Shock Horror: Baillie Gifford Trust Outperforms

It has been a tough time for investors in Baillie Gifford with the growth-oriented fund management group suffering poor returns right across the board after an extended period of fantastic performance. The change in fortune is largely a result of the sharp increase in interest rates that has undermined the valuations of their favoured stocks, but could the interim accounts for Baillie Gifford European Growth (LON: BGEU) bea sign that the worst is now over?

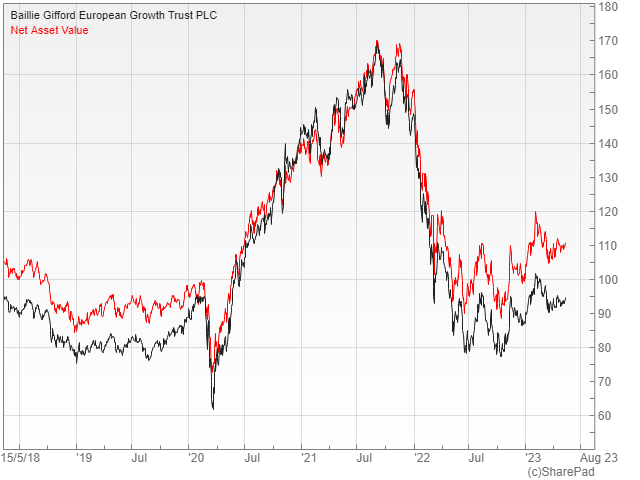

In the six months to the end of March the £334m trust made an NAV total return of 22.9%, slightly ahead of the 21.7% recorded by the FTSE Europe ex UK benchmark. It wasn’t all good news though, as the increase in the discount to 16% left investors with a share price gain of just under 20%.

The longer term picture is also pretty mixed. After a year of staggering outperformance – 73.9% gain versus 34.9% appreciation in the index in the Covid-dominated 12 months to 31 March 2021 – it has badly lagged the benchmark. This has meant that over the 10 years to the end of March 2023 it has fallen just over 30% behind its associated index.

Growth Opportunities

Writing in the accounts, the managers said that companies that can generate free cash flow and grow the returns on capital are much more likely to be in control of their own destiny. They pointed out that three-quarters of the portfolio is invested in stocks that are expected to generate positive free cash flow over the next twelve months, while most of the rest benefit from profitable core businesses whose cash flows can be harnessed to invest elsewhere.

Two examples of the sorts of opportunities available are the Polish ecommerce platform Allegro and meal kit business HelloFresh. The former is down over 60% since its IPO in October 2020, despite the fact that one of its main competitors has recently exited the market and Amazon appears to have gained little traction in the two years that it has been operating in the country.

Allegro has nearly doubled its addressable market with the acquisition of Mall, which opened up new countries like Czechia and Slovakia that are ripe for disruption, yet most investor attention is understandably focused on Polish inflation and the war next door. HelloFresh has also suffered a massive write-down with the shares falling over 80% from their peak in November 2021.

The company has built an entirely new business in the ready-to-eat range alongside its core meal kit operation and now has a dominant market position in the US. It continues to expand into different countries and launch new brands while generating solid cash flow.

Additions And Outlook

There were two new positions added during the reporting period, with the first being AutoStore, which designs cubic storage systems that consist of large metal frames and small box-like robots that whizz around them in search of items on request. Its shares had fallen significantly since the IPO, yet the company addresses one of the biggest pinch points in warehouse automation: the storage and retrieval of items.

The other addition was Hypoport, which is a leading mortgage marketplace in Germany that allows mortgage brokers to match lenders with borrowers in a highly under-digitised area. It has fallen significantly in value as mortgage volumes plummeted in response to higher interest and energy costs, thereby allowing the fund to get a good purchase price.

The managers say that although they appreciate the stress in the broader economy, the best they can do is build a portfolio of companies capable of weathering the storm and thriving over the long-term. This means focusing on different factors from the average market participant and heeding fundamental signals that are often drowned out by the noise of the here and now.

One of the main criticisms of some of the other Baillie Gifford funds is the high allocation to private investments, which can be difficult to value in a transparent manner, but BG European Growth only has an 8.5% allocation to this area. In view of this it is possible that the 16% discount to NAV represents a reasonable buying opportunity for longer term investors who are comfortable with the risk.

Comments (0)