The best British trusts and funds

The UK stock market has been out of favour for years and looks cheap relative to many of its overseas peers. If the rotation from value to growth gains traction it could lead to an improvement in performance and tempt more international investors to close their underweight positions.

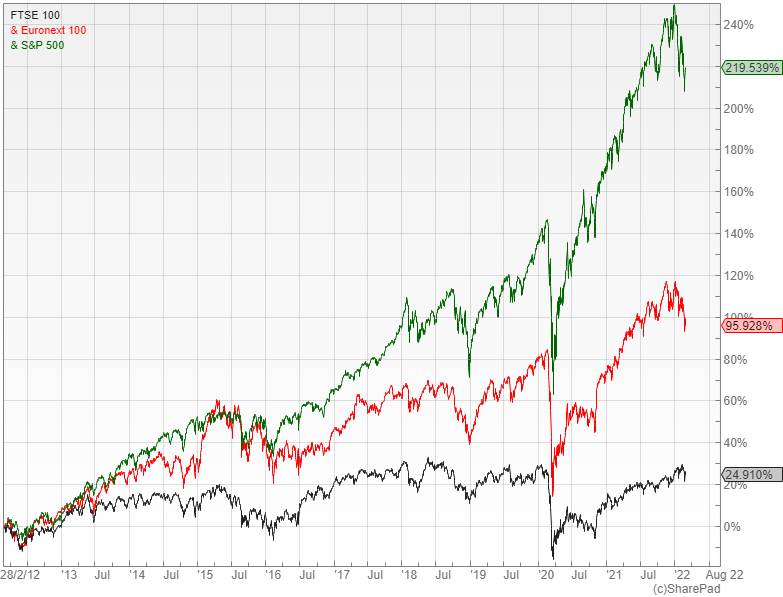

It has been a hard decade for those with money in the UK who have seen their returns lag well behind the other major markets. Over the last 10 years the FTSE 100 has increased just 25% compared to the 96% gain by the Euronext 100 and 220% from the S&P 500.

Rob Morgan, spokesperson and chief analyst at Charles Stanley, says that the main reason for this is the huge structural disadvantage of the UK market in terms of its sector weightings.

“Quantitative easing and negative real interest rates in the 13 years since the global financial crisis has not favoured banks − the biggest sector at 20.2% of the FTSE 100 in 2007 − and the rise and subsequent bursting of the commodities super-cycle was terrible for miners, another significant sector, while the start of the pandemic impeded energy firms.”

The biggest beneficiary of low global interest rates has been large tech, yet these stocks only make up a small part of the UK market, whereas they dominate the US and have resulted in the massive outperformance of the NASDAQ and S&P 500.

There have also been numerous other bumps in the road along the way for the FTSE, including the uncertainty around Brexit, which has dogged the performance since the June 2016 referendum.

Cheap as chips

Mick Gilligan, portfolio manager at Killik & Co, says that the FTSE All-Share index currently trades at 1.8x price/book versus 3.1x for MSCI World and 4.5x for the S&P 500. It is on a forward PE ratio of 11.3x compared to 15.5x and 16.7x for the other markets respectively.

Another good indication that the market is cheap is that takeovers of British companies have hit the highest level since 2007, led by the supermarket Morrisons and aerospace business Meggitt, both of which were the subject to multi-billion-pound bids. The total value of deals in 2021 according to Refinitiv was $630.8bn and involved 6,926 UK companies.

This same level of confidence can also be seen in the IPO market as 2021 was a bumper year for flotations. A total of 122 companies listed on the main market last year, attracting £16.8bn, making London the biggest single source of capital outside the US and China.

Darius McDermott, MD of Chelsea Financial Services, says that towards the end of last year UK equities were trading on about a 40% discount to global peers, a 30-year low, although after the recent sharp underperformance of the US, Europe and China it is no longer as cheap as it was.

“One thing to bear in mind though is that the quality of UK companies is generally poorer at the large and mega cap end of the spectrum than their global peers. The mid and small cap space are different and generally have better growth and quality characteristics.”

Will the UK stock market be positively re-rated?

The UK has been unloved for a long time through a combination of the underperformance of value stocks, Brexit and the pandemic, all of which have made it easy for global investors to ignore.

It is widely seen as a graveyard of old fashioned companies: obsolete oil majors, polluting miners, staid banks and legacy telecoms, yet the UK is cheap relative to other markets and value stocks are trading close to the greatest ever discount to growth stocks.

“I expect to see a further improvement in the UK market’s rating,” says Gilligan. “I think further increases in commodity prices, particularly oil should help drive a positive re-rating and higher interest rates should help financials, which account for 18% of the UK market.”

Ryan Hughes, head of active portfolios at AJ Bell, says that the Brexit agreement with the EU at the end of 2020 started to put the UK back on the radar for global investors and interest seemed to pick up through 2021 as expectations built that interest rate rises would have to come through.

“Global investors have been underweight value stocks for some time given the strength of the technology and growth bull market and this has left the UK looking attractive as an easy way of increasing value exposure and diversifying away from the expensive US market.”

So far in 2022 the UK has been one of only a handful of developed markets to hold up reasonably well, as its bias towards banks and energy companies has benefitted performance. If inflation proves to be more than transitory with interest rates rising, supply chains becoming more localised and globalisation receding, then the UK could sustain this outperformance, assuming the crisis in the Ukraine doesn’t de-rail everything.

McDermott says that the fact that the UK has started to outperform again may force international investors to sit up and take notice, as many are underweight the UK and it is a high dividend paying market.

“The global move to electrification should help our large, diversified miners. High oil and commodity prices are likely to benefit large parts of the UK market and higher interest rates could also help the banking sector.”

The main risks

The main risk of investing in the UK would be if inflation dies down and the pressure to raise interest rates eases off. This would result in a continuation of the easy money regime that we have seen for the past decade, which would tend to favour other markets, notably the US.

“It is also possible that many larger UK companies in areas such as oil & gas and banking will ultimately come under renewed pressure from challenging, disruptive trends such as the pivot to green energy and digital transformation,” warns Morgan.

Another point to bear in mind is that the UK is generally quite a cyclical market with a lot of exposure to commodities, oil and financials. A downturn in the global economy would probably hit it disproportionately hard with a prolonged economic war with Russia being a potential catalyst.

“The UK’s lack of tech exposure continues to be a major weakness,” cautions McDermott. “The lack of tech has been a strength year to date, but may harm the market over the coming decades in an increasingly digital world.”

If inflation results in higher wage demands then there could be a margin squeeze, with the areas most at risk likely to be the sub-sectors within consumer discretionary such as hospitality and retail. These are also the parts of the market – along with leisure and travel – that would be vulnerable to further disruption from Covid.

Given the relatively small size of the UK economy and the significant government debt that has ballooned during the pandemic, there is a risk to the domestic economy that could see growth falter as the weight of the debt holds the economy back.

“This could prove to be a headwind for the more domestically focused parts of the market with medium and smaller companies particularly exposed. However, many companies operating in this area have market leading positions in niche fields so being selective is important,” explains Hughes.

The best investment trusts

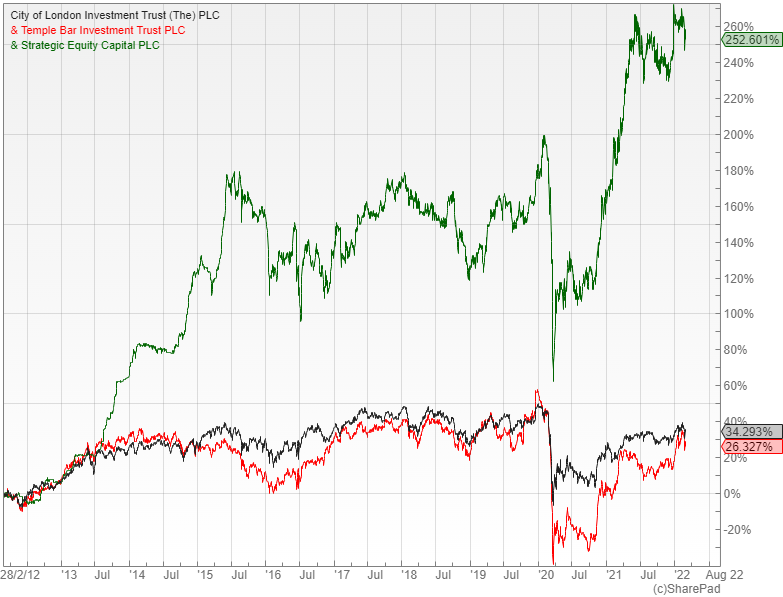

In order to take advantage of the possible re-rating of the UK stock market Gilligan suggests the City of London investment trust (LON: CTY), which has a well-diversified portfolio with good exposure to mining and financials.

“The trust has a value bias, so should prove more resilient than many peers in an equity market where highly rated stocks are under pressure. It has an excellent record of dividend growth and is currently yielding 4.7%”.

Alternatively he suggests Temple Bar (LON: TMPL) that has a strong value bias with large allocations to financials, oil & gas and mining. The new managers who were appointed in 2020 have good experience running this type of portfolio.

Hughes is also a fan and says that it has a low ongoing charges figure of 0.50% and an attractive yield of three percent that should grow after the managers reduced the pay-out when they took over responsibility for the mandate.

“As a contrarian fund, this trust should sit well in a portfolio that has exposure to growth, while giving exposure to the cheapest elements of the UK market.”

Another option is Strategic Equity Capital (LON: SEC), which is an unusual small-cap investment trust trading at a 13% discount to NAV.

“The managers use a private equity approach to invest in public markets. They have built a concentrated portfolio of stocks that typically have high margins, operating in niche areas where they have good pricing power. Its holdings tend to attract an above average level of takeover approaches,” explains Gilligan.

Value funds

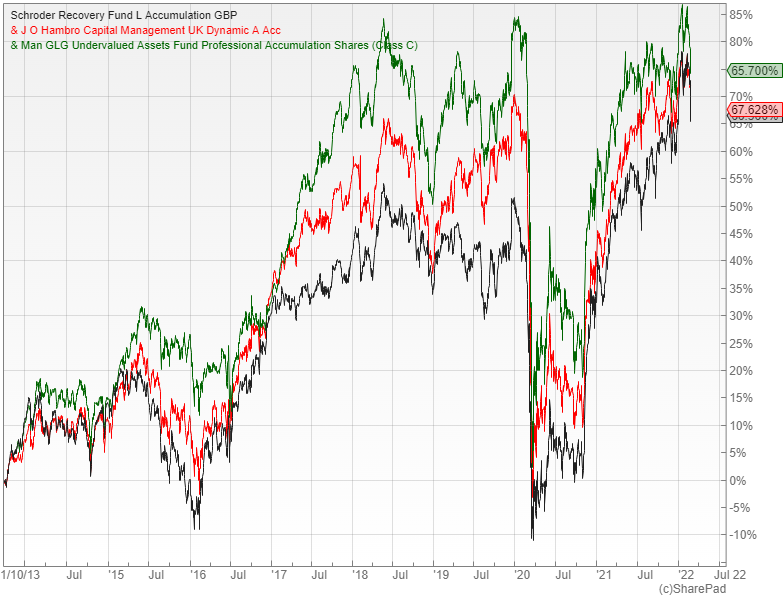

If inflation persists and interest rates have to rise to bring it back under control it would normally be value funds that would benefit the most, with a prime example being Schroder Recovery.

“It is a classic value fund that invests in cheap and unloved stocks, one of the few that have survived the last ten years during a very difficult period for this type of approach. The fund could be a big beneficiary if the tide has turned for real this time,” enthuses McDermott.

Another option he likes is JOHCM UK Dynamic, which he says has a value bias and a good manager. It has had a positive start to the year and is now recovering well after a difficult period at the outset of the pandemic.

Morgan prefers Man GLG Undervalued Assets that follows a disciplined approach to value investing with an emphasis on financial strength.

“By focusing more on the current shape of the balance sheet the managers target companies whose share prices they believe do not fully reflect their intrinsic value or those whose profit streams are undervalued. It is dynamically managed, with assets sold as they come to be priced at what the managers consider to be fair value and replaced with fresh ideas in cheap territory.”

UK equity income

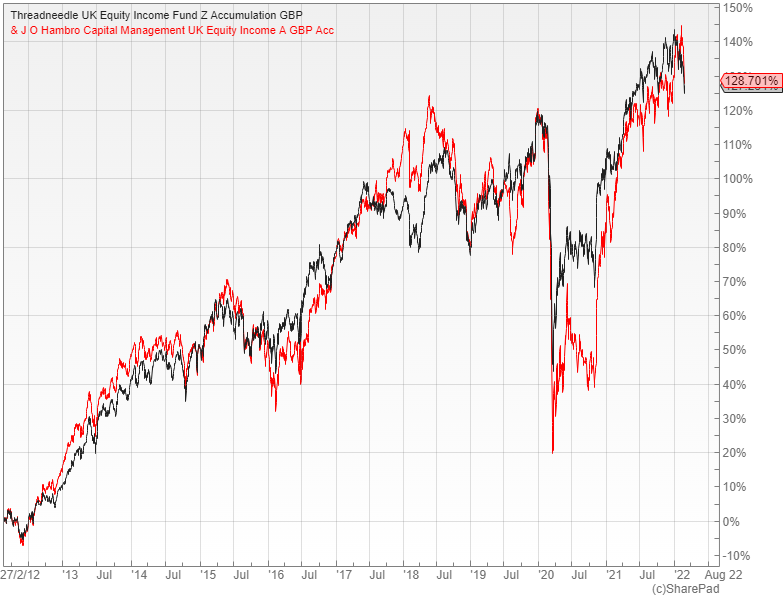

A similar type of exposure is available from the dividend-paying funds in the UK Equity Income sector where Hughes recommends Threadneedle UK Equity Income.

He says that manager Richard Colwell is a hugely experienced investor who likes to take a long term view, recognising that many investors misread short term news which creates long term opportunity.

“This fund is different to a lot of UK equity income funds in that it doesn’t own the big oil stocks and is significantly underweight banks, but it does have exposure to the attractive industrials space where some of the UK’s best companies reside. Big positions in AstraZeneca, Electrocomponents and 3i give the fund a growth and income feel and makes it suitable as a long term core holding.”

Alternatively Morgan suggests JOHCM UK Equity Income, which aims to achieve long term capital growth and to generate a dividend yield that is above the FTSE All-Share index average. It is currently yielding 3.9%.

“Managers Clive Beagles and James Lowen seek to invest in fundamentally strong companies at an attractive price, meaning growth opportunities as well as relatively high starting yields. We like the repeatability of their process, which is always forcing them to look where value exists in the market and their willingness to own both large and small companies to create a ‘best ideas’ fund that covers most of the market spectrum.”

Smaller companies funds

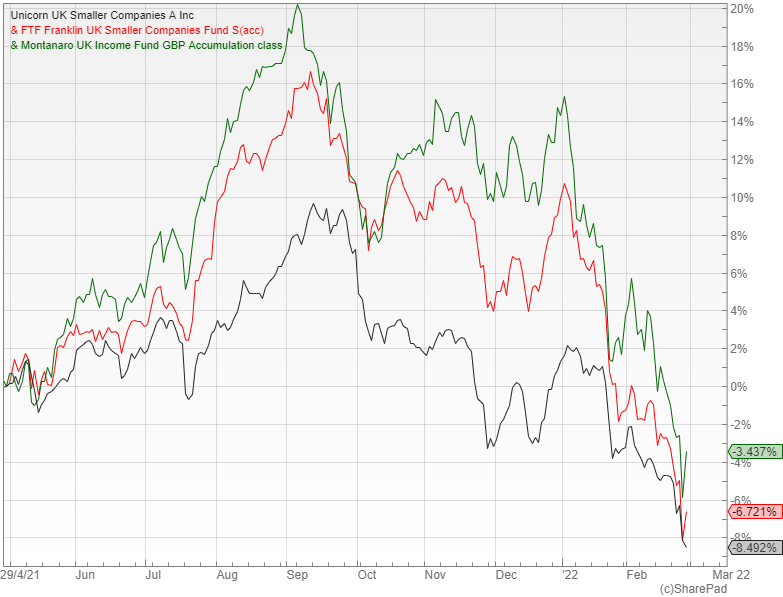

The small cap end of the market offers the potential for higher returns, albeit at an elevated level risk and can add an important element of diversification. There are plenty of funds operating in this area with McDermott singling out Unicorn UK Smaller Companies, which he describes as a small, flexible fund with a solid investment process and a highly competent team.

“We like the focus on company fundamentals and understanding businesses in detail. It is also quite concentrated, which allows it to capture the performance from its best ideas.”

Alternatively Morgan suggests FTF Franklin UK Smaller Companies that is managed in a pragmatic fashion and contains a good balance of smaller companies, from growth-oriented businesses to potentially under-appreciated value names.

“Its concentrated portfolio increases the impact of each holding on performance and can lead to meaningful sector-beating returns if the managers get their stock selection right. This fund has done a good job in capturing the growth and dynamism of the market, albeit with a more conservative valuation discipline than some of its peers,” he says.

Smaller companies and income seem like an unlikely combination, but the reality is that many small stocks in the UK pay attractive dividends because their founders still retain significant holdings.

“Small cap specialist Montanaro UK Income has a large team of smaller companies’ experts that focus on higher quality businesses that have low debt and are profitable. The result is a portfolio that yields over three percent, while still providing some attractive growth opportunities,” concludes Hughes.

Extremely helpful article as I look to reduce my exposure to tech growth stocks via SMT without bailing on this historically productive fund.