New Star Investment Trust’s 33% discount beckons

Last week I wrote about Miton Global Opportunities (LON:MIGO), which is an interesting investment trust that exploits pricing anomalies amongst closed-ended funds. One of its holdings is the New Star Investment Trust (LON:NSI) and I think it is worth a closer look as it offers an intriguing and possibly unique opportunity.

NSI was originally launched as the Jupiter Investment Trust in May 2000 as a tax-efficient vehicle for the original shareholders of Jupiter Asset Management following the sale of the business to the German group Commerzbank.

John Duffield, the founder of Jupiter AM, made around £175m from the sale and he and his family now have an estimated fortune of £340m. This includes a majority 59% stake in the New Star Investment Trust, with the 42 million shares worth around £40m.

After leaving Jupiter Duffield went on to set-up New Star Asset Management and the investment trust went with him. It was renamed the New Star Investment Trust and the management passed over to the new firm.

Duffield has a bit of a chequered history as New Star Asset Management ran into problems during the financial crisis and was sold to Henderson Global Investors in January 2009. This prompted him to create his current venture, Brompton Asset Management, and it was no great surprise when the management of the investment trust was switched from New Star to Brompton with effect from 1st January 2010.

Initially NSI invested in other New Star funds, but it has since become a genuine fund-of-funds with its largest holdings including the likes of Fundsmith Equity and Polar Capital Technology.

Legacy issues

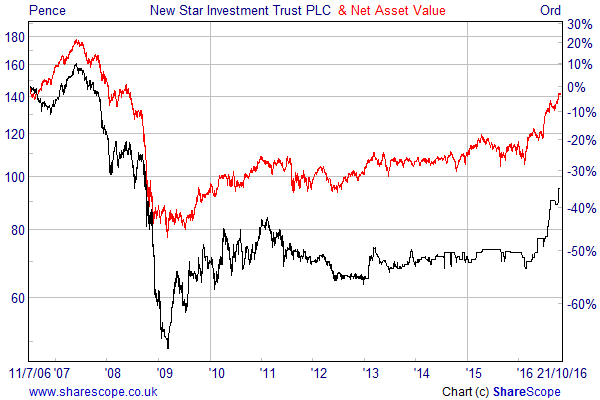

The performance during the period when it was run by New Star was really poor, but things have picked up since it was taken over by Brompton, where Duffield is the senior partner and other family members and former colleagues make up the rest of the senior management.

The disappointing initial returns and the fact that 59% of the shares are held by Duffield explains why the investment trust has typically traded at a wide discount to net asset value (NAV). This currently stands at 33%, with the shares changing hands at 95p but backed by an estimated 142p of assets.

Mr Duffield is 77 years old and his stake of £40m is a material part of his overall wealth. Miton Global Opportunities has invested on the basis that the fund is unlikely to remain in its current guise for long, although the timing of any change would be dependent on Duffield himself.

If the New Star investment trust were to be wound up or make a partial tender offer at close to NAV it would give investors a huge uplift on their purchase price. Without wishing to sound morbid, this has to be a distinct possibility at some point in the next few years given Mr Duffield’s age.

Price to be paid

Before buying any shares it is important to appreciate that this is an unusual set of circumstances. Small investors would need to be willing to accept the fact that Duffield has a controlling interest and will run the fund according to his own priorities.

Obviously he will want to achieve good performance, but the fund also provides a steady stream of fees for his new venture and it is not cheap. On top of the basic management charge of 0.75% there is a performance fee of 15% of the growth in net assets over 3-month Libor plus 1% subject to a high watermark. There are also the fees charged by the managers of the underlying funds, hence the ongoing charges figure of 0.93%.

Investors need to bear in mind the small size of the fund as it has a market value of just £67m and net assets of £100m. When you take into account the limited free float this tends to make the shares relatively illiquid and explains the wide bid-offer spread of 6p on a mid-market price of 95p.

It would only make sense to invest on a buy and hold basis and then wait for Duffield to take steps to realise the true value of the fund. If you were going to do this you would need to be comfortable with the objective and underlying portfolio as it could be a few years before anything happens.

The New Star investment trust aims to generate long-term capital growth. It has a multi-asset mandate and can invest in funds, ETFs, futures and options and limited partnerships. It can also allocate up to 15% of the portfolio to direct investments in the relevant markets.

At the end of December the investment trust had 86.4% of its portfolio invested in funds with the remaining 13.6% in cash alternatives. The ten largest holdings accounted for just over 50% of the assets and included: FP Crux European Special Situations, Fundsmith Equity, Aberforth Geared and the FP Brompton Global Conservative fund.

In the 2015 accounts the chairman acknowledged that the shares continue to trade at a significant discount to NAV and that the directors have discussed various options with a view to reducing it but that no satisfactory solution has yet been found. He then says that the position is being kept under review by the Board.

If you are patient enough to wait, this could be a good opportunity.

“In the 2015 accounts the chairman acknowledged that the shares continue to trade at a significant discount to NAV and that the directors have discussed various options with a view to reducing it but that no satisfactory solution has yet been found. He then says that the position is being kept under review by the Board.”

Potential investors should note that they say this every single year.

That may be so, but it is interesting that Miton Global Opportunities is anticipating a narrowing of the discount, although as I said, you may need to be patient, but the uplift should be worth it especially given the improvement in the performance.