Schroder Asian Total Return: attractive ‘all-weather’ mandate

Some investment trusts don’t get the attention they deserve with Schroder Asian Total Return being a case in point; its strong track record and element of downside protection making it worth a closer look.

The £580m Schroder Asian Total Return (LON: ATR) aims to provide a “high rate of total return” from the Asia Pacific ex Japan region and offers a degree of capital preservation through the tactical use of derivatives. Longstanding managers Robin Parbrook and King Fuei Lee have an unconstrained, benchmark agnostic approach that is driven by fundamental research.

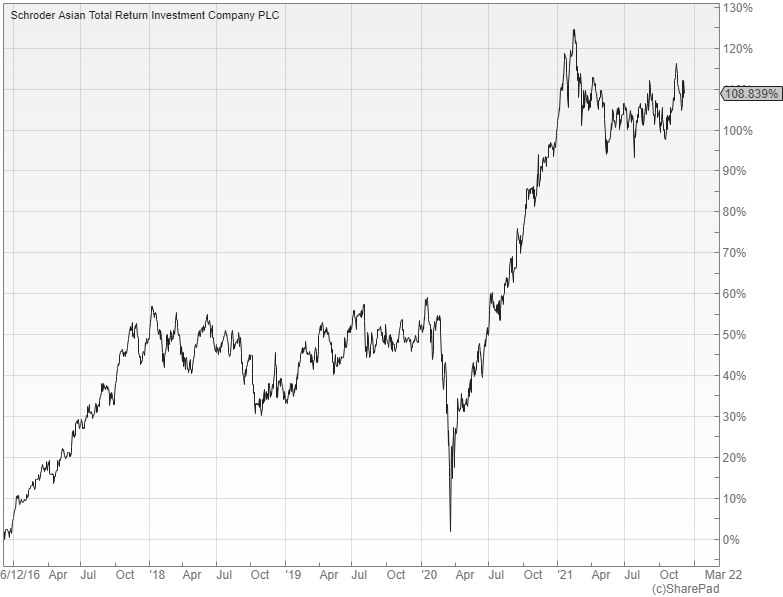

Over the last five years they have delivered an impressive NAV total return of 103.8%, which is well ahead of the 53.1% produced by their MSCI AC Asia Pacific ex Japan benchmark and the peer group average of 92.9%. The performance has also held up well this year despite the negative returns from some of the other trusts operating in the region.

A key factor in this was the decision to reduce the fund’s exposure to China to 13% due to the managers’ wariness of state intervention in publicly listed businesses. The ability to use derivatives to hedge is also important as Parbrook and Lee have shown that they are capable of capturing a significant amount of the growth opportunities, while protecting investors in more difficult market conditions.

Portfolio approach

The portfolio consists of around 40 to 70 stocks that are selected on a best ideas basis and the managers then use quantitative models to identify whether particular countries are expensive or cheap in the medium term. Hedges are used to reduce the risk of those considered expensive, with the same tactic also employed to guard against a short-term market correction whenever necessary.

At the end of October the largest country allocations were: Taiwan 18%, China 13%, India and Korea both 12% and Australia 11%. The largest sector weightings were information technology at 33%, followed by consumer discretionary 15% and communication services 12%.

The fund’s short-term tactical indicators are currently at sell levels, reflecting the near-term risks such as inflationary pressure and the fact that economic and earnings surprises are no longer positive. As a result the managers have added downside protection by buying out-of-the-money put options as well as short Taiwan stock exchange futures, which gives the portfolio a net notional market exposure of around 90%.

Buying opportunity

Parbrook and Lee think that the recent regulatory interventions in China should be considered a major policy re-set and no longer invest in some of the areas that have been affected such as insurance, healthcare and education. They don’t however consider the country to be completely off limits and are still willing to own exporters, technology hardware and companies aligned with the newly introduced policies.

Because of its strong performance record, for much of the last five years the trust has traded at a small premium to NAV, which has enabled it to regularly issue new shares to mop up the excess demand. Although it is still one of the highest rated funds in its peer group, it is currently available at a discount of around two percent.

The broker Winterflood believes that its ‘all-weather’ mandate is particularly appealing at the moment given the concerns around inflation and increasing regulation in China. They say that Schroder Asian Total Return remains an attractive way to access the long-term growth opportunities in the region.

Comments (0)