Star fund manager strikes cautious note

The Personal Assets Trust (LON:PAT) has just released its interim accounts for the six months to the end of October. It is one of the most cautiously positioned investment trusts on the market, yet has an excellent long-term track record, so it is well worth having a close look at the manager’s latest update.

Sebastian Lyon of Troy Asset Management has been running the fund since March 2009 with the aim of protecting and increasing (in that order) the value of shareholders’ funds per share over the long term. He also has skin in the game as he owns Personal Assets shares worth more than £3m.

Lyon’s Investment Advisor’s Report makes sobering reading:

“The past six months have seen remarkable financial extremes. UK interest rates have been cut by 0.25% to a 322-year low. 10-year UK gilt yields have reached an all-time low of 0.5%. Sterling’s effective exchange rate fell to a 168-year low (according to the Financial Times). Elsewhere, Japanese and German sovereign 10-year bond yields have turned negative as investors buy to lock in capital losses. All is not well with the financial world.”

“In the West there is rising political anger, epitomised by the outcome of the UK referendum in June. Now, Trump has trumped Brexit. But there remain plenty more invidious choices to be made by disgruntled electorates, including in Italy’s constitutional referendum in December and in the 2017 elections in France and Germany. We hold the view that political outcomes are likely to offer investors asymmetric risks, skewed to the downside.”

He points out that the FTSE 100 index has been range bound between 6000 and 7000 points for that last three and a half years – other than the occasional brief breakout – and says that this shows that investors have not been well rewarded for taking risk.

Lyon thinks that the weak pound will result in higher inflation in the UK as multinationals pass on higher import costs to consumers. He believes that the re-emergence of inflation will threaten the ‘stretched equity valuations’ as future profits will be worth less in real terms. Normally as we get near to the end of the economic cycle the central bank would cut interest rates to boost growth, but that is no longer an option, which suggests that a significant fall in the stock market is on the cards.

Safety first attitude

In their latest quarterly update the fund’s Executive Director, Robin Angus, acknowledged that in a world of inflation, Personal Assets would have to invest differently, but said that the time was not yet right to do this. He then explained their strategy for the current environment:

“The essential qualities for a successful defensive investment manager just now are patience and a high boredom threshold. Courage is also needed, to withstand accusations of being inert, too risk averse, lacking ideas and being idle.”

The current positioning of the fund revolves around a number of key points:

– “The first and most important thing is to hold on to what we’ve already got ― our ‘irreplaceable capital’ or ‘sacred savings’.”

– “Stay short. This is a time to be liquid and flexible. The long end of the conventional bond market is today’s entrance to Hell.”

– “Go for companies which are kind to their shareholders.”

– “Once again, remember and make use of the merits of cash. Returns on cash today are minimal or even negative, so at first glance cash seems unattractive. But it doesn’t carry the same capital risks as bonds. To be cautious today means going into cash, not bonds.”

Defensively positioned portfolio

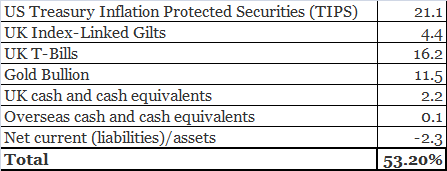

Lyon’s solution to all this is to maintain a high level of liquidity with just over half of the portfolio invested in ‘safe assets’:

% as at 31 October 2016

The rest of the fund is invested in a concentrated portfolio of high quality, defensive shares, most of which are listed in the US or UK. These include the likes of Philip Morris, British American Tobacco, Coca-Cola, Nestle, and Microsoft.

We have seen in the past that a portfolio like this will tend to lag behind in a strongly rising market, but will hold its value far better when share prices are falling. Over the last ten years and numerous market crashes the Personal Assets Trust has returned 76% compared to a 65% return from the FTSE All-Share.

There are thousands of funds available to private investors, but it is very rare to find one with this sort of safety first mandate and a manager and Board that is prepared to back it to the hilt. If you agree with Lyon’s cautious outlook then the Personal Assets Trust would be well worth considering as a core portfolio holding.

Comments (0)