Scottish Mortgage: significant potential following the tech pullback

The latest annual results cap a long period of outperformance for Scottish Mortgage (LON:SMT), yet despite the recent weakness there is still plenty of possible upside with the managers re-positioning the portfolio for the next decade.

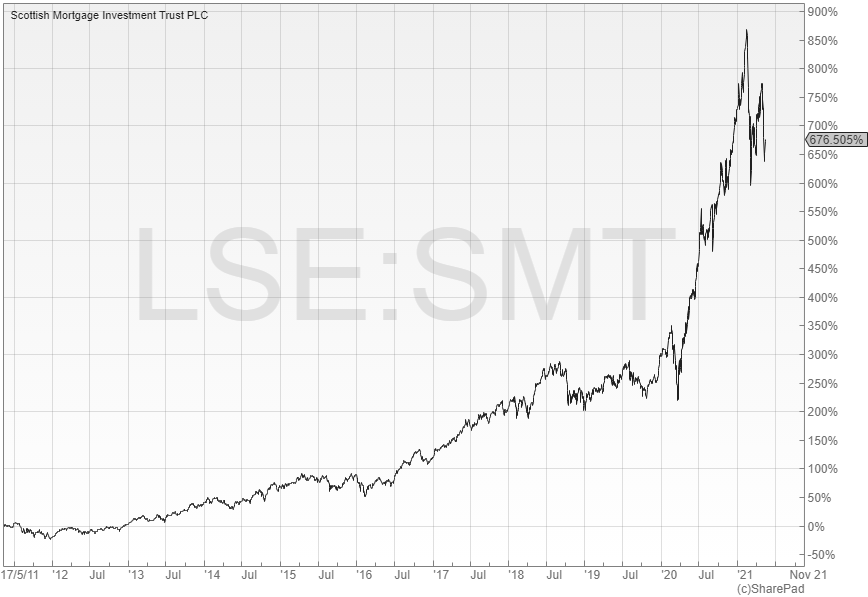

Scottish Mortgage has just released its strongest ever final results with a 12-month NAV total return of 111.2% in the year to the end of March. Even after taking into account the recent pullback the shares are still up by more than 730% over the last 10 years.

Managers Anderson and Slater look for exponential structural growth opportunities by identifying companies that can change and dominate consumer spending habits, which often leads them to take sizeable long-term positions in volatile stocks including in the tech sector. Many of these sorts of holdings benefited from the lockdown with the likes of Illumina, Amazon and Zoom all contributing to the strong annual performance.

Long-serving manager James Anderson is to step down in April 2022 after 22 years in charge, a period in which an initial investment of £1,000 would have grown to £18,000. He will be replaced by the current co-manager Tom Slater and the fund’s new deputy manager Lawrence Burns.

Positioning for the next decade

Anderson was largely responsible for introducing the high-conviction, unconstrained approach that has enabled the fund to target exceptional growth companies from around the world. As joint manager he will now concentrate on positioning the portfolio for the next decade of growth.

The key trends they have identified include: the move away from fossil fuels; implications for the continued growth in computing power in areas such as transport and logistics, which could be anything from robot and drone delivery to space travel; as well as healthcare, particularly synthetic biology.

There have been some significant changes to the portfolio in the last year with the fund selling 80% of its holding in Tesla after the strong performance and switching into the infrastructure of electric vehicles including Northvolt (batteries) and ChargePoint (charging networks). Mature internet platforms Facebook and Google have also been sold, while Chinese tech positions such as Tencent have been added to.

A challenging period

It has been a difficult few months for investors in the fund with the shares down around 20% since the peak in mid-February as growth stocks have de-rated because of higher inflation and interest rate expectations. According to the broker Numis, this is the third largest drawdown − peak to trough decline − in the last 15 years.

The tailwind of low interest rates that has helped these long duration stocks with growing earnings streams going well out into the future could easily turn into a headwind if rates have to rise, but investors can take comfort from the fact that the managers have already re-positioned the portfolio.

Numis believe that Scottish Mortgage has the potential to deliver significant growth from its new holdings, especially its interesting collection of unquoted investments. They think that the fund will still be able to generate strong returns even in an inflationary environment and that it acts as a useful diversifier because of its differentiated approach.

The assumption that growth/disruption stocks will be hard hit by the probable – perhaps eventual – rise in interest rates is the common comment we hear almost every day. But will this really happen, I wonder? Stocks and sectors get overbought and oversold, react to economic and behavioural changes, but markets are led over time by a small group of companies that produce stunning growth because they are leaders in technology change and indeed create their own new markets.