The Secure Income REIT: 4.3% yield with inflation protection

One of the things I like about investment trusts is that they don’t always get the attention that they deserve, which means you can often find attractively priced funds that have gone under the radar. A good example is the Secure Income REIT (LON:SIR).

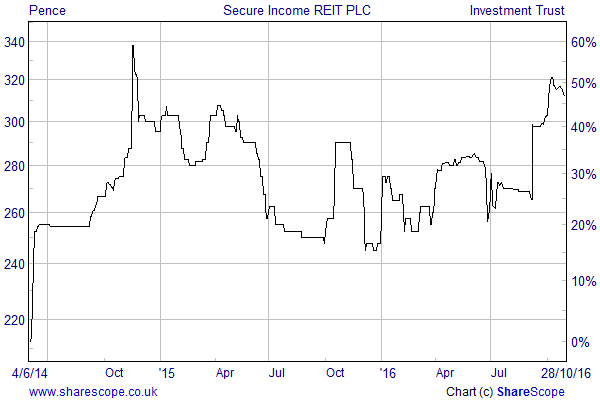

The fund was launched in 2014 to provide a high quality, safe, inflation-protected source of income. This is something that investors have been crying out for and the demand has driven many investment trusts that operate in this area on to a high premium to net asset value (NAV), but the Secure Income REIT seems to have largely gone unnoticed.

SIR owns a freehold portfolio of 26 significant real-estate assets that were externally valued at £1.38 billion at the end of June. All the properties have been fully let to financially strong global businesses and they have a weighted average unexpired lease term of over 23 years.

The underlying assets

The largest segment of the portfolio consists of 19 private hospitals situated in various locations throughout England. These are let out to Ramsay Health Care Limited, which is one of the top 5 private healthcare providers in the world with a market cap of £9.3 billion.

The annual rental income from these sites was £45.6m at the end of June and will increase by a minimum of 2.75% per annum throughout the lease, which has a further 21 years to run with no break options.

SIR also owns central London’s only psychiatric hospital, which has been let to Florence Nightingale Hospitals Limited. All the obligations under the lease are guaranteed by Orpea SA, the French parent company of a group that operates retirement homes, outpatient and rehabilitation clinics and psychiatric care. The annual rental income from the site is currently £2m and will increase by 3% per annum over the remaining 28 years of the lease and there are no break options.

The remainder of the portfolio includes four well known visitor attractions including Alton Towers and Thorpe Park, which are two of the top theme parks in the UK. The rental income on these is £30.9m with annual RPI increases and the payments are guaranteed by Merlin Entertainments Plc, the world’s second largest visitor attraction business after Disney.

At the end of June, 38% of the £1.38bn portfolio was attributable to leisure-related assets with the healthcare properties accounting for the other 62%. In total they generated annual rents of £78.5m, which was equivalent to a rental yield of 5.6%.

On October 28 it was announced that the Board had acquired 55 Travelodge hotels for £196m with the purchase financed by a share placing of £140m and a new £60m 7-year secured debt facility. The initial rental yield is 7% and there are RPI linked rent reviews throughout the remaining 27 years of the lease.

Attractive source of income

The Secure Income REIT has an established portfolio that has been let out to high quality tenants on long leases with fixed annual or RPI-linked increases. It has predictable costs and revenues that should support a rising stream of dividends. The portfolio is managed by Prestbury, which has a strong track record and an 18% stake that aligns its interests to those of the other shareholders.

Its first quarterly distribution of 2.9375 pence per share was paid in August and it has recently announced an equivalent payment to be made on November 25 to shareholders on the register on October 28.

The Board has said that the Travelodge acquisition should enable it to increase the next quarterly payment that is due in February to 3.325p. If it maintains this level it would put the shares that are currently trading at 310p on a prospective yield of 4.3%.

According to analysts at Edison, a medium-term increase in RPI of about 3% would enable the fund to grow its dividend per share by about 6.5% per annum to 2022. When you add in the expected increase in the value of the properties due to the higher rents it should enable the fund to achieve an annual 11% NAV total return.

At the end of June the fund’s NAV was around 300p per share, which means it is trading on about a 3% premium. The nearest equivalents are the infrastructure investment trusts and they are trading on an average premium of 16%.

As well as the valuation and the yield, I also like the fact that it is less susceptible to a slowdown in the UK economy than a more mainstream property fund. This was a point made by the trust’s Chairman, Martin Moore, in the interim accounts to the end of June, where he wrote:

“We have always been keen to make a clear distinction between mainstream commercial property and the composition of our portfolio, which is entirely let to strong covenants on long leases with guaranteed uplifts in less cyclical alternative property sectors. Whereas the rental levels of traditional property assets tend to follow economic growth, both upwards and downwards, our cash flows are much more predictable and resilient.”

The most significant risk is likely to be the high borrowing, as the fund had a net loan to value ratio of 59.5% at the end of June, although this has since fallen to 56% following the share placing to finance the Travelodge acquisition.

You also need to bear in mind the low number of tenants. I know that these are large and well financed businesses, but if anything serious happened to one of them it would have a potentially disastrous impact on the fund. As long as you are comfortable with this it should be a useful diversifying source of income for your portfolio.

Comments (0)