting that the inflationary pressures have eroded the profitability of potential new developments and with little supply coming on-stream, sub-sectors such as industrial and logistics are experiencing low vacancy rates and attractive prospects for rental growth.

The broker Numis believes that the sector as a whole offers opportunities for those who are willing to ride out the prospect of further near term share price volatility. They say that in many cases the potential capital downside is already priced in via the discounts and that investors are being compensated for the risk through an attractive income return.

What role can REITs play in a portfolio?

Commercial property has proven to be an attractive long-term option, offering diversification away from both equities and fixed interest. The main issue has been how to gain access to what is essentially an illiquid asset class in a tradeable form.

Ryan Hughes, head of active portfolios at AJ Bell, says that the REITs market has developed over the last few years and now offers a wide range of broad based and specialist vehicles, enabling investors to be able to fine tune their property exposure.

“Today, areas such as healthcare, supermarkets, warehouses and logistics all have their own options, giving investors more choice and enabling them to avoid parts of the property market that may be unappealing.”

Darius McDermott, MD of Chelsea Financial Services, says that REITs pay out a minimum of 90% of the income they collect so they are useful for those seeking income. “Also, as with property generally, it is a diversifier from equities and bonds.”

In the short-term, REITs tend to correlate with equities, but they offer significant diversification benefits over the medium to long-term. They are of particular interest to income seekers as they tend to offer a good yield pickup over investment grade bonds and most equities, although the combination of income and rental growth can be attractive to all investors.

“Rents are often explicitly linked to inflation, so there is something of a hedge built into the asset class. However, this has been undermined over the past year by the very rapid increase in inflation and interest rates, which has suppressed the value of all assets,” notes Rob Morgan, spokesperson and chief analyst at Charles Stanley.

A poor 2022 has thrown up some bargains

Most REITs operate in specialist sub-sectors such as care homes, social housing, GP surgeries, supermarkets and warehousing. For many of these areas the key to the performance is supply and demand, although the quality of the tenants and the lengths of the leases are also important, as is the nature of the rent revisions and whether they are linked to inflation.

“It has basically been the cost of capital (interest rate rises) and the relative value to gilt yields which has caused the big sell-off in most REITs. Prior to this they had been very attractive, yielding four to seven percent when gilts were yielding 0.5%, but as gilt yields rose sharply the REITs sold-off,” explains McDermott.

Another relevant factor is that property tends to do badly in a recession, which is widely predicted for the UK. This would bring an increased risk of bankruptcies, CVAs and voids among the underlying tenants, potentially disrupting the flow of income.

“REITs are particularly affected by rising interest rate expectations as they are constructed from long duration assets that pay a steady return, so there is a loose relationship with the bond market, which had a terrible 2022. The ill-fated Kwasi Kwarteng mini budget proved to be an especially detrimental turning point for most UK property investments as gilt yields spiked sharply higher,” says Morgan.

The negative sentiment has been further affected by the gearing (borrowing to invest), which carries additional risk in times of uncertainty. Generally it is the residential and social housing trusts that are the most highly geared and these tend to be trading on some of the biggest discounts as a result.

“There’s also been the issue of rising debt costs, something that some trusts are well insulated from as borrowing is fixed for a decade or more, but an expensive headache for others, either because they are heavily weighted towards floating rate debt or because large refinancing requirements came at an unfortunate time,” adds Morgan.

It’s not uncommon for REITs to have gearing of up to 60%, which means that the servicing costs will have risen sharply on the back of much higher interest rates. The expected future returns are therefore much lower, as more of the capital will be required to finance the borrowing costs.

Value versus value traps

When investing in property, the vast majority of the return is likely to come from rental income and the growth in this rather than from large increases in capital values. This should mean that areas that offer greater certainty of yield would be the most appealing, especially if the rent is underpinned by government or has built in escalators to keep pace with inflation.

“Given the liquid nature of REITs and the time lag between valuations on the physical properties, it’s not unusual for these types of investments to move to a discount in times of stress. After all, that is effectively the trade-off for liquidity, in that investors can sell their property exposure, but not necessarily at the full price of the underlying properties,” explains Hughes.

Wide discounts can be enticing, but it is important to understand whether they offer value that can be exploited or a trap to avoid. There are a number of factors to take into account when identifying the one from the other, including: the quality of tenant, the length of the leases and whether they are linked to inflation.

Mick Gilligan, head of managed portfolio services at Killik and Co, says that the sub-sector he likes most is logistics. “Demand is still exceeding supply, particularly for last mile deliveries around major conurbations.”

He thinks that the value traps are more REIT specific than across sub-sectors and says that he would be very wary of REITs with high levels of leverage. “The residential and social housing trusts are the most highly geared of the different sectors.”

A mixed picture

McDermott points out that some areas are very much out of favour, such as warehousing and social care, but says that they trade on large discounts.

“That said, we are very careful when buying new REITs in the current market. We do however like care homes, as the demand outweighs the supply, also GP surgeries, where some of them have their rent guaranteed by the government.”

Morgan says that there are some parts of the market where the outlook is especially challenged, such as retail and offices, though the discounts on those vehicles with significant exposure typically compensates investors.

“The low values and high income on offer reflect the uncertainty as to the trajectory of rents and the capital expenditure necessary to convert properties to alternative uses where necessary.”

Generic retail continues to look challenged as more and more commerce moves online. Many of the prime tenants now hold the negotiating cards with landlords who are desperate not to lose them and because of this they are able to squeeze rents lower, hitting the capital values.

If you want to invest in commercial property the most important thing is to build a resilient exposure through balance and diversification. A basket of REITs spread across various areas and sectors should generate a more reliable overall income stream.

Recommendations

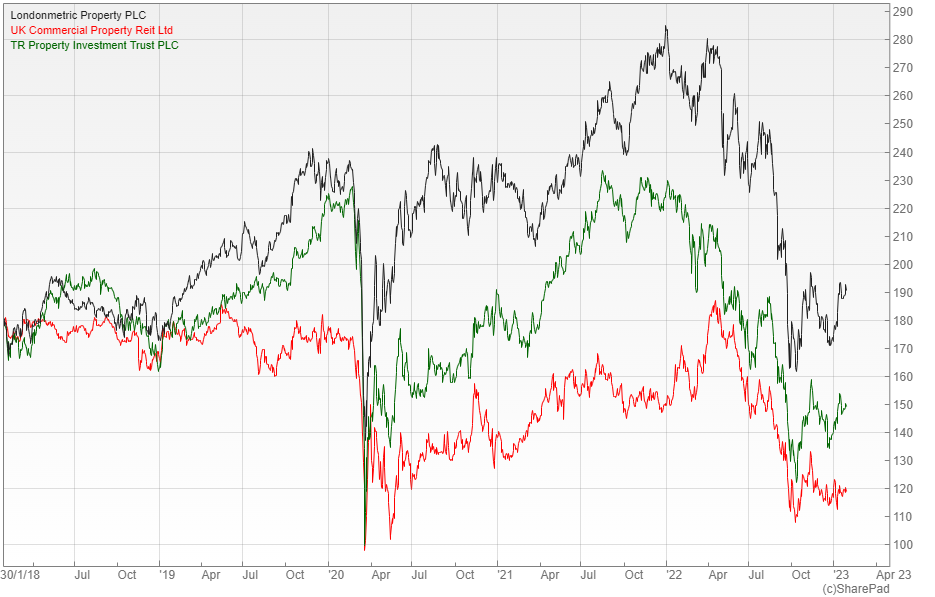

When it comes to the selections, Gilligan likes London Metric Properties (LON: LMP), which has good exposure to last mile logistics. He says that the company has a broad portfolio of tenants and most of the rents have indexation clauses, while the leverage is relatively low with gross gearing of less than 35%.

He also recommends UK Commercial Property (LON: UKCM), which he believes looks attractive when you take into account the leverage, discount, yield and quality of the portfolio.

“Almost two thirds of the UKCM portfolio is in logistics and industrial assets. While valuations in these areas have been hit hard, they still look very attractive in terms of supply and demand. The portfolio boasts some high-quality tenants such as Ocado, Amazon and the UK Government.”

McDermott says that his favoured option is the diversified property REIT, TR Property (LON: TRY). “The trust is run by one of the most experienced and top performing managers in the sector, Marcus Phayre-Mudge. His long-term track record is very strong and it offers good diversification across the UK and Europe.”

Morgan is also a fan and points out that it mainly invests in other REITs and property companies across Europe, rather than the actual bricks and mortar.

“It offers a high quality, diverse exposure to the asset class with a bias towards logistics, healthcare and residential. The trust has outperformed over the long-term but is down 33% over one year. It is on a nine percent discount to NAV and with 95% of the underlying REITs on a significant discount to their own NAVs that means a ‘double discount’ opportunity as well as a 4.5% yield.”

Other specialist options

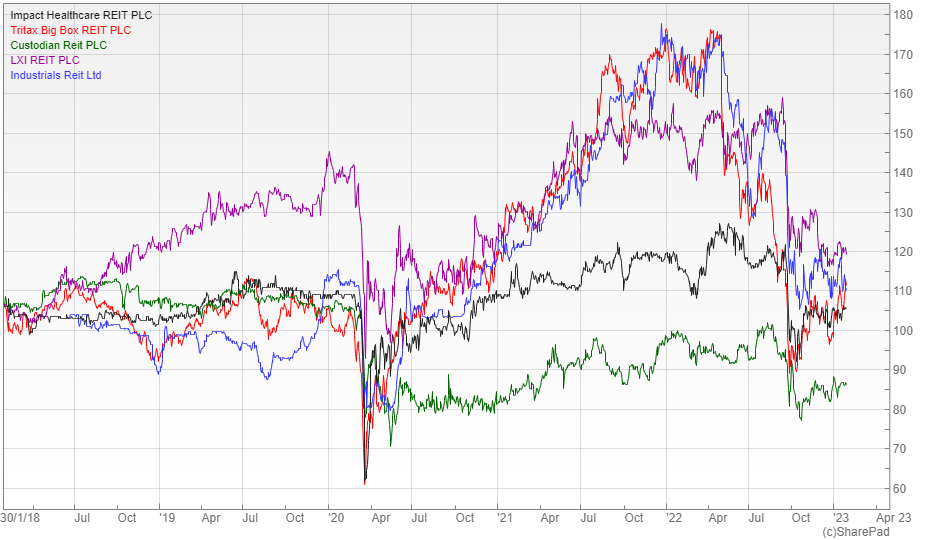

A more specialist option suggested by McDermott is Impact Healthcare (LON: IHR),which benefits from strong proven management in the care home sector with the team behind it having a decent amount of money invested alongside shareholders.

Morgan prefers Tritax Big Box (LON: BBOX) that is focused on large scale logistics real estate. It has dozens of renters across the 60-asset portfolio with the biggest tenant in terms of income being Amazon.

“The current evidence is that demand for these types of assets remains strong as they are mission critical for the large companies that use them. A UK recession would likely hamper rental growth and capital values, but a near 35% discount to NAV looks excessive and there is a decent 4.2% yield.”

The broker Numis has three core recommendations in the sector starting with Custodian Property Income (LON: CREI), which is a diversified offering that generates a consistent income by focusing on small lots. It is yielding 5.6% and trading on a discount of 17%.

Their second suggestion is the LXI REIT (LON: LXI) that benefits from an experienced management team and whose income has a high degree of inflation linkage from a diversified portfolio of key operating assets. The trust is currently yielding five percent with the shares available on a 19% discount.

Finally there is the Industrials REIT (LON: MLI), which they describe as best-in-class management and offering a bespoke platform that is revolutionising the multi-let sector. It is paying a 5.4% yield and available on a 19% discount.

Comments (0)