The best funds to invest in Russia

For many investors Russia has something of a pariah status thanks to president Putin’s hard-line stance against the West, but the valuations have declined to such an extent that it could be worth a closer look. If the global reflation trade continues and the oil price holds on to its gains the local stock market could be due for a major re-rating.

Russia is the world’s largest energy exporter, which makes it a key beneficiary of the reopening and reflation trade. Its economy is expected to return to growth this year, yet the country is home to the cheapest major global equity market in the world.

One of the best ways to assess whether a market is over- or under-valued is to use the cyclically adjusted price-to-earnings (CAPE) ratio, a metric developed by Robert Shiller, professor of economics at Yale University.

It is calculated by taking the current index price and dividing it by the average of the last ten years of earnings after adjusting for inflation. This gives you the current market multiple based on the average earnings over the latest business cycle.

Shiller demonstrated using 130 years of back-tested data that the 20-year returns are strongly inversely correlated with the CAPE ratio at the point of purchase. In other words, whenever the CAPE ratio is high, it means stocks are overvalued and the subsequent performance will probably be poor.

The reverse is also true, so if the ratio is low, it means that stocks are undervalued and returns over the next 20 years will likely be good. This is what you would expect, as when stocks are cheap they can increase in price both from improving corporate earnings and from moving to a higher earnings multiple.

Many developed and emerging markets look expensive based on the current CAPE ratios, especially the S&P 500 in the US, whereas Russia stands out as one of the cheapest places in the world.

Rob Morgan, an investment analyst at Charles Stanley, says that the forward P/E ratio for the Russian market is around 7.5 times earnings, about half that of broader emerging markets, so there is room for a positive rerating if the political outlook was to improve.

“In the meantime there are some very large dividends on offer. The market yields a remarkable six percent and some stocks pay 10% plus and are increasing pay-outs. Despite valuations at practically distressed levels, Russia looks likely to have a decent short-term outlook boosted by strong commodity prices, low interest rates and a surge in business activity.”

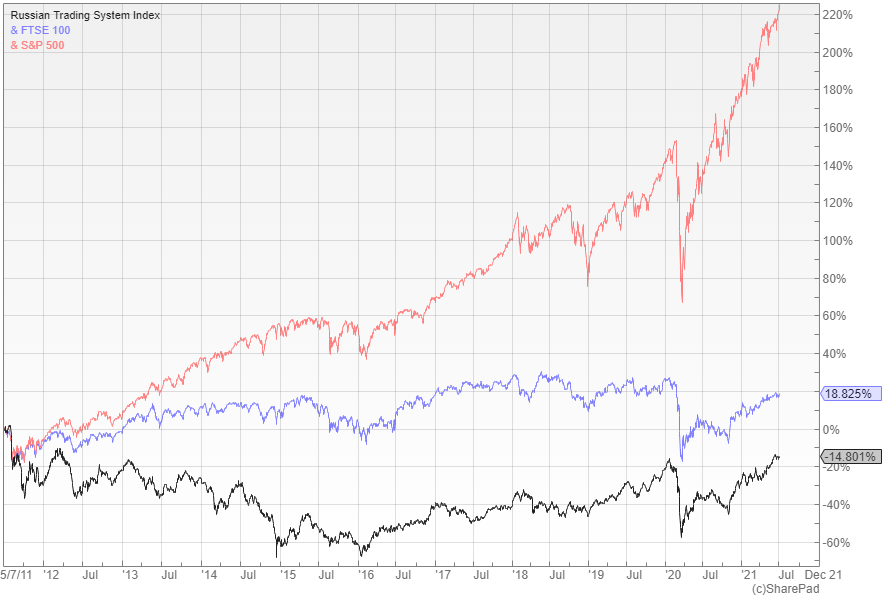

Looking back over the last 10 years the S&P 500 is up 225%, whereas the Russian Trading System index (RTS) is down 15%. The latter is much more closely correlated to the FTSE 100 because of the large energy and mining exposure, but even though the UK has struggled it has still outperformed Russia with a gain of 19%.

Cheap as chips

Russia was among the worst performing markets in 2020 with the RTS index finishing the year down 10%. For overseas investors the decline was exacerbated by the weakness in the rouble that posted the fourth-biggest loss across emerging market currencies in the calendar year.

Darius McDermott, MD of Chelsea Financial Services, warns that the Russian market is cheap for a reason.

“There is large political risk and the potential for sanctions. The threat of black swan events such as the annexation of Crimea is very high and could lead to stock market shocks, making it difficult to assess the investment characteristics. There are a couple of good companies though, such as Sberbank, which taps into the growing need for financial products in the country.”

The energy-dependent economy was badly affected by the slump in the oil price during the pandemic, with the US and EU sanctions also taking their toll. A tougher stance under Joe Biden’s administration remains a threat, but there are reasonable grounds for optimism.

As the global economy recovers from the coronavirus there is a strong argument for a cyclical rebound that should support the rally in oil and other commodity prices. The higher-than-average dividend yield should also help to attract more capital into the country.

“There is a fast emerging consumer sector and a tech giant Yandex so Russia is more than just oil and gas, although the fate of much of economy is still very much predicated on fossil fuels and mining,” explains Morgan. “The problem is that the market could stay cheap as it will remain off limits to a large number of investors who rule it out on ESG grounds or for the risk of an escalation of political sanctions.”

The Russian central bank recently increased interest rates to 5.5% and said that further hikes may be needed to tackle inflation, which hit a five year high of 6% in May. If left unchecked the rising prices could threaten the country’s economic recovery.

Manageable debt levels

The World Bank reports that Russian GDP fell by 3% in 2020, but it is forecast to grow by four percent in 2021 and then to slow to 3.8% in 2022. Employment is still below pre-pandemic levels, although the labour market began to show signs of improvement towards the end of last year.

Russia’s debt to GDP ratio is currently around 32%, whereas in the UK and US it is up at about the 100% level. The country’s 10-year sovereign bonds are yielding just over 7%, which is significantly higher than in the West, but the debt levels are much more manageable.

Ben Yearsley, a director at Shore Financial Planning, points out that the hit to GDP was low compared to many developed market countries last year and although vaccination rates aren’t great they do at least have access to their own working vaccine.

“The economy isn’t overloaded with debt, nor are companies. Valuations are good, compared to virtually every other developed and emerging market and there is a thriving private sector that operates in an almost closed shop environment giving companies the opportunity to make excess returns.”

The vaccination rate in Russia is relatively low, but the limited lockdowns have meant resumption to normal activity has been ongoing. There is a good chance that earnings and dividends will recover and the cost of capital for Russian stocks could fall.

Morgan says that Russian equities are under-owned by foreign investors because of the European and US sanctions imposed on companies and officials in the country, so its prospects partly depend on what degree a ‘political discount’ is applied.

“This is arguably still pretty high after accusations of Russia meddling in the US election campaign in 2016 and the poisoning of Yulia and Sergei Skripal in Salisbury; but if Russia was to dial back its interference in foreign affairs and this led to a relaxation of sanctions, it could ignite what is a very cheap market,” says Morgan.

Single country funds and trusts

Even if you are bullish about the prospects it is important to only allocate a small amount of your portfolio to the country as the risks are extremely high, especially politically. The economy is heavily dependent on oil and gas prices, which could hurt market sentiment, there are also relatively few high-quality companies.

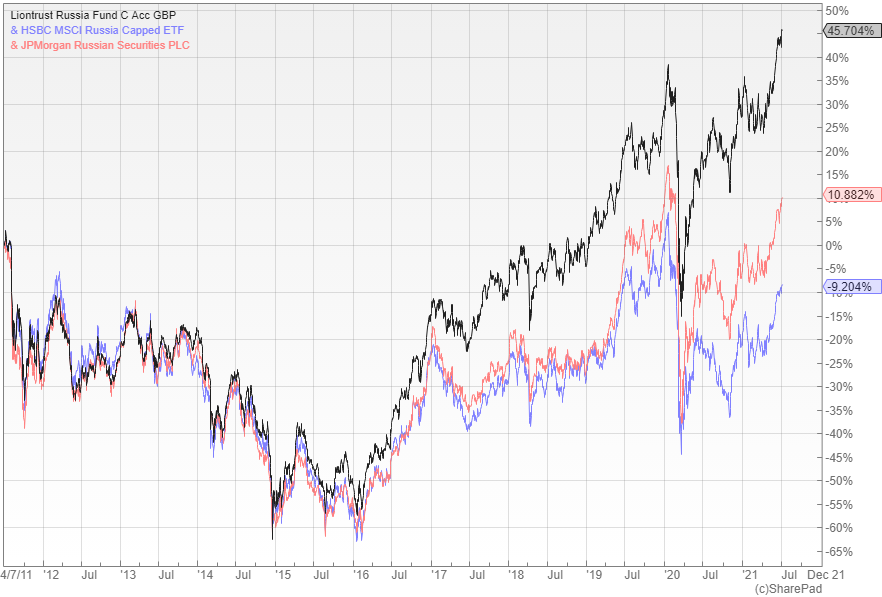

McDermott says that the Russian stock market is quite small, so it is difficult to differentiate yourself as an active manager in the region. He does however single out Liontrust Russia, which has done well for investors in the past.

The manager, Tom Smith, has been in place since 2013 and he has put together a concentrated 21 stock portfolio that is currently yielding 4%. Over the last five years it has returned 118.5% versus 92.2% by its MSCI Russia benchmark.

Yearsley also likes Liontrust Russia, which is one of the longest standing single country Russian funds. Alternatively he suggests the JPMorgan Russian Securities investment trust (LON:JRS) that focuses on companies with low leverage (see fund of the month below).

Morgan is sceptical about having a single country fund exposure as there is such a high level of concentration in the top 10 holdings, but for those who are comfortable with the risk he suggests the HSBC MSCI Russia Capped UCITS ETF. It has an operating charges figure of about 0.5%, a competitive bid/offer spread and is a decent size.

There is a reasonable argument for using a cheap ETF in Russia as the managed funds typically have very low active shares and don’t differ that much from the index. This is because the main benchmark is heavily weighted towards a few very large companies.

Over the last 10 years, Liontrust Russia has considerably outpaced JPMorgan Russian Securities and the HSBC MSCI Russia Capped ETF with a cumulative return of 46% versus a gain of 11% and a loss of nine percent respectively, although the relative performance differs depending on the period you look at.

“The stock market is cheap and gives you access to many commodity-related industries, which can be useful in the current inflationary environment,” points out McDermott. “The population is enormous and patriotic, so the domestic market can be lucrative.”

Regional EM funds with a high allocation to Russia

Russia only makes up about 3% of the MSCI EM index, but there are a handful of global emerging markets funds with a decent allocation to the country. These offer a more diversified way to benefit without running the full risk of a single country fund.

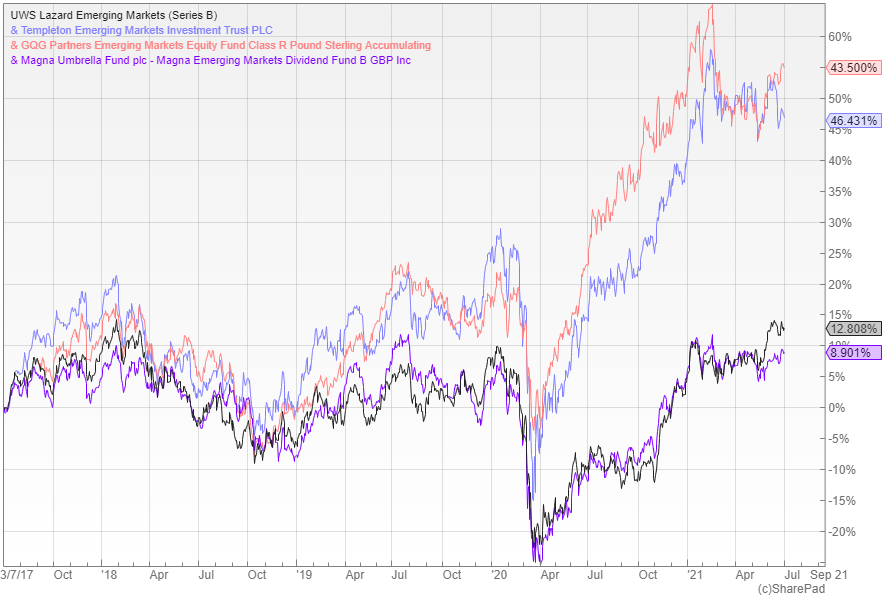

“Lazard Emerging Markets is overweight Russia with significant positions in Lukoil and Sberbank. I like the disciplined, value-focused approach applied by James Donald’s long-serving team and the fact that ESG factors are fully integrated within the process and have a material impact on stock selection and portfolio construction,” says Morgan.

Yearsley is also a fan and points out that the Lazard fund has a 10% stake in Russia, which is perhaps not that surprising given that it is an unashamedly value-based fund that seeks relative value.

Another option suggested by Morgan is the Templeton Emerging Market investment trust (LON:TEM), which has a significant allocation to Russia at about 8%. It is a good choice for a broad emerging market exposure as it is well-diversified by country and sector with 70-100 holdings.

“We would much prefer a global emerging markets fund over a specific Russia fund if we wanted to get exposure. This is because of the volatility involved and our belief that the country is more of a trade than a long-term allocation,”explains McDermott.

He says that an active EM manager would be well-placed to deal with these issues and find the best names in the index and balance them for risk alongside other countries with different macro drivers.

“We like GQG Partners Emerging Markets Equity, which is run by specialist EM investors and has an 11% allocation to Russia. We also favour Magna Emerging Markets Dividend, which also has 11% in Russian companies and captures the income opportunity from a few of the higher quality firms in the country,” adds McDermott.

Over the last four years the GQG and Templeton funds have been highly correlated and returned around 45%, whereas the Lazard and Magna options have lagged behind with gains of 13% and nine percent respectively.

The Russian stock market looks cheap relative to its peers and is well-placed to benefit from the global economic recovery due to its high dependency on oil and other commodity prices. Investors who are comfortable with the volatility may want to allocate a small part of their portfolio to the country, although there is no getting away from the political risk associated with President Putin.

Fund of the month

The £345m JPMorgan Russian Securities (LON:JRS) benefits from a highly experienced manager, Oleg Biryulyov, who has been in place since 2002. He uses a bottom-up approach and focuses on making long-term investments in best-in-class companies with robust corporate governance and strong balance sheets.

JRS has a concentrated portfolio, with Gazprom, which is benefiting from increased demand for gas in Europe and Sberbank, the dominant player in the Russian banking sector, being the largest holdings. It is not a closet tracker though as it is significantly underweight in Yandex, another major stock in the market, on valuation grounds.

Biryulyov has recently added to his cyclical exposure to benefit from the economic recovery. As a result, the energy and materials weighting is much higher than at the start of the financial year and represents the majority of the fund along with financials.

The 10-year returns have marginally outperformed the RTS benchmark, with the shares currently available on a 12% discount and paying an attractive yield of 4.2%. There is an active share buyback programme and other discount controls to help protect investors if demand was to weaken.

Comments (0)