The best Real Estate Investment Trusts for 2022

Last year was a good one for Real Estate Investment Trusts (REITs) with the sector outperforming the FTSE All-Share index by around 11% and it looks like there could be further strong returns in 2022.

Numis have just released their forecast for the REIT sector this year in which they say that it is reasonable to expect high single digit or even double digit gains in many instances. If inflation continues to be a feature as seems likely, then these closed-ended property funds are capable of producing strong real returns.

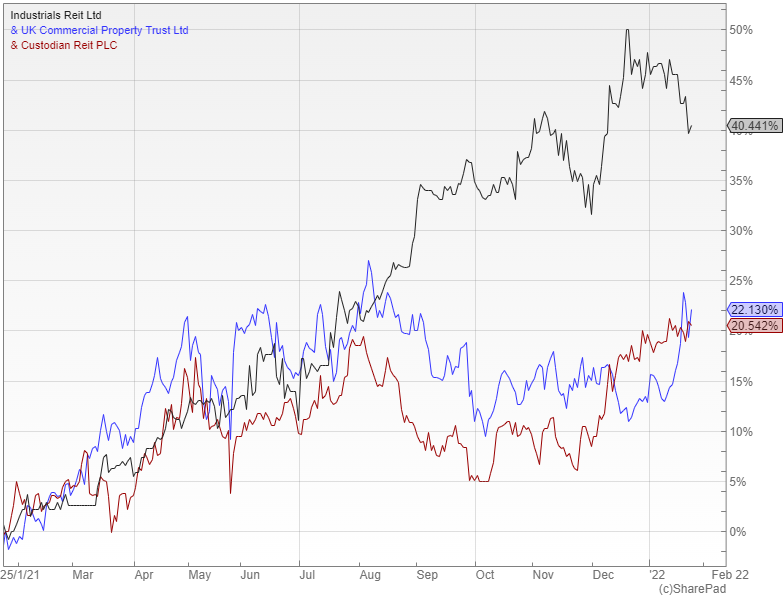

The broker is especially bullish on the industrials sub-sector with their key pick being the Industrials REIT (LON: MLI). This has now completed its transition to a pure-play UK multi-let business with the management forecasting 10% annual returns for the foreseeable future split between a five percent running yield and five percent rental growth.

MLI has huge potential as the management estimate that rents will need to rise by around 50% before new supply becomes economical. E-commerce that depends on these types of properties continues to grow and Numis expect to see headlines this year about warehouse space ‘running out’ in the UK, at which point occupiers will be vulnerable to steeper rent-rises.

Diversified opportunities

The rise of the specialist sub-sectors has meant that the diversified REITs that invest across different types of properties have fallen out of favour, yet Numis suggest that both UK Commercial Property (LON: UKCM) and the Custodian REIT (LON: CREI) should do well this year. UKCM is mainly a value play as its shares are trading on a double digit discount to NAV with dividend increases in the pipeline.

Custodian REIT is differentiated from its peers through a deliberate focus on small-lots in the two to ten million pound bracket, which earn a yield more than one percent higher than larger buildings that have more capital chasing them. The fund offers a fully covered income of 5.2% that is around one percent higher than you can get elsewhere in the sector despite the conservative 21% loan to value ratio.

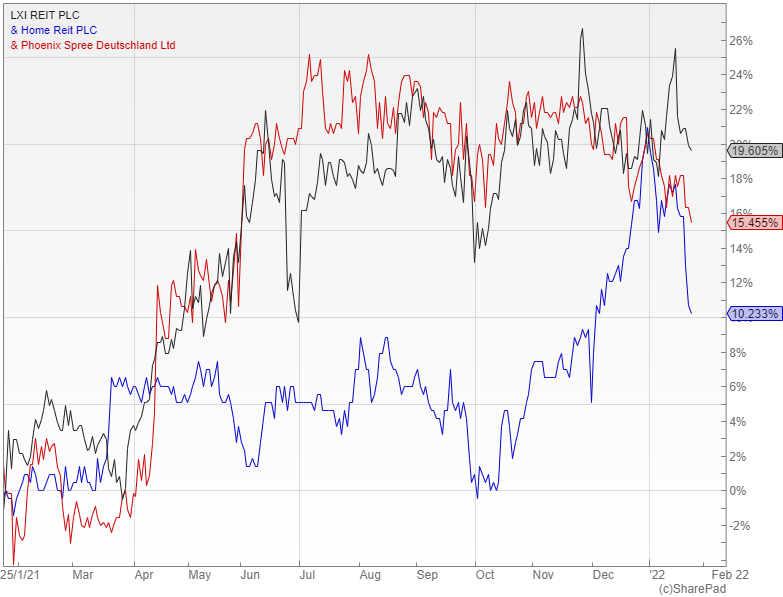

Numis rate the LXI REIT (LON: LXI) as a core holding in view of its long-dated inflation-linked leases and impressive track record, having generated an average NAV total return of around 11% per annum since its IPO in 2017. The management have built a diversified long-income portfolio and have proved adept at uncovering interesting assets and sectors.

No place like home

In the residential sector they like the Home REIT (LON: HOME), which offers long-lease, inflation-linked returns with pseudo government-backing and strong ESG credentials. The fund launched in October 2020 and owns a portfolio of properties that are let to charities that house homeless people with the rent funded by local authorities from a segregated budget.

Their final pick is Phoenix Spree Deutschland (LON: PSDL) that invests in Berlin apartments, which Numis describe as ‘arguably the best value opportunity in the UK listed property market’. The population of Berlin is growing and although rent rises are still controlled to a degree it is uneconomical to build new flats, so with vacancy rates almost non-existent it means the supply/demand imbalance is putting continual upwards pressure on rents.

PSDL shares are effectively available on a ‘triple discount’; as they trade 18% below their latest NAV, which does not reflect the fact that the portfolio is 70% split into condominiums that are fetching a 15% to 20% uplift on book value upon sale, while Berlin valuations are cheap relative to other European capitals. Unfortunately the yield as it stands now is just under two percent.

Comments (0)